Canada Qst Rebate Road Vehicle 2018-2026

What is the Canada QST Rebate Road Vehicle?

The Canada QST Rebate Road Vehicle is a tax rebate program designed for individuals and businesses in Quebec who purchase or lease a vehicle. This rebate allows eligible taxpayers to recover a portion of the Quebec Sales Tax (QST) paid on the acquisition of a road vehicle. The program aims to alleviate the financial burden associated with vehicle purchases, promoting economic activity and mobility within the province.

How to use the Canada QST Rebate Road Vehicle

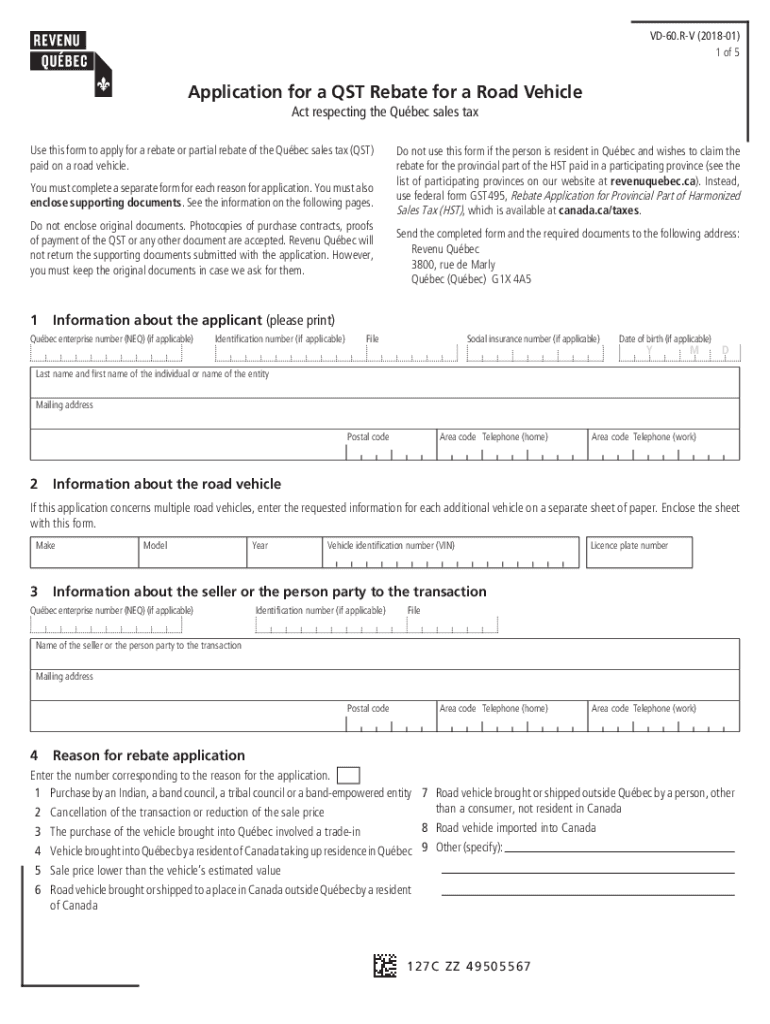

To utilize the Canada QST Rebate Road Vehicle, taxpayers must first ensure they meet the eligibility criteria. Once confirmed, the next step involves completing the appropriate forms, such as the VD 60 R V form. This form requires detailed information about the vehicle, the purchase price, and the QST paid. After filling out the form, submit it to the designated tax authority along with any required documentation to claim the rebate.

Steps to complete the Canada QST Rebate Road Vehicle

Completing the Canada QST Rebate Road Vehicle involves several key steps:

- Verify eligibility for the QST rebate program.

- Gather necessary documentation, including proof of purchase and QST payment.

- Fill out the VD 60 R V form accurately, ensuring all required fields are completed.

- Submit the completed form and supporting documents to the appropriate tax authority.

- Wait for confirmation of the rebate approval and the subsequent refund process.

