941 501 Quarterly with Instructions City of Jackson, Michigan Cityofjackson Form

What is the 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson

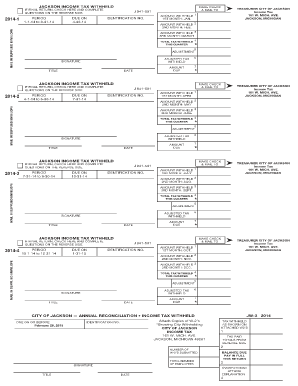

The 941 501 Quarterly form is a critical document used by employers in Jackson, Michigan, to report employment taxes. This form includes detailed instructions that guide users through the process of accurately reporting wages, tips, and other compensation paid to employees. It is essential for ensuring compliance with local, state, and federal tax regulations. The form must be completed quarterly, reflecting the employer's payroll activities over the previous three months.

Steps to complete the 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson

Completing the 941 501 Quarterly form involves several key steps:

- Gather necessary information, including total wages paid, tips received, and any federal income tax withheld.

- Fill out the form accurately, ensuring all required fields are completed, such as employer identification number (EIN) and employee counts.

- Review the completed form for errors or omissions, as inaccuracies can lead to penalties.

- Sign and date the form to validate it before submission.

How to use the 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson

Using the 941 501 Quarterly form effectively requires understanding its structure and purpose. Employers should familiarize themselves with each section of the form, including the reporting of wages and tax liabilities. It is beneficial to refer to the accompanying instructions to ensure compliance with all reporting requirements. Digital tools may assist in filling out the form, making the process more efficient and reducing the likelihood of errors.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the 941 501 Quarterly form to avoid penalties. The deadlines typically fall on the last day of the month following the end of each quarter. For example, the due dates are:

- April 30 for the first quarter (January to March)

- July 31 for the second quarter (April to June)

- October 31 for the third quarter (July to September)

- January 31 for the fourth quarter (October to December)

Key elements of the 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson

Several key elements must be included when completing the 941 501 Quarterly form:

- Employer Identification Number (EIN): A unique identifier for the business.

- Employee Count: The number of employees during the quarter.

- Total Wages: The sum of all wages paid to employees.

- Tax Liability: The total amount of federal taxes withheld and owed.

Legal use of the 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson

The legal use of the 941 501 Quarterly form is vital for compliance with tax laws. Employers must ensure that the information reported is accurate and submitted by the deadlines to avoid legal repercussions. The form serves as an official record of employment taxes and is subject to audits by the IRS or state tax authorities. Proper completion and timely submission help maintain good standing with tax obligations.

Quick guide on how to complete 941 501 quarterly with instructions city of jackson michigan cityofjackson

Effortlessly Prepare 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it on the internet. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Handle 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to Edit and Electronically Sign 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson with Ease

- Obtain 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your updates.

- Decide how you wish to send your form—via email, SMS, an invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 941 501 quarterly with instructions city of jackson michigan cityofjackson

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson?

The 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson is a specific tax form used by businesses in Jackson, Michigan to report their quarterly taxes. This form provides detailed instructions to ensure compliance with local regulations and simplify the filing process.

-

How can airSlate SignNow assist with filing the 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson?

airSlate SignNow offers an easy-to-use platform that allows businesses to create, sign, and manage their 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson documents electronically. This streamlines the filing process and ensures that all necessary signatures are obtained quickly and securely.

-

What are the key features of the airSlate SignNow platform for the 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson?

Key features include document templates specifically for the 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson, customizable workflows, secure e-signature capabilities, and convenient access from any device. These features enhance productivity and ensure compliant filing.

-

Is airSlate SignNow cost-effective for handling the 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing their 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson forms. With flexible pricing plans, businesses can choose an option that fits their budget while streamlining their documentation process.

-

What integrations does airSlate SignNow offer for the 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson?

airSlate SignNow integrates seamlessly with popular business applications like Google Drive, Dropbox, and CRM systems, making it easier to manage your 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson documents alongside other business processes. This enhances workflow efficiency.

-

How secure is airSlate SignNow when dealing with the 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson documents. This ensures that your sensitive tax information remains confidential and secure.

-

Can I track the status of my 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson forms with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson forms in real-time. This transparency helps businesses stay informed and manage deadlines effectively.

Get more for 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson

Find out other 941 501 Quarterly With Instructions City Of Jackson, Michigan Cityofjackson

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer