RI 1040V Tax Ri Form

What is the RI 1040V Tax Ri

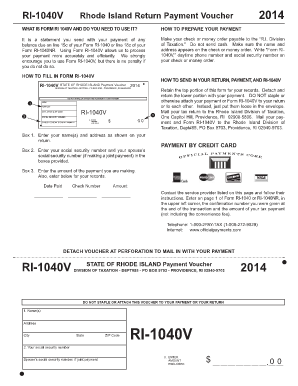

The RI 1040V Tax Ri form is a payment voucher used in the state of Rhode Island for individual income tax returns. This form allows taxpayers to submit their tax payments electronically or by mail. It is essential for individuals who owe taxes and need to ensure that their payments are processed accurately and on time. The RI 1040V serves as a record of payment and helps to streamline the tax filing process, making it easier for both taxpayers and the state’s tax authorities.

How to use the RI 1040V Tax Ri

Using the RI 1040V Tax Ri form is straightforward. Taxpayers must first complete their Rhode Island income tax return, the RI-1040. Once the return is prepared, the taxpayer can fill out the RI 1040V form to indicate the amount owed. The completed voucher should accompany the payment, whether it is made electronically or by mail. It is important to ensure that all information on the form is accurate to avoid any processing delays.

Steps to complete the RI 1040V Tax Ri

Completing the RI 1040V Tax Ri involves a few key steps:

- Gather necessary documentation, including your completed RI-1040 tax return.

- Fill out the RI 1040V form, entering your name, address, and the amount you are paying.

- Choose your payment method—either electronic payment through the state’s tax portal or a check/money order if mailing.

- Submit the form along with your payment by the tax deadline to ensure timely processing.

Legal use of the RI 1040V Tax Ri

The RI 1040V Tax Ri form is legally recognized as a valid method for submitting tax payments in Rhode Island. It complies with state tax laws and regulations, ensuring that taxpayers fulfill their obligations. Proper use of this form can prevent penalties and interest that may arise from late payments. Taxpayers should retain copies of the completed form and payment confirmation for their records.

Filing Deadlines / Important Dates

Timely submission of the RI 1040V Tax Ri is crucial. The filing deadline typically aligns with the federal tax deadline, which is usually April 15. However, taxpayers should verify any changes or extensions announced by the Rhode Island Division of Taxation. It is advisable to submit the RI 1040V along with payments well in advance of the deadline to avoid any last-minute issues.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the RI 1040V Tax Ri form through various methods:

- Online: Payments can be made electronically through the Rhode Island Division of Taxation’s online portal, which allows for quick and secure transactions.

- Mail: If submitting by mail, taxpayers should send the completed RI 1040V along with their payment to the address specified on the form.

- In-Person: Payments may also be made in person at designated state tax offices, where taxpayers can receive immediate confirmation of their payment.

Quick guide on how to complete ri 1040v tax ri

Complete RI 1040V Tax Ri effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage RI 1040V Tax Ri on any device using airSlate SignNow's Android or iOS applications and simplify any document-based task today.

How to edit and eSign RI 1040V Tax Ri without difficulty

- Find RI 1040V Tax Ri and click Get Form to begin.

- Use the tools available to complete your form.

- Emphasize pertinent sections of your documents or redact confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or by downloading it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from the device of your choice. Edit and eSign RI 1040V Tax Ri and facilitate outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ri 1040v tax ri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RI 1040V Tax Ri form used for?

The RI 1040V Tax Ri form is a payment voucher for Rhode Island income tax returns. It allows taxpayers to submit payments for any tax due when filing their annual returns. Understanding how to accurately fill out the RI 1040V Tax Ri is essential for ensuring timely payment and avoiding penalties.

-

How does airSlate SignNow simplify the completion of the RI 1040V Tax Ri form?

airSlate SignNow streamlines the process of completing the RI 1040V Tax Ri form by providing an intuitive interface for electronic signatures and document management. Users can easily upload their tax forms, fill them out, and eSign without the hassle of paper forms. This efficiency saves time and helps ensure accuracy in submission.

-

Is there a cost associated with using airSlate SignNow for the RI 1040V Tax Ri form?

Yes, airSlate SignNow offers a variety of pricing plans, including options that cater to individuals and businesses. The pricing is competitive and designed to provide cost-effective solutions for sending and signing documents, including tax forms like the RI 1040V Tax Ri. Check the website for specific pricing details and available features.

-

Can I use airSlate SignNow on multiple devices for the RI 1040V Tax Ri form?

Absolutely! airSlate SignNow is compatible with multiple devices, including laptops, tablets, and smartphones. This allows users to complete and eSign their RI 1040V Tax Ri forms anytime and anywhere, enhancing convenience and flexibility in managing tax documents.

-

What features does airSlate SignNow offer for managing the RI 1040V Tax Ri process?

airSlate SignNow provides features such as document editor, collaboration tools, and secure eSigning options tailored for the RI 1040V Tax Ri process. Users can easily invite others to sign, track document status in real-time, and ensure everything is securely stored in one place. These features enhance workflow efficiency signNowly.

-

Are there integrations available with airSlate SignNow that support the RI 1040V Tax Ri?

Yes, airSlate SignNow integrates with various popular applications and platforms, making the management of the RI 1040V Tax Ri seamless. Whether you use cloud storage services or accounting software, these integrations facilitate easy uploading and sharing of tax documents. Explore the integration options to find what suits your needs.

-

What are the benefits of using airSlate SignNow for the RI 1040V Tax Ri?

Using airSlate SignNow for the RI 1040V Tax Ri offers multiple benefits including time savings, increased accuracy, and enhanced security. The electronic signing and document management process helps reduce the risk of errors, and the secure platform ensures that sensitive information is protected. It’s a hassle-free way to handle important tax documentation.

Get more for RI 1040V Tax Ri

Find out other RI 1040V Tax Ri

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online