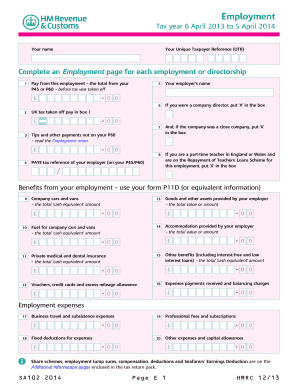

Sa 102 Form

What is the SA 102 Form

The SA 102 form is a tax document used in the United States, primarily for reporting income from self-employment. It is essential for individuals who receive income from freelance work, contract jobs, or any other form of self-employment. This form allows taxpayers to report their earnings accurately and fulfill their tax obligations. Understanding the purpose of the SA 102 form is crucial for maintaining compliance with IRS regulations and ensuring that all income is reported correctly.

How to use the SA 102 Form

Using the SA 102 form involves several steps to ensure accurate reporting of income. First, gather all necessary documentation related to your self-employment earnings, such as invoices, receipts, and bank statements. Next, complete the form by entering your total income, expenses, and any deductions you are eligible for. It is important to double-check all entries for accuracy before submission. Once completed, the form can be submitted electronically or via mail, depending on your preference and the guidelines provided by the IRS.

Steps to complete the SA 102 Form

Completing the SA 102 form requires attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, including income statements and expense records.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total self-employment income in the designated section.

- List any business expenses that can be deducted, ensuring you have documentation to support these claims.

- Review the form for accuracy and completeness before submission.

Legal use of the SA 102 Form

The SA 102 form is legally binding when completed and submitted according to IRS guidelines. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or audits. The form must be filed by the designated deadline to avoid late fees. Additionally, maintaining copies of submitted forms and supporting documents is advisable for future reference and compliance verification.

Filing Deadlines / Important Dates

Filing deadlines for the SA 102 form are crucial for compliance. Typically, the form must be submitted by April 15 of the following tax year. However, if you are unable to meet this deadline, you may file for an extension, which usually grants an additional six months. It is important to stay informed about any changes in deadlines, as they can vary based on specific circumstances or IRS updates.

Examples of using the SA 102 Form

There are various scenarios in which the SA 102 form is utilized. For instance, a freelance graphic designer would report their earnings from client projects using this form. Similarly, a consultant who provides services on a contract basis would also use the SA 102 to report income. Each individual must ensure that all income sources are accurately reflected to comply with tax regulations.

Quick guide on how to complete sa 102 form

Complete Sa 102 Form smoothly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle Sa 102 Form on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to modify and eSign Sa 102 Form effortlessly

- Locate Sa 102 Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or hide sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that require printing new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device of your choice. Modify and eSign Sa 102 Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sa 102 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SA 102 form and how is it used with airSlate SignNow?

The SA 102 form is a self-assessment tax return used in the UK, and airSlate SignNow allows users to send and eSign this form easily. With our platform, completing tax documents like the SA 102 becomes efficient and secure, ensuring that your information is handled with care.

-

Is there a cost associated with using airSlate SignNow for the SA 102 form?

Yes, airSlate SignNow offers various pricing plans to accommodate your needs when handling documents like the SA 102 form. Our cost-effective solutions allow users to manage electronic signatures, streamline document processes, and save time without breaking the bank.

-

Can I easily integrate airSlate SignNow with other applications for managing the SA 102 form?

Absolutely! airSlate SignNow integrates seamlessly with many popular applications, making it simple to manage the SA 102 form alongside your existing tools. This integration enhances your workflow and simplifies the process of eSigning and sending important documents.

-

What features does airSlate SignNow offer specifically for the SA 102 form?

When using the SA 102 form with airSlate SignNow, users can take advantage of features such as customizable templates, advanced security options, and real-time tracking of document status. These features ensure that your signing process is not only quick but also secure and compliant.

-

How can airSlate SignNow help in reducing errors when completing the SA 102 form?

airSlate SignNow minimizes errors when filling out the SA 102 form through its user-friendly interface and validation features. By guiding you through the necessary fields and providing tips, it ensures that your information is accurate before submission.

-

Is the SA 102 form compatible with mobile devices while using airSlate SignNow?

Yes, the SA 102 form can be easily accessed and signed on mobile devices through airSlate SignNow's mobile-friendly platform. This flexibility allows you to manage important tax documents conveniently from anywhere, at any time.

-

What benefits do businesses gain when using airSlate SignNow for the SA 102 form?

Using airSlate SignNow for the SA 102 form provides businesses with efficiency, cost savings, and improved compliance in handling tax documents. The platform allows teams to collaborate better and get documents signed faster, which enhances overall productivity.

Get more for Sa 102 Form

- Registrar of societies kenya form

- Dencover claim form

- American homes 4 rent lease agreement form

- Kra score sheet form

- Florida sellers real property disclosure form

- Study certificatefor the student under ap brahmi form

- Gibbs reflective 0rgho cpdme cpd portfolio builder form

- Boating licence terms and conditions form

Find out other Sa 102 Form

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure