Form 10a100

What is the Form 10a100

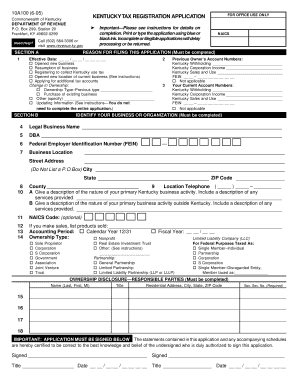

The Form 10a100 is a specific document used in various administrative processes, often related to legal or regulatory compliance. This form is essential for individuals and businesses in the United States who need to provide specific information or declarations to governmental agencies. Understanding the purpose and requirements of the Form 10a100 is crucial for ensuring that it is filled out correctly and submitted on time.

How to use the Form 10a100

Using the Form 10a100 involves several steps to ensure that the information provided is accurate and complete. Begin by obtaining the latest version of the form from the appropriate source. Carefully read the instructions accompanying the form to understand what information is required. Fill out the form with the necessary details, ensuring that all fields are completed as instructed. Once completed, review the form for accuracy before submitting it to the designated agency.

Steps to complete the Form 10a100

Completing the Form 10a100 involves a systematic approach to ensure compliance and accuracy. Follow these steps:

- Obtain the Form 10a100 from the official source.

- Read the instructions thoroughly to understand the requirements.

- Gather all necessary information and documents needed to fill out the form.

- Complete each section of the form, ensuring clarity and accuracy.

- Review the completed form for any errors or omissions.

- Submit the form as directed, whether online, by mail, or in person.

Legal use of the Form 10a100

The legal use of the Form 10a100 is governed by specific regulations and guidelines. It is important to ensure that the form is filled out in compliance with applicable laws to avoid any legal repercussions. This includes understanding the requirements for signatures, dates, and any supporting documentation that may need to accompany the form. Using a reliable electronic signature solution can enhance the legal validity of the form when submitting it electronically.

Key elements of the Form 10a100

The Form 10a100 comprises several key elements that must be accurately completed for the form to be considered valid. These elements typically include:

- Personal or business identification information.

- Specific declarations or statements as required by the agency.

- Signature of the individual or authorized representative.

- Date of submission.

Ensuring that all key elements are correctly filled out is essential for the successful processing of the form.

Form Submission Methods

The Form 10a100 can be submitted through various methods, depending on the requirements of the agency involved. Common submission methods include:

- Online submission via the agency's official website.

- Mailing the completed form to the designated address.

- Submitting the form in person at the appropriate office.

Each method may have different processing times and requirements, so it is important to choose the one that best fits your situation.

Quick guide on how to complete form 10a100

Complete Form 10a100 effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Form 10a100 on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to modify and eSign Form 10a100 without hassle

- Acquire Form 10a100 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for distributing your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing out new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 10a100 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 10a100

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 10a100 and how is it used?

The form 10a100 is a document used for submitting specific information to regulatory authorities. It is essential for businesses to ensure compliance with state requirements. By utilizing airSlate SignNow, you can easily fill out, eSign, and send the form 10a100 securely and efficiently.

-

How does airSlate SignNow simplify the process of submitting form 10a100?

airSlate SignNow streamlines the process of submitting form 10a100 by allowing users to complete the form online. You can add your signature and send it directly to the required recipients without printing or scanning. This saves time and ensures that your submissions are processed promptly.

-

Is there a cost associated with using airSlate SignNow for the form 10a100?

Yes, there are various pricing plans available for using airSlate SignNow. Each plan offers different features that can help you manage documents, including the ability to handle the form 10a100 efficiently. Choose a plan that fits your business needs to maximize value.

-

What features does airSlate SignNow offer for handling the form 10a100?

airSlate SignNow offers an array of features for handling the form 10a100, including customizable templates, secure eSigning, and real-time tracking of document status. These tools ensure that your documents are managed seamlessly, reducing the risk of errors.

-

Can I integrate airSlate SignNow with other software when working on the form 10a100?

Absolutely! airSlate SignNow integrates with many popular applications, including CRMs and project management tools. This means you can easily sync your workflows and keep your form 10a100 process aligned with your existing systems.

-

What benefits does airSlate SignNow provide for businesses dealing with form 10a100?

Using airSlate SignNow for the form 10a100 provides several benefits, such as increased efficiency, reduced paper usage, and improved compliance. It allows businesses to manage documents digitally, ensuring speed and accuracy in their submissions.

-

Is airSlate SignNow secure for eSigning the form 10a100?

Yes, airSlate SignNow prioritizes security with robust encryption and authentication measures. This ensures that your eSigned form 10a100 is protected against unauthorized access, giving you peace of mind when handling sensitive information.

Get more for Form 10a100

- Fba chart form

- Letter of intent for joint venture pdf form

- The christ hospital financial assistancce application form

- Form ssa 795 2 76 espaol

- Police clearance certificate template form

- Texas response to motion for summary judgment example form

- Medical history initial intake form 346188132

- Piedmont hospital discharge papers 449000602 form

Find out other Form 10a100

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement