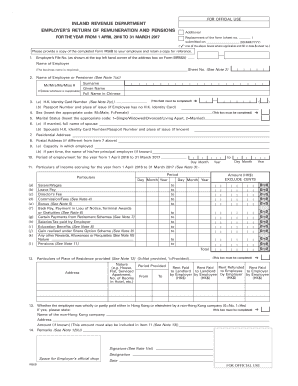

Employer's Return of Remuneration Pensions Form

What is the Employer's Return of Remuneration Pensions?

The Employer's Return of Remuneration Pensions is a crucial document that employers in the United States must complete to report pension contributions and remuneration for their employees. This form plays a significant role in ensuring compliance with tax regulations and maintaining accurate records for pension plans. It outlines the total remuneration paid to employees and the corresponding pension contributions made by the employer. Understanding this form is essential for both employers and employees to ensure that pension benefits are accurately calculated and reported.

Steps to Complete the Employer's Return of Remuneration Pensions

Completing the Employer's Return of Remuneration Pensions involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect data on employee remuneration, including salaries, bonuses, and other compensation.

- Calculate pension contributions: Determine the total pension contributions made by the employer for each employee.

- Fill out the form: Accurately input the gathered information into the Employer's Return of Remuneration Pensions form.

- Review for accuracy: Double-check all entries to ensure that the information is complete and correct.

- Submit the form: File the completed form by the specified deadline to avoid penalties.

Legal Use of the Employer's Return of Remuneration Pensions

The legal use of the Employer's Return of Remuneration Pensions is governed by federal and state regulations. This form must be completed accurately to comply with tax laws and pension regulations. An improperly filled form can lead to legal repercussions, including fines or penalties. It is essential for employers to understand the legal implications of this form, ensuring that all information reported is truthful and complete to maintain compliance with the law.

Filing Deadlines / Important Dates

Filing deadlines for the Employer's Return of Remuneration Pensions are critical for compliance. Employers should be aware of the following important dates:

- Annual filing deadline: Typically, the form must be submitted by the end of the fiscal year.

- Quarterly deadlines: If applicable, certain contributions may need to be reported quarterly.

- Amendment deadlines: If errors are discovered, amendments should be filed promptly to avoid penalties.

Required Documents

To complete the Employer's Return of Remuneration Pensions, employers must have several documents on hand:

- Employee payroll records: Detailed records of all remuneration paid to employees.

- Pension contribution statements: Documentation of all pension contributions made during the reporting period.

- Tax identification numbers: Ensure that all employee and employer identification numbers are accurate and up-to-date.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Employer's Return of Remuneration Pensions can lead to significant penalties. Employers may face:

- Fines: Monetary penalties for late or incorrect submissions.

- Increased scrutiny: Potential audits from tax authorities if discrepancies are found.

- Legal action: In severe cases, non-compliance can result in legal consequences.

Quick guide on how to complete employers return of remuneration pensions

Complete Employer's Return Of Remuneration Pensions effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Handle Employer's Return Of Remuneration Pensions on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Employer's Return Of Remuneration Pensions seamlessly

- Obtain Employer's Return Of Remuneration Pensions and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Employer's Return Of Remuneration Pensions to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employers return of remuneration pensions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the employer's return feature in airSlate SignNow?

The employer's return feature in airSlate SignNow allows businesses to easily send, track, and manage documents requiring signatures. It streamlines the process of obtaining necessary approvals, ensuring that the employer's return is both efficient and secure.

-

How does airSlate SignNow improve the employer's return process?

By utilizing airSlate SignNow, organizations can automate and expedite the employer's return process. This solution minimizes paperwork and reduces the time spent on manual document handling, resulting in faster transactions and improved productivity.

-

Are there any costs associated with using airSlate SignNow for employer's return?

airSlate SignNow offers various pricing plans suitable for different business sizes and needs. Clients can select a plan based on their requirements, ensuring that the cost associated with managing the employer's return remains budget-friendly.

-

What features does airSlate SignNow offer for managing employer's returns?

airSlate SignNow includes essential features like document templates, automated reminders, and real-time tracking to streamline the employer's return process. These tools help businesses maintain control and visibility over their document workflows.

-

Can I integrate airSlate SignNow with other applications for managing employer's returns?

Yes, airSlate SignNow offers seamless integrations with popular applications such as CRM and project management tools. This capability enhances the employer's return management process by connecting different systems and ensuring a cohesive workflow.

-

What are the benefits of using airSlate SignNow for employer's return management?

Using airSlate SignNow for employer's return management provides several benefits, including faster turnarounds and reduced paperwork. Businesses can easily track document statuses, leading to improved efficiency and fewer errors in the process.

-

Is airSlate SignNow secure for handling employer's return documents?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and secure cloud storage for all documents related to the employer's return. This ensures that sensitive information is protected and only accessible by authorized personnel.

Get more for Employer's Return Of Remuneration Pensions

- Toe 250 form

- Printable iep agenda template form

- Pool chemical log sheet form

- Parliamentary procedure script example form

- Credit references form

- Libreview patient consent form

- Outreach certification form

- Sample bylaws the following is an example of bylaws for a typical neighborhood association tucsonaz form

Find out other Employer's Return Of Remuneration Pensions

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed