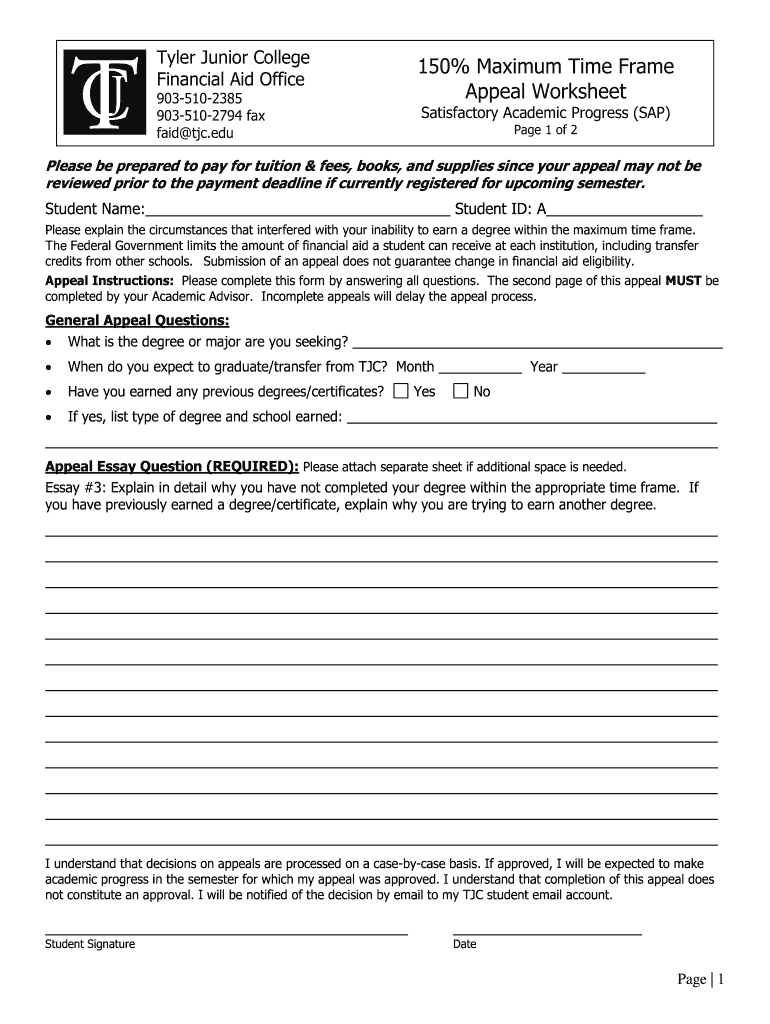

Tyler Junior College 150 Maximum Time Frame Financial Aid Form

Understanding the Tyler Junior College 150 Maximum Time Frame Financial Aid

The Tyler Junior College (TJC) 150 Maximum Time Frame Financial Aid is a guideline that determines the maximum number of credit hours a student can attempt while receiving federal financial aid. This policy ensures that students complete their educational programs within a reasonable timeframe, typically set at one hundred fifty percent of the published length of the program. For example, if a program requires sixty credit hours for completion, a student may attempt up to ninety credit hours while still being eligible for financial aid.

Eligibility Criteria for the Tyler Junior College 150 Maximum Time Frame Financial Aid

To qualify for the TJC 150 Maximum Time Frame Financial Aid, students must meet specific criteria. These include:

- Enrollment in an eligible degree or certificate program.

- Maintaining satisfactory academic progress, which typically includes a minimum GPA and completion rate.

- Not exceeding the maximum allowable credit hours as outlined by TJC policies.

Students should regularly check their academic standing and credit hour usage to ensure continued eligibility for financial aid.

Steps to Apply for the Tyler Junior College 150 Maximum Time Frame Financial Aid

Applying for the TJC 150 Maximum Time Frame Financial Aid involves several steps:

- Complete the Free Application for Federal Student Aid (FAFSA) to determine financial need.

- Submit any required documentation to the TJC financial aid office, including transcripts and enrollment verification.

- Review the financial aid award letter provided by TJC, which outlines the types and amounts of aid available.

- Accept the financial aid offer by following the instructions provided in the award letter.

It is essential to stay informed about deadlines and requirements to ensure a smooth application process.

Key Elements of the Tyler Junior College 150 Maximum Time Frame Financial Aid

Several key elements define the TJC 150 Maximum Time Frame Financial Aid:

- Credit Hour Limit: Students can attempt up to one hundred fifty percent of the credits required for their program.

- Academic Progress: Students must maintain satisfactory academic progress to remain eligible for aid.

- Program Length: The policy applies to all degree and certificate programs offered at TJC.

Understanding these elements helps students navigate their financial aid options effectively.

Legal Use of the Tyler Junior College 150 Maximum Time Frame Financial Aid

The legal framework surrounding the TJC 150 Maximum Time Frame Financial Aid is guided by federal regulations. These regulations ensure that financial aid is distributed fairly and that students are held accountable for their academic progress. Compliance with these regulations is crucial for both the institution and the students receiving aid, as failure to adhere may result in the loss of financial support.

