Reg 1 Earned Income and Net Profits Tax Regulations 2024-2026

Understanding the Reg 1 Earned Income and Net Profits Tax Regulations

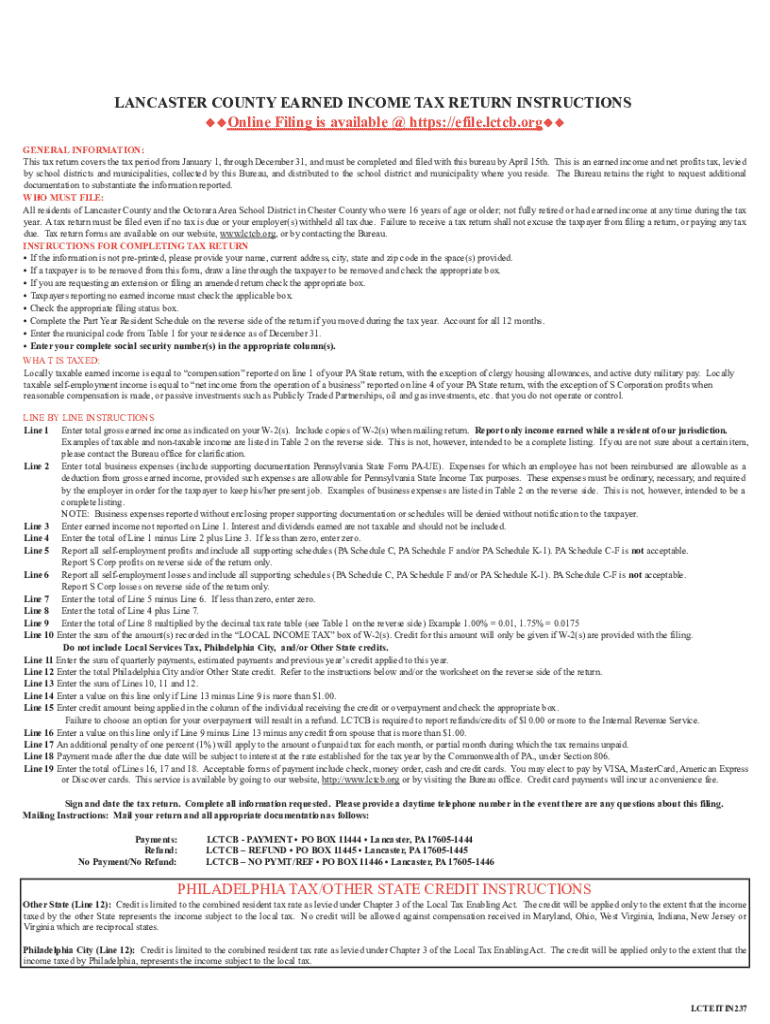

The Reg 1 Earned Income and Net Profits Tax Regulations are essential guidelines for individuals and businesses in Pennsylvania. These regulations define what constitutes earned income and outline the tax obligations for residents and non-residents earning income within the state. Understanding these regulations is crucial for compliance and accurate tax reporting.

Earned income generally includes wages, salaries, commissions, and other forms of compensation for services rendered. Net profits, on the other hand, refer to the income generated from business activities after deducting allowable expenses. Familiarity with these definitions helps taxpayers determine their liabilities and ensures they are meeting state tax requirements.

Steps to Complete the Reg 1 Earned Income and Net Profits Tax Regulations

Completing the Reg 1 Earned Income and Net Profits Tax Regulations involves several key steps. First, gather all necessary documentation, including W-2 forms, 1099 forms, and records of any business income and expenses. Accurate record-keeping is vital for substantiating your income and deductions.

Next, calculate your total earned income and net profits. Review the regulations to identify any specific deductions or credits you may be eligible for. Once you have completed your calculations, fill out the appropriate forms, ensuring all information is accurate and complete. Finally, submit your forms by the designated deadlines to avoid penalties.

Required Documents for Filing

When filing the Reg 1 Earned Income and Net Profits Tax return, several documents are necessary to ensure accurate reporting. Commonly required documents include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of business income and expenses

- Any documentation supporting deductions or credits claimed

Having these documents ready will streamline the filing process and help avoid potential issues with your tax return.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the Reg 1 Earned Income and Net Profits Tax return. Typically, the tax return is due on April 15 for the previous calendar year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day.

Additionally, taxpayers should keep track of any extensions or changes to deadlines announced by the Pennsylvania Department of Revenue. Staying informed about these dates helps ensure timely compliance and avoids penalties for late submissions.

Penalties for Non-Compliance

Failure to comply with the Reg 1 Earned Income and Net Profits Tax Regulations can result in significant penalties. Common penalties include fines for late filing, underpayment of taxes, and interest on unpaid amounts. The Pennsylvania Department of Revenue actively enforces compliance, and taxpayers may face audits if discrepancies arise.

To mitigate the risk of penalties, it is advisable to file accurately and on time, as well as to maintain thorough records of income and deductions. Seeking assistance from a tax professional can also help ensure compliance with all regulations.

Eligibility Criteria for Filing

Eligibility to file the Reg 1 Earned Income and Net Profits Tax return depends on several factors, including residency status and the nature of income earned. Generally, all Pennsylvania residents, as well as non-residents who earn income within the state, must file this return.

Specific criteria may vary based on individual circumstances, such as age, income level, and type of employment. It is important to review these criteria carefully to determine your filing obligations and ensure compliance with state tax laws.

Create this form in 5 minutes or less

Find and fill out the correct reg 1 earned income and net profits tax regulations

Create this form in 5 minutes!

How to create an eSignature for the reg 1 earned income and net profits tax regulations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PA earned income tax return?

A PA earned income tax return is a tax form that residents of Pennsylvania must file to report their earned income. This return is essential for calculating state taxes owed and ensuring compliance with Pennsylvania tax laws. Using airSlate SignNow can simplify the process of signing and submitting your PA earned income tax return.

-

How can airSlate SignNow help with my PA earned income tax return?

airSlate SignNow provides an easy-to-use platform for electronically signing and managing your PA earned income tax return. With its intuitive interface, you can quickly prepare and send your tax documents for eSignature, ensuring a smooth filing process. This saves you time and reduces the hassle of traditional paper-based methods.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. Each plan includes features that can assist with managing documents, including your PA earned income tax return. You can choose a plan that fits your budget while still accessing essential eSignature capabilities.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow employs advanced security measures to protect your sensitive documents, including your PA earned income tax return. With encryption and secure cloud storage, you can trust that your information is safe. This ensures that your tax documents remain confidential and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your workflow when filing your PA earned income tax return. This integration allows you to streamline document management and eSigning, making the entire process more efficient. Check the integrations page for a list of compatible applications.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features for document management, including templates, reminders, and real-time tracking. These tools can help you efficiently manage your PA earned income tax return and other important documents. With these features, you can ensure that all necessary signatures are collected promptly.

-

How long does it take to complete a PA earned income tax return using airSlate SignNow?

The time it takes to complete a PA earned income tax return using airSlate SignNow can vary based on the complexity of your documents. However, the platform is designed to expedite the signing process, allowing you to complete your return quickly. Most users find that they can finalize their documents in a fraction of the time compared to traditional methods.

Get more for Reg 1 Earned Income and Net Profits Tax Regulations

Find out other Reg 1 Earned Income and Net Profits Tax Regulations

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer