California W9 Form

What is the California W-9 Form

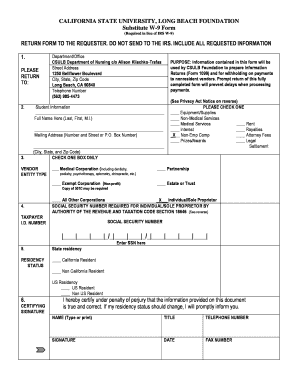

The California W-9 form is a tax document used by individuals and businesses to provide their taxpayer identification information to entities that are required to report payments made to them. This form is essential for freelancers, contractors, and other self-employed individuals who receive income from clients. By submitting the W-9, the requester can accurately report payments to the IRS, ensuring compliance with federal tax regulations.

How to use the California W-9 Form

To use the California W-9 form, individuals must fill out their name, business name (if applicable), address, and taxpayer identification number (TIN), which can be a Social Security number or an Employer Identification Number. Once completed, the form should be submitted to the requester, who will use the information to prepare the necessary tax documents, such as Form 1099. It is important to keep a copy of the completed form for personal records.

Steps to complete the California W-9 Form

Completing the California W-9 form involves several straightforward steps:

- Download the form from a reliable source.

- Fill in your name and business name, if applicable.

- Provide your address and taxpayer identification number.

- Sign and date the form to certify that the information is accurate.

- Submit the completed form to the requesting party.

Key elements of the California W-9 Form

The key elements of the California W-9 form include:

- Name: The name of the individual or business entity.

- Business Name: If applicable, the name under which the business operates.

- Address: The complete address where the individual or business is located.

- Taxpayer Identification Number: Either a Social Security number or Employer Identification Number.

- Signature: A signature certifying the accuracy of the information provided.

Legal use of the California W-9 Form

The California W-9 form is legally valid when completed accurately and submitted to the appropriate requester. It serves as a declaration of taxpayer status and is essential for compliance with IRS regulations. The form must be filled out truthfully, as providing false information can lead to penalties, including fines and legal repercussions.

Penalties for Non-Compliance

Failure to submit a completed California W-9 form when requested can result in penalties. The IRS may impose backup withholding on payments made to the individual or business, which means that a percentage of payments will be withheld for tax purposes. Additionally, inaccuracies or failure to provide the correct taxpayer identification number can lead to further penalties and complications during tax filing.

Quick guide on how to complete california w9 form

Complete California W9 Form effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed paperwork, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents promptly without delays. Manage California W9 Form on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to modify and electronically sign California W9 Form with ease

- Obtain California W9 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized documents, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign California W9 Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california w9 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CA W9 form and why is it important?

A CA W9 form is a request for taxpayer identification number and certification used by businesses in California for tax purposes. It is important because it ensures that the correct taxpayer information is on file for reporting income to the IRS. By utilizing airSlate SignNow, you can easily create, send, and eSign your CA W9 form without hassle.

-

How does airSlate SignNow handle CA W9 document security?

airSlate SignNow prioritizes document security by providing advanced encryption and secure cloud storage for your CA W9 forms. All documents are stored with top-notch security measures to prevent unauthorized access while ensuring compliance with regulations. Your sensitive tax information remains safe and confidential throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for my CA W9 needs?

Yes, airSlate SignNow offers seamless integrations with various applications to streamline your workflow. You can easily connect tools like CRM systems and cloud storage to automate the sending and signing of your CA W9 forms. This enhances efficiency and helps you manage your documents effectively.

-

What are the pricing options for using airSlate SignNow for CA W9 forms?

airSlate SignNow provides flexible pricing plans tailored to different business needs. You can choose from individual, team, or enterprise plans based on the volume of CA W9 forms you need to manage. Each plan provides features designed to facilitate smooth document eSigning without breaking your budget.

-

Is it easy to eSign a CA W9 form with airSlate SignNow?

Absolutely! airSlate SignNow offers a user-friendly interface that makes eSigning CA W9 forms simple and intuitive. You can complete the signing process in just a few clicks, allowing you to focus on your business rather than paperwork.

-

What features can I expect for managing CA W9 forms with airSlate SignNow?

When using airSlate SignNow for your CA W9 forms, you'll benefit from features like customizable templates, real-time tracking, and automated reminders. These features ensure that you can manage your document workflow efficiently while staying on top of deadlines.

-

How does airSlate SignNow improve the efficiency of processing CA W9 paperwork?

By digitizing the CA W9 process, airSlate SignNow improves efficiency dramatically. You can easily send, sign, and store your CA W9 forms, reducing paper waste and expediting processing time. This streamlined approach allows your business to operate more efficiently.

Get more for California W9 Form

- Consent of agency in nonstepparent adoption vermont form

- Vermont stepparent adoption form

- Consent of spouse of prospective adoptive parent in adoption of adult or emancipated minor vermont form

- Vermont adoption form

- Adoption biological form

- Adoption decree partner adoption of a minor form 139k vermont

- Agreed written termination of lease by landlord and tenant vermont form

- Certificate of appointment vermont form

Find out other California W9 Form

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online