Common Issues and Resolutions Related to the Tyler Junior College 150 Maximum Time Frame Financial Aid

Students may encounter several common issues when navigating the TJC 150 Maximum Time Frame Financial Aid, including:

- Exceeding the maximum credit hour limit, which can lead to ineligibility for future aid.

- Not meeting satisfactory academic progress, resulting in a financial aid warning or suspension.

- Misunderstanding the requirements for maintaining eligibility.

To resolve these issues, students should communicate directly with the TJC financial aid office for guidance and support.

Quick guide on how to complete tyler junior college 150 maximum time frame financial aid

The optimal method to obtain and sign Tyler Junior College 150 Maximum Time Frame Financial Aid

On the scale of your entire organization, ineffective procedures concerning document approval can take up signNow work hours. Executing documents like Tyler Junior College 150 Maximum Time Frame Financial Aid is a routine aspect of operations across various sectors, which is why the effectiveness of each agreement’s lifecycle is critically important to the overall performance of the company. With airSlate SignNow, signing your Tyler Junior College 150 Maximum Time Frame Financial Aid is as straightforward and rapid as it can be. This platform provides you with the latest version of nearly any form. Even better, you can sign it immediately without downloading additional software on your system or printing any hard copies.

Steps to obtain and sign your Tyler Junior College 150 Maximum Time Frame Financial Aid

- Browse through our library by category or use the search option to locate the document you require.

- Check the form preview by clicking Learn more to verify it’s the correct one.

- Click Get form to begin editing without delay.

- Fill out your form and include any necessary information using the toolbar.

- When finished, click the Sign feature to sign your Tyler Junior College 150 Maximum Time Frame Financial Aid.

- Select the signature method that suits you best: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options if needed.

With airSlate SignNow, you possess everything necessary to handle your paperwork efficiently. You can search, complete, modify, and even send your Tyler Junior College 150 Maximum Time Frame Financial Aid all within a single tab without any fuss. Simplify your workflows by utilizing one cohesive eSignature solution.

Create this form in 5 minutes or less

FAQs

-

What can I do when a divorced parent refuses to fill out a college financial aid form?

Anything that does not involve going to university and paying for it with loans/grants.Join the service.Get a full time job and take a class at a time and pay with cash.Find an employer that will pay for your schooling.Get married so you can be considered an independent student 9but not from your husband).Jus t get a job. By the time the government lets you file as an independent student(age 24) you may have found an even better pattern that doesn’t involve college at all.

-

Do I have to fill out both the FAFSA (since I'm a US citizen living abroad) and a CSS profile form to get financial aid for colleges?

There’s nothing about the FAFSA that is exclusive or required for US citizens living abroad. The FAFSA is simply the most commonly used application form for student aid applications GENERALLY, and almost every college and university asks for it rather than go to the trouble of inventing their own - even though, in fact, many of them DO have their own application, and STILL want to see a FAFSA.What you actually should do, is go to the website OF THE COLLEGES you are interested in, and check the parts where financial aid is discussed, and see what they want to see.Probably 90% or more will want a FAFSA, maybe 10% will want their own form IN ADDITION to the FAFSA, and a certain number will also want to see the CSS profile.So fill out the FAFSA online. There is part of it which asks for the codes (every college has one) for the colleges you want to have them send the form to. You can send a FAFSA to TEN colleges when you fill out the FAFSA in the first place - AND, you can go back later, and add more colleges.Fill out the FAFSA. The one for fall semester 2018- spring 2019 is available to be filled out beginning, I believe, around October 2017. Most colleges want to have that in their possession by January 2018.Unless, of course, you are independently wealthy, and can afford to pay for college by yourself.Other notes:you fill out the FAFSA every year for the next college year.you can link to the IRS website to pre-fill in a lot of the information the FAFSA asks for (this saves time).you need your own tax return data (if you have such a thing yet) and your parents’ information also.It looks intimidating, but it really isn’t terribly difficult - I would suggest going through the FAFSA website and reading most of the information there before you start, because there are various documents and numbers you will need to have to fill out the form, and it is easier if you have collected all that stuff before you sit down to fill the form out.By the way - I see this idea often and it is wrong - ‘FAFSA’ does NOT give anybody any money. It is an APPLICATION FOR AID. The college you apply to and get accepted at will look at your application, your FAFSA form, all the other required forms you supply to them, and THEN the Financial Aid office will decide a) whether to offer you an aid package and b) what that aid package will contain.It could be a mix of scholarships (great!), grants (wonderful!), student loans of various kinds (read the fine print) and perhaps an offer of work-study. You can accept or refuse any of those, individually.Good luck!

-

If you are disowned by your family before college at age 18, how would you fill out the financial aid form?

I’m not sure what ‘disowned’ means, is this a legal situation where you are emancipated or are you just out of the house and not supported?If you are just on your own and not supported you are out of luck. It isn’t any different than any other kid. Until you are 24, you are not independent for aid and have to file FAFSA with your information and your parent financial information. This does not require your parents to pay anything. But it is used for the aid calculations.There are a limited set of circumstances where you can file with just your information only. This is called being an Independent Student for aid and it is not based on your parents supporting you are not. It is based on these criteria:https://studentaid.ed.gov/sa/faf...Now if your parents refuse to provide information you are still out of luck. You may file a FAFSA with only your information but aid will be limited. The most you will get is a federal loan starting at $5,500 for freshman year. You will have to contact the financial aid office at the colleges where you are accepted in order to get the override instructions. You won’t get any Pell Grant or college aid in this case.

