Goldsmiths Returns Form

What is the Goldsmiths Returns

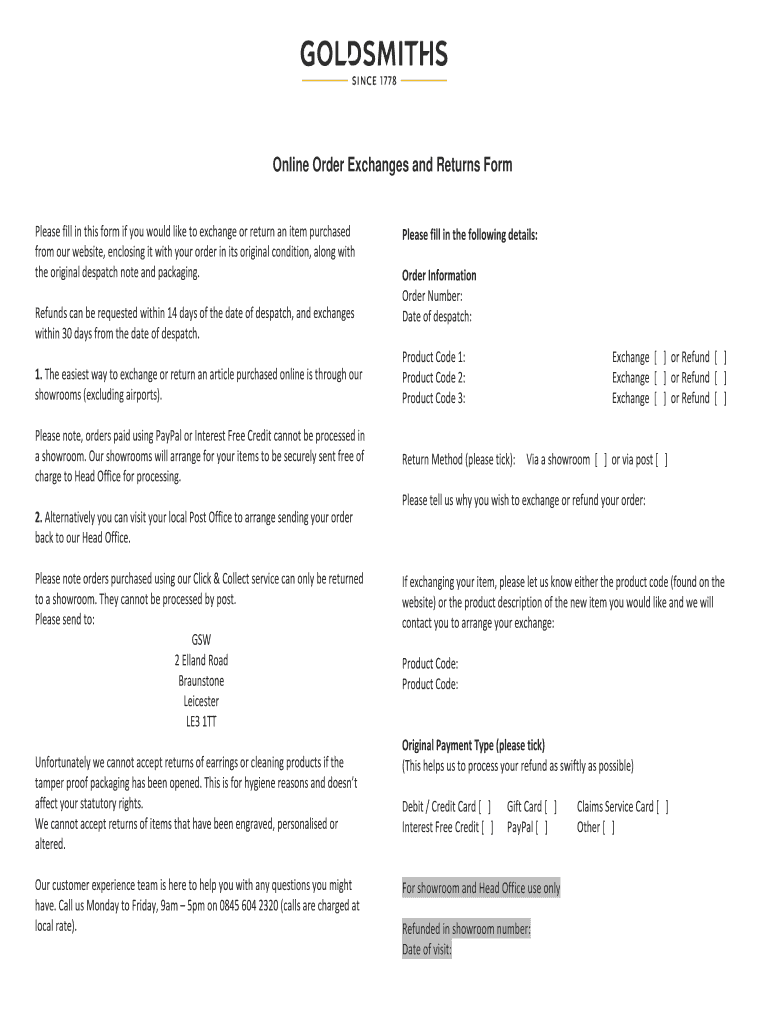

The Goldsmiths Returns is a specific form used for reporting and returning goldsmith-related transactions and activities. This form is essential for goldsmiths to maintain compliance with state regulations and tax obligations. It typically includes details about sales, purchases, and other relevant financial activities within the goldsmithing industry. Understanding the purpose and requirements of the Goldsmiths Returns is crucial for ensuring accurate reporting and avoiding potential penalties.

How to Use the Goldsmiths Returns

Using the Goldsmiths Returns involves several key steps to ensure proper completion and submission. First, gather all necessary financial records and transaction details relevant to the reporting period. Next, accurately fill out the form, ensuring that all required fields are completed. It is important to double-check the information for accuracy before submission. Finally, choose a submission method that suits your needs, whether online, by mail, or in person, to ensure timely filing.

Steps to Complete the Goldsmiths Returns

Completing the Goldsmiths Returns requires careful attention to detail. Follow these steps:

- Collect all relevant documentation, including sales receipts and purchase invoices.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the form by the specified deadline using your preferred method.

Legal Use of the Goldsmiths Returns

The Goldsmiths Returns must be completed and submitted in accordance with applicable laws and regulations. This includes adhering to state-specific requirements and ensuring that all reported information is truthful and accurate. Utilizing a reliable electronic signature platform can enhance the legal validity of the completed form, ensuring compliance with eSignature laws such as ESIGN and UETA.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for the Goldsmiths Returns. Typically, these forms must be submitted by specific dates set by state authorities. Missing deadlines can result in penalties or fines. It is advisable to keep track of these dates and set reminders to ensure timely submission.

Required Documents

To complete the Goldsmiths Returns, certain documents are required. These may include:

- Sales records detailing all transactions during the reporting period.

- Purchase invoices for materials and supplies used in goldsmithing.

- Any additional documentation required by state regulations.

Examples of Using the Goldsmiths Returns

Examples of situations where the Goldsmiths Returns is applicable include:

- A goldsmith reporting sales from custom jewelry orders.

- A business documenting purchases of gold and other materials for production.

- Record-keeping for tax purposes to demonstrate compliance with state laws.

Quick guide on how to complete goldsmiths returns

Complete Goldsmiths Returns seamlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any holdups. Manage Goldsmiths Returns on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Goldsmiths Returns effortlessly

- Locate Goldsmiths Returns and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

No more lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Goldsmiths Returns and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the goldsmiths returns

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the goldsmiths returns policy?

The goldsmiths returns policy allows customers to return their products within a specified period for a full refund or exchange. This ensures that you are satisfied with your purchase, as goldsmiths returns can be processed easily within the designated timeframe. Make sure to keep the packaging intact to simplify the return process.

-

How can I initiate a goldsmiths return?

To initiate a goldsmiths return, you can start by visiting the returns section on the official website. There, you'll find detailed instructions on how to return items and any necessary forms required for the process. Following these steps will help streamline your goldsmiths returns experience.

-

Are there any fees associated with goldsmiths returns?

Typically, goldsmiths returns do not incur any fees if you follow the return guidelines as specified. However, if items are returned after the deadline or without proper documentation, there may be a deduction from your refund. It is advisable to review the return policy for specific conditions related to fees.

-

What items are eligible for goldsmiths returns?

Generally, items that are unused and in their original packaging can be eligible for goldsmiths returns. Custom or personalized items may not qualify, so it's important to check the product details before purchasing. By understanding these conditions, you can ensure a smooth return process.

-

How long does it take to process a goldsmiths return?

The processing time for goldsmiths returns typically ranges from a few days to a couple of weeks, depending on the method of return and the company's processing standards. Once your returned item is received, the refund or exchange will be initiated promptly. Keeping track of your return shipment can help you stay updated.

-

Can I track my goldsmiths return?

Yes, you can track your goldsmiths return if you use a shipping service that provides tracking information. By keeping your shipping receipt and tracking number, you can monitor the progress of your return shipment. This added transparency helps ease any concerns while waiting for your refund.

-

What should I do if my goldsmiths return is denied?

If your goldsmiths return is denied, it is recommended to signNow out to customer service for clarification on the reason. They may provide more information on why the return was not accepted. Understanding the policy can help you avoid similar issues in the future and ensure compliance with return standards.

Get more for Goldsmiths Returns

- Moca instructions pdf form

- Form p1 for domicile

- Dealership borrowed car agreement form

- No harm contract pdf form

- Sepa lastschriftmandat muster ausgefllt form

- Mutation application form pdf

- Direct entry nursing prerequisite course verification form gradschool unh

- Certificado de deuda reclamada por el organismo pblico para form

Find out other Goldsmiths Returns

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer