Monthly Return of BPayrollb Tax P6 PG12009 Update Form

What is the Monthly Return Of BPayrollb Tax P6 PG12009 Update

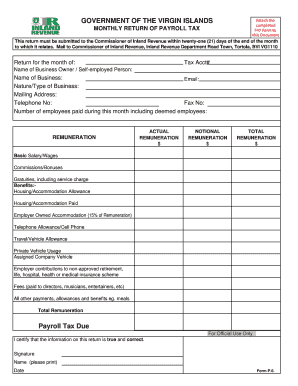

The Monthly Return Of BPayrollb Tax P6 PG12009 Update is a specific tax form used by businesses to report payroll taxes on a monthly basis. This form is essential for ensuring compliance with federal and state tax regulations. It captures critical information regarding employee wages, tax withholdings, and contributions to various tax funds. Completing this form accurately is vital for maintaining proper tax records and avoiding penalties.

Steps to complete the Monthly Return Of BPayrollb Tax P6 PG12009 Update

Completing the Monthly Return Of BPayrollb Tax P6 PG12009 Update involves several key steps:

- Gather necessary payroll records, including employee wages and tax withholdings.

- Fill out the form with accurate information, ensuring all fields are completed.

- Double-check calculations for accuracy, particularly tax amounts owed.

- Sign and date the form to validate the submission.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the Monthly Return Of BPayrollb Tax P6 PG12009 Update

The legal use of the Monthly Return Of BPayrollb Tax P6 PG12009 Update is governed by various tax laws and regulations. To be considered legally binding, the form must be completed accurately and submitted on time. Additionally, using a reliable electronic signature tool can enhance the legal validity of the form, as it complies with the ESIGN and UETA acts. Ensuring that all required signatures are obtained is crucial for the form's acceptance by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Monthly Return Of BPayrollb Tax P6 PG12009 Update are typically set by the IRS and may vary based on the specific tax year. It is important for businesses to be aware of these deadlines to avoid late fees and penalties. Generally, forms are due on the last day of the month following the reporting period. Keeping a calendar of these dates can help ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The Monthly Return Of BPayrollb Tax P6 PG12009 Update can be submitted through various methods:

- Online: Many businesses choose to file electronically using approved software, which often streamlines the process and reduces errors.

- Mail: Forms can be printed and mailed to the appropriate tax authority. Ensure to use the correct address as specified by the IRS.

- In-Person: Some businesses may prefer to submit forms in person at local tax offices, providing an opportunity for immediate confirmation of receipt.

Penalties for Non-Compliance

Failure to submit the Monthly Return Of BPayrollb Tax P6 PG12009 Update on time can result in significant penalties. These may include fines based on the amount of tax owed and the duration of the delay. Additionally, repeated non-compliance can lead to increased scrutiny from tax authorities, potentially resulting in audits. Businesses are encouraged to maintain accurate records and adhere to filing deadlines to mitigate these risks.

Quick guide on how to complete monthly return of bpayrollb tax p6 pg12009 update

Effortlessly Prepare Monthly Return Of BPayrollb Tax P6 PG12009 Update on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Monthly Return Of BPayrollb Tax P6 PG12009 Update on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

The simplest method to modify and eSign Monthly Return Of BPayrollb Tax P6 PG12009 Update effortlessly

- Find Monthly Return Of BPayrollb Tax P6 PG12009 Update and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for this task.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your changes.

- Select how you wish to share your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Monthly Return Of BPayrollb Tax P6 PG12009 Update and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the monthly return of bpayrollb tax p6 pg12009 update

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Monthly Return Of BPayrollb Tax P6 PG12009 Update?

The Monthly Return Of BPayrollb Tax P6 PG12009 Update is a crucial tax documentation process that businesses need to complete. It helps ensure compliance with payroll tax obligations and provides the necessary details for tax authorities. Utilizing tools like airSlate SignNow can streamline the process, allowing you to eSign and send documents quickly and securely.

-

How can airSlate SignNow assist with the Monthly Return Of BPayrollb Tax P6 PG12009 Update?

airSlate SignNow simplifies the Monthly Return Of BPayrollb Tax P6 PG12009 Update by enabling businesses to automate document management. You can easily create, send, and eSign your returns online, reducing paperwork and minimizing errors. This efficiency can help you stay focused on your business operations while ensuring compliance.

-

What features does airSlate SignNow offer for the Monthly Return Of BPayrollb Tax P6 PG12009 Update?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows for the Monthly Return Of BPayrollb Tax P6 PG12009 Update. These tools make it easier to prepare and submit your tax returns without the hassle of traditional paperwork. Moreover, the platform ensures that all documents are securely stored and accessible.

-

Is airSlate SignNow cost-effective for handling payroll tax updates?

Yes, airSlate SignNow provides a cost-effective solution for managing your Monthly Return Of BPayrollb Tax P6 PG12009 Update. With flexible pricing plans, businesses of all sizes can find a suitable option that fits their budget while maximizing efficiency. Investing in this solution can save you both time and money on your payroll tax processes.

-

Can I integrate airSlate SignNow with other software for the Monthly Return Of BPayrollb Tax P6 PG12009 Update?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and payroll software, facilitating a smooth workflow for the Monthly Return Of BPayrollb Tax P6 PG12009 Update. This compatibility helps ensure that your tax documentation is accurate and up-to-date, further easing the burden of compliance.

-

How does airSlate SignNow enhance security for the Monthly Return Of BPayrollb Tax P6 PG12009 Update?

Security is a priority at airSlate SignNow, especially for sensitive documents like the Monthly Return Of BPayrollb Tax P6 PG12009 Update. The platform employs advanced encryption and secure data storage practices to protect your information from unauthorized access. This gives you peace of mind when managing your payroll tax returns.

-

What are the benefits of using airSlate SignNow for payroll tax documents?

Using airSlate SignNow for your payroll tax documents, such as the Monthly Return Of BPayrollb Tax P6 PG12009 Update, offers numerous benefits. It streamlines the signing process, reduces errors, and ensures timely submission of documents. Additionally, it allows for easy tracking and management of all your important files.

Get more for Monthly Return Of BPayrollb Tax P6 PG12009 Update

Find out other Monthly Return Of BPayrollb Tax P6 PG12009 Update

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word