-

How should one account for the value of non-qualified deferred compensation and pension plans and its distributions when filling out the college tuition financial aid forms in FAFSA?

How should one account for the value of non-qualified deferred compensation and pension plans and its distributions when filling out the college tuition financial aid forms in FAFSA?Elective employee contributions to and all distributions from the non-qualified plans during the FAFSA’s base year are reported as income on the FAFSA. Employer contributions are not reported as income. If a reportable contribution or distribution is not reported in adjusted gross income (AGI), it is reported as untaxed income of the FAFSA. This is no different than the treatment of qualified retirement plans.A non-qualified plan should not be reported as an asset, if access to the plan is restricted until the employee signNowes retirement age. But, many non-qualified plans provide the employee with access to the plan after employment is terminated, not just when the employee signNowes retirement age. If so, the non-qualified plan should be reported as an asset on the FAFSA, to the extent that it has vested.

-

I am going to my dream college in the fall, but I don't know I am going to afford it over time because they don't give out a lot of financial aid. How can I pay for it over time with the least amount of student loans?

As someone going through the same thing, I’ll give you the advices I got when I asked for help. (This is assuming you are in the United States).File for FAFSA. This is a federal grant that the government gives you to help you pay your tuition, you need to take advantage of this. In addition, search up some grants that your states offer and apply for those.Search for scholarships, both private and university. Apply to as much as you can even if the amount is under 1k. Any amount helps!Apply for Work Study Programs. Work Study programs are when the student works while going to college.Get a side hustle. If you have something you are good at, NEVER do it for free. For example, try to tutor students. If you are good at making shirts, pants, make a small hustle on that. My cousin buys and sells sneakers and he gets a good amount of profit (he buys those expensive sneakers).Ask about RA is your housings. In many colleges, RAs have free housing, try asking your college about that.Cut down your costs as much as possible! Don’t buy things you don’t need. Don’t go on vacations if you can’t afford it.Try to find pdf versions of your textbooks online. Ask the teacher they want the specific version of the textbook that is required, if not, e-mail the upperclassmen and ask them for their textbooks. Buying second hand is much a lot less cheap than buying new textbooks.These are some of the things I have read, I’ll add more if I find

Create this form in 5 minutes!

How to create an eSignature for the tyler junior college 150 maximum time frame financial aid

How to create an eSignature for the Tyler Junior College 150 Maximum Time Frame Financial Aid in the online mode

How to create an eSignature for the Tyler Junior College 150 Maximum Time Frame Financial Aid in Google Chrome

How to make an electronic signature for signing the Tyler Junior College 150 Maximum Time Frame Financial Aid in Gmail

How to generate an eSignature for the Tyler Junior College 150 Maximum Time Frame Financial Aid right from your smartphone

How to create an eSignature for the Tyler Junior College 150 Maximum Time Frame Financial Aid on iOS devices

How to create an eSignature for the Tyler Junior College 150 Maximum Time Frame Financial Aid on Android devices

People also ask

-

What is the tjc financial aid number, and why is it important?

The tjc financial aid number is a unique identifier assigned to students seeking financial assistance at Tyler Junior College. This number is crucial for processing financial aid applications and ensuring you receive the funds you need for your education.

-

How can I find my tjc financial aid number online?

You can find your tjc financial aid number by logging into your student portal on the Tyler Junior College website. If you have trouble accessing the portal, you may contact the financial aid office directly for assistance.

-

Can I use the tjc financial aid number for other schools?

The tjc financial aid number is specific to Tyler Junior College and should be used only for transactions and applications related to this institution. If you are applying for aid at other schools, you will need to obtain their specific financial aid number.

-

What types of financial aid can I access using my tjc financial aid number?

With your tjc financial aid number, you can apply for various types of financial aid including grants, loans, and scholarships at Tyler Junior College. This number streamlines the application process, making it easier to determine your eligibility for different funding sources.

-

How does airSlate SignNow facilitate the submission of financial aid documents?

AirSlate SignNow makes it easy to send and eSign your financial aid documents securely and efficiently. By using our cost-effective solution, you can ensure that your tjc financial aid number is properly submitted with all necessary paperwork.

-

Are there any fees associated with using the tjc financial aid number for applications?

There are no direct fees for using your tjc financial aid number when applying for financial aid, but you may encounter costs related to specific programs or services. Be sure to review Tyler Junior College's financial aid policies for detailed information.

-

What should I do if I forget my tjc financial aid number?

If you forget your tjc financial aid number, you can retrieve it by accessing your student account online or by contacting the Tyler Junior College financial aid office for further assistance. They can provide the necessary information to help you recover your number.

Get more for Tyler Junior College 150 Maximum Time Frame Financial Aid

Find out other Tyler Junior College 150 Maximum Time Frame Financial Aid

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document