Legal use of the Canada QST Rebate Road Vehicle

The legal use of the Canada QST Rebate Road Vehicle is governed by specific regulations set forth by the provincial tax authority. Taxpayers must adhere to these regulations to ensure compliance and avoid penalties. Proper documentation must be maintained, and the rebate can only be claimed for eligible vehicles purchased or leased within the stipulated time frame. Understanding these legalities is crucial for a successful rebate application.

Eligibility Criteria

To qualify for the Canada QST Rebate Road Vehicle, individuals and businesses must meet certain eligibility criteria. Generally, the vehicle must be registered in Quebec, and the purchaser must have paid the QST at the time of acquisition. Additionally, the vehicle must be used primarily for personal or business purposes, as specified in the program guidelines. It is essential to review these criteria thoroughly before applying for the rebate.

Required Documents

When applying for the Canada QST Rebate Road Vehicle, several documents are required to support the application. These typically include:

- Proof of purchase or lease agreement for the vehicle.

- Receipt or invoice showing the QST paid.

- Completed VD 60 R V form with accurate information.

- Any additional documentation as specified by the tax authority.

Form Submission Methods

Taxpayers can submit the VD 60 R V form through various methods, depending on their preference and the guidelines provided by the tax authority. Common submission methods include:

- Online submission through the official tax authority website.

- Mailing the completed form and documents to the designated office.

- In-person submission at local tax authority offices.

Quick guide on how to complete canada qst rebate road vehicle

Complete Canada Qst Rebate Road Vehicle effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents rapidly without delays. Manage Canada Qst Rebate Road Vehicle on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign Canada Qst Rebate Road Vehicle without any hassle

- Find Canada Qst Rebate Road Vehicle and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you prefer to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new printed copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Canada Qst Rebate Road Vehicle and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct canada qst rebate road vehicle

Create this form in 5 minutes!

How to create an eSignature for the canada qst rebate road vehicle

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the vd 60 r v and how does it work?

The vd 60 r v is an innovative feature within the airSlate SignNow platform that allows users to easily manage document workflows. It provides a straightforward way to send, sign, and store documents securely, ensuring efficiency in business operations.

-

How much does the vd 60 r v cost?

The vd 60 r v is part of the airSlate SignNow pricing plans, which are designed to be cost-effective and accommodate different business needs. You can choose from various subscription options that offer excellent value for the features provided.

-

What features does the vd 60 r v include?

The vd 60 r v includes features such as customizable templates, in-app signing, and seamless document tracking. These features enhance user experience by making document management more organized and efficient.

-

How can the vd 60 r v benefit my business?

By utilizing the vd 60 r v, businesses can streamline their document processes, reduce turnaround times, and increase overall productivity. This leads to better compliance and more secure transactions in everyday operations.

-

Are there any integrations available with the vd 60 r v?

Yes, the vd 60 r v easily integrates with various third-party applications, including CRM systems and cloud storage solutions. This integration capability ensures a seamless workflow that enhances collaborative efforts across different platforms.

-

Is the vd 60 r v secure for sensitive documents?

Absolutely! The vd 60 r v is built with top-notch security measures, including encryption and secure authentication, to protect sensitive documents. This ensures compliance with industry standards and gives users peace of mind.

-

Can I use the vd 60 r v on mobile devices?

Yes, the vd 60 r v is fully optimized for mobile use, allowing users to send and eSign documents from anywhere. The mobile-friendly design ensures that you can manage your important documents on the go without any hassle.

Get more for Canada Qst Rebate Road Vehicle

- Case conceptualization example pdf form

- Addendum to purchase agreement counteroffer mn form

- Office 365 plans comparison pdf form

- Eastern woodland metis form

- Kiltwalk sponsor form

- Authorization to release immunization records chirp chirp in form

- Catering order form nucuisine

- All terrain vehicle dealer registration instructions ny dmv form

Find out other Canada Qst Rebate Road Vehicle

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy