135 Form

What is the 135 Form

The 135 form is a specific document used primarily in the context of tax reporting and compliance. It serves as a means for taxpayers to report certain types of income or deductions to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the 135 form is essential for ensuring accurate reporting and compliance with federal regulations. This form is particularly relevant for individuals or businesses that need to document specific financial transactions or claims.

How to use the 135 Form

Using the 135 form involves several key steps to ensure proper completion and submission. First, gather all necessary financial documents and information related to the income or deductions you are reporting. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to double-check your entries for any errors before submission. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the guidelines provided by the IRS.

Steps to complete the 135 Form

Completing the 135 form requires attention to detail and adherence to specific guidelines. Follow these steps to ensure accuracy:

- Gather all relevant financial documents, such as receipts, statements, and previous tax returns.

- Review the instructions provided with the form to understand the requirements for each section.

- Fill out the form, providing accurate information in each designated area.

- Double-check all entries for accuracy, ensuring there are no omissions or errors.

- Sign and date the form as required.

- Submit the form electronically or by mail, following the submission guidelines outlined by the IRS.

Legal use of the 135 Form

The legal use of the 135 form is governed by IRS regulations, which outline the requirements for valid submissions. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated time frames. Additionally, electronic submissions must comply with eSignature regulations to be considered valid. Maintaining proper records of the completed form and any supporting documentation is crucial for legal compliance and future reference.

Filing Deadlines / Important Dates

Filing deadlines for the 135 form are critical to avoid penalties and ensure compliance. Typically, the form must be submitted by a specific date each tax year, which is often aligned with the general tax filing deadline. It is essential to stay informed about any changes to these deadlines, as they can vary based on individual circumstances or IRS announcements. Marking these dates on your calendar can help ensure timely submission.

Required Documents

When completing the 135 form, certain documents are required to support your claims. These may include:

- Income statements, such as W-2 forms or 1099 forms.

- Receipts for deductions being claimed.

- Previous tax returns for reference.

- Any other documentation that substantiates the information reported on the form.

Having these documents readily available can streamline the completion process and enhance the accuracy of your submission.

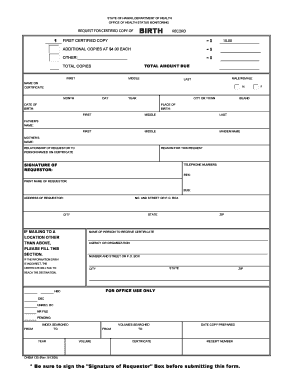

Quick guide on how to complete 135 form

Effortlessly Prepare 135 Form on Any Device

Managing documents online has gained popularity among companies and individuals. It offers an excellent sustainable alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents quickly without delays. Manage 135 Form on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to Alter and eSign 135 Form with Ease

- Obtain 135 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign 135 Form and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 135 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 135 form?

The 135 form is a specific type of document used for various administrative and operational purposes. In the context of airSlate SignNow, it relates to the efficient electronic signing of important business agreements. Understanding how to use the 135 form is crucial for optimizing your document workflows.

-

How can airSlate SignNow help with 135 forms?

airSlate SignNow allows users to easily create, send, and eSign 135 forms electronically. This streamlined process reduces paper usage and enhances productivity by enabling quick turnaround times for document approvals. By using airSlate SignNow, businesses can manage their 135 forms efficiently.

-

Is there a cost associated with using the 135 form on airSlate SignNow?

Yes, there are pricing plans associated with using airSlate SignNow for managing 135 forms. Our cost-effective solutions offer various tiers depending on your business needs, allowing you to choose a plan that best fits your budget. Explore our pricing page for more details on plans related to 135 form usage.

-

What features does airSlate SignNow offer for 135 forms?

airSlate SignNow provides multiple features for handling 135 forms, including templated document creation, customizable fields, and automated reminders for signers. The platform also supports mobile access, so you can manage your 135 forms conveniently from any device. Additionally, integration capabilities with other apps enhance usability.

-

Can airSlate SignNow integrate with other software for 135 form processing?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications to facilitate the processing of 135 forms. Popular integrations include CRM systems, cloud storage, and project management tools. This enhances your overall workflow by allowing you to manage documents efficiently within your existing software ecosystem.

-

What are the benefits of using airSlate SignNow for 135 forms?

Using airSlate SignNow for 135 forms offers several benefits, including increased efficiency, reduced turnaround time, and enhanced security. The eSigning process is user-friendly and helps maintain compliance with legal standards. This ensures that your business can handle important documents quickly and securely.

-

Is it easy to get started with 135 forms on airSlate SignNow?

Yes, getting started with 135 forms on airSlate SignNow is straightforward. Users can easily set up their accounts and begin creating and sending forms within minutes. Our user-friendly interface guides you through each step, making it simple to manage your 135 forms without technical expertise.

Get more for 135 Form

Find out other 135 Form

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple