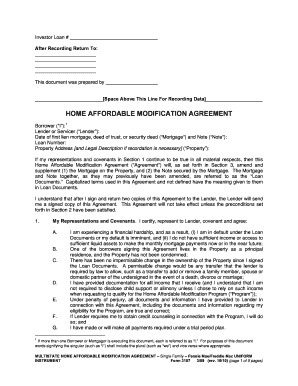

Sample Loan Modification Agreement Form

What is the Sample Loan Modification Agreement

A sample loan modification agreement is a legal document that outlines the terms and conditions under which a borrower and lender agree to modify the original loan agreement. This modification can include changes to the interest rate, loan term, or monthly payment amounts. The purpose of this agreement is to help borrowers who may be struggling to meet their current loan obligations by providing them with more manageable payment options.

How to Use the Sample Loan Modification Agreement

Using a sample loan modification agreement involves several steps. First, the borrower should review their financial situation to determine the necessary modifications. Next, they can obtain a sample loan modification agreement template, which can be customized to fit their specific needs. After filling out the required information, both parties should review the document carefully to ensure all terms are clear and agreeable. Finally, both the borrower and lender must sign the agreement to make it legally binding.

Steps to Complete the Sample Loan Modification Agreement

Completing a sample loan modification agreement involves the following steps:

- Gather necessary financial documents, such as pay stubs, tax returns, and bank statements.

- Identify the specific changes needed in the loan terms.

- Fill out the sample loan modification agreement with accurate information.

- Review the agreement with the lender to discuss any concerns or adjustments.

- Obtain signatures from both parties to finalize the agreement.

Legal Use of the Sample Loan Modification Agreement

The legal use of a sample loan modification agreement requires adherence to specific regulations. In the United States, it is essential that the agreement complies with federal and state laws governing loan modifications. This includes ensuring that the terms are fair and that both parties understand their rights and obligations. A properly executed agreement, with signatures and dates, will be considered legally binding in a court of law.

Key Elements of the Sample Loan Modification Agreement

Several key elements should be included in a sample loan modification agreement to ensure it is comprehensive and legally sound:

- Identification of Parties: Clearly state the names and addresses of both the borrower and lender.

- Loan Details: Include original loan amount, current balance, and any relevant account numbers.

- Modification Terms: Specify the new interest rate, payment schedule, and loan term.

- Signatures: Ensure both parties sign and date the agreement to validate it.

Eligibility Criteria

To qualify for a loan modification agreement, borrowers typically need to meet certain eligibility criteria. These may include demonstrating financial hardship, providing documentation of income and expenses, and being current on mortgage payments or having a limited number of missed payments. Lenders will assess these factors to determine whether to approve the modification request.

Quick guide on how to complete sample loan modification agreement

Complete Sample Loan Modification Agreement seamlessly on any device

Digital document management has gained signNow traction among enterprises and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Sample Loan Modification Agreement on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Sample Loan Modification Agreement effortlessly

- Obtain Sample Loan Modification Agreement and click Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Sample Loan Modification Agreement and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sample loan modification agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sample loan modification agreement?

A sample loan modification agreement is a template that outlines the revised terms of a loan, allowing borrowers to adjust their payments and obligations. This document is useful for both the lender and borrower to ensure clarity on the new agreement terms. By using a sample loan modification agreement, you can streamline the modification process while ensuring compliance with legal requirements.

-

How can I create a sample loan modification agreement with airSlate SignNow?

Creating a sample loan modification agreement with airSlate SignNow is straightforward. You can choose from various templates, customize the terms specific to your situation, and utilize our easy-to-use eSignature feature. This ensures that all parties involved can securely sign the agreement online, making the process quick and efficient.

-

What are the benefits of using a sample loan modification agreement?

Using a sample loan modification agreement can signNowly reduce the time and effort needed to create a legal document. It provides a clear structure that ensures all necessary details are included, minimizing the risk of errors. Additionally, it can help borrowers negotiate better terms with their lenders more effectively.

-

Are there any costs associated with using a sample loan modification agreement in airSlate SignNow?

airSlate SignNow offers various pricing plans that accommodate different business needs, including free and paid options. While you can access sample loan modification agreement templates for free, advanced features and eSigning capabilities may vary by plan. For detailed pricing, explore our subscription options to find the best fit for your requirements.

-

Does airSlate SignNow support integrations for managing loan modification agreements?

Yes, airSlate SignNow supports various integrations that enhance the management of loan modification agreements. You can connect with popular applications like Google Drive, Dropbox, and CRM systems to streamline your document workflows. This integration capability allows for efficient organization and storage of your agreements.

-

Can I share a sample loan modification agreement with multiple parties?

Absolutely! With airSlate SignNow, you can easily share a sample loan modification agreement with multiple parties for signing. The platform allows you to invite collaborators via email, ensuring everyone involved can access and eSign the document securely, facilitating streamlined communication.

-

Is it legally binding to use a sample loan modification agreement created in airSlate SignNow?

Yes, a sample loan modification agreement signed through airSlate SignNow is legally binding. Our platform complies with electronic signature laws, ensuring that all signatures are valid and recognized in a court of law. It is important to ensure all parties agree to the terms outlined in the agreement for it to be enforceable.

Get more for Sample Loan Modification Agreement

- Kansas lottery claim form

- Copy certification by document custodian pdf 382484953 form

- J107e form

- Emotional pain chart pdf form

- 2nd grade spelling words 94115979 form

- Proof of allowance letter form

- A dedicated pregnancy clinic improves reproductive form

- Reg 1 earned income and net profits tax regulations form

Find out other Sample Loan Modification Agreement

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document