Printable Small Business Loan Application Form Bangor Savings Bank 2007

Understanding the Printable Small Business Loan Application Form Bangor Savings Bank

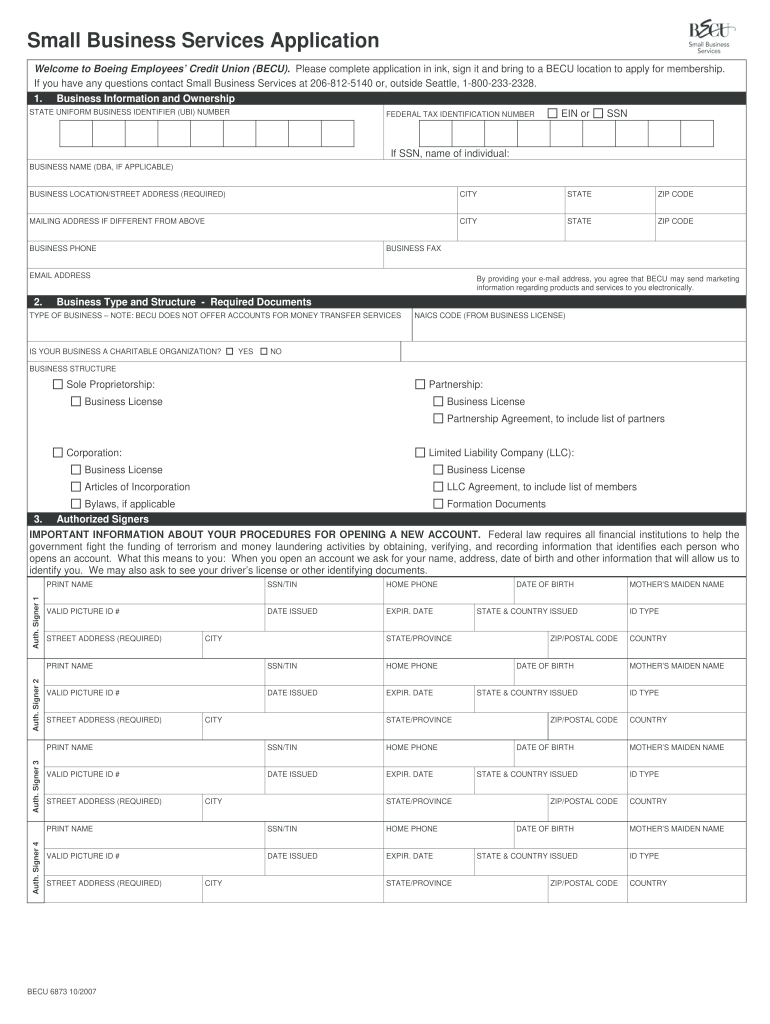

The Printable Small Business Loan Application Form Bangor Savings Bank is a crucial document for entrepreneurs seeking financial assistance to grow their businesses. This form collects essential information about the applicant's business, including financial history, business structure, and loan requirements. It is designed to assess the creditworthiness of the applicant and determine their eligibility for a loan. By completing this form accurately, applicants can facilitate a smoother loan approval process.

Steps to Complete the Printable Small Business Loan Application Form Bangor Savings Bank

Completing the Printable Small Business Loan Application Form Bangor Savings Bank involves several key steps:

- Gather necessary information: Collect details about your business, including its legal structure, financial statements, and ownership information.

- Fill out the form: Provide accurate and complete information in all required fields, ensuring clarity and legibility.

- Review the application: Double-check the information for accuracy and completeness to avoid delays in processing.

- Sign and date the form: Ensure that all required signatures are provided, as this is essential for the application to be valid.

Legal Use of the Printable Small Business Loan Application Form Bangor Savings Bank

The Printable Small Business Loan Application Form Bangor Savings Bank is legally binding once completed and signed. For the application to be valid, it must comply with applicable federal and state laws governing loan applications. This includes providing truthful information and adhering to the stipulations outlined in the form. Misrepresentation or incomplete information can lead to legal repercussions, including denial of the loan or potential fraud charges.

Key Elements of the Printable Small Business Loan Application Form Bangor Savings Bank

Several key elements are essential to the Printable Small Business Loan Application Form Bangor Savings Bank:

- Business Information: This section includes the business name, address, and contact details.

- Financial Information: Applicants must provide financial statements, including income statements and balance sheets.

- Loan Amount Requested: Clearly state the amount of funding needed and the intended use of the funds.

- Owner Information: Include personal information about the business owner(s), such as Social Security numbers and ownership percentages.

How to Obtain the Printable Small Business Loan Application Form Bangor Savings Bank

The Printable Small Business Loan Application Form Bangor Savings Bank can be obtained directly from the bank's official website or by visiting a local branch. It is essential to ensure that you are using the most current version of the form to avoid any issues during the application process. If you prefer a physical copy, you can request one at the bank, where staff can also provide assistance in completing the form.

Application Process & Approval Time

The application process for the Printable Small Business Loan Application Form Bangor Savings Bank typically involves several stages:

- Submission: After completing the form, submit it along with any required documentation.

- Review: The bank will review the application, assessing the provided information and financial viability.

- Approval: Once the review is complete, the bank will notify the applicant of the decision. This process can take anywhere from a few days to several weeks, depending on the complexity of the application and the bank's workload.

Quick guide on how to complete printable small business loan application form bangor savings bank

Effortlessly Prepare Printable Small Business Loan Application Form Bangor Savings Bank on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it on the internet. airSlate SignNow provides all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Printable Small Business Loan Application Form Bangor Savings Bank on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Edit and eSign Printable Small Business Loan Application Form Bangor Savings Bank with Ease

- Locate Printable Small Business Loan Application Form Bangor Savings Bank and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Printable Small Business Loan Application Form Bangor Savings Bank and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable small business loan application form bangor savings bank

Create this form in 5 minutes!

How to create an eSignature for the printable small business loan application form bangor savings bank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Printable Small Business Loan Application Form Bangor Savings Bank?

The Printable Small Business Loan Application Form Bangor Savings Bank is a standardized document that helps small businesses apply for loans. This form gathers essential information required by Bangor Savings Bank to evaluate loan applications efficiently.

-

How do I access the Printable Small Business Loan Application Form Bangor Savings Bank?

You can access the Printable Small Business Loan Application Form Bangor Savings Bank directly from the Bangor Savings Bank website or through platforms like airSlate SignNow. Once you have the form, you can fill it out online or print it for a handwritten submission.

-

Are there any fees associated with applying for the Printable Small Business Loan Application Form Bangor Savings Bank?

There are no fees associated with obtaining the Printable Small Business Loan Application Form Bangor Savings Bank itself. However, be aware that Bangor Savings Bank may have associated fees once you proceed with the loan process.

-

What features come with the Printable Small Business Loan Application Form Bangor Savings Bank?

The Printable Small Business Loan Application Form Bangor Savings Bank includes fields for essential business information, financial data, and loan purpose details. This ensures a comprehensive understanding of your business needs, which can help expedite loan approval.

-

How can airSlate SignNow enhance my experience with the Printable Small Business Loan Application Form Bangor Savings Bank?

Using airSlate SignNow streamlines the process of completing and submitting the Printable Small Business Loan Application Form Bangor Savings Bank. You can easily eSign and send the form securely, eliminating the need for physical paperwork and providing a more efficient process overall.

-

What benefits can I expect from using the Printable Small Business Loan Application Form Bangor Savings Bank?

By using the Printable Small Business Loan Application Form Bangor Savings Bank, you can ensure that your application is complete and well-organized, which may increase your chances of approval. Additionally, it saves you time and reduces the likelihood of errors during the application process.

-

Can I integrate the Printable Small Business Loan Application Form Bangor Savings Bank with other tools?

Yes, by using airSlate SignNow, you can integrate the Printable Small Business Loan Application Form Bangor Savings Bank with other business tools and systems. This includes CRM software, which can help manage your loan application along with other business processes seamlessly.

Get more for Printable Small Business Loan Application Form Bangor Savings Bank

- Planet earth caves 47 minutes answer key form

- Abb vfd warranty form

- Igneous rocks worksheet answer key form

- Mass effect d20 character sheet form

- Cantonment board birth certificate form

- Readworks answer key form

- Function report adult form ssa 3373 bk

- Authorization release information albany medical center

Find out other Printable Small Business Loan Application Form Bangor Savings Bank

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed