Lumico Life Insurance Claim Form

What is the Lumico Life Insurance Claim Form

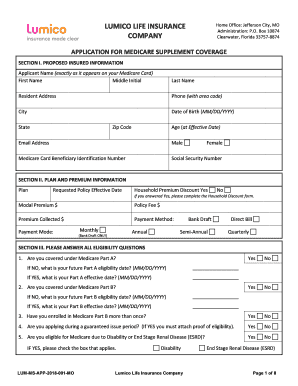

The Lumico Life Insurance Claim Form is a crucial document for policyholders wishing to file a claim for benefits under their life insurance policy. This form serves as a formal request for the insurance company to review and process the claim, ensuring that beneficiaries receive the financial support they are entitled to in the event of the policyholder's passing. The form typically requires detailed information about the insured individual, the circumstances surrounding the claim, and relevant policy details.

How to use the Lumico Life Insurance Claim Form

Using the Lumico Life Insurance Claim Form involves several steps to ensure accurate completion and submission. First, gather all necessary documentation, including the policy number and any relevant medical records. Next, fill out the form with precise details, including the date of death, cause of death, and the names of beneficiaries. It is essential to review the completed form for accuracy before submission. After ensuring all information is correct, submit the form according to the instructions provided, either online or via mail.

Steps to complete the Lumico Life Insurance Claim Form

Completing the Lumico Life Insurance Claim Form requires careful attention to detail. Follow these steps:

- Gather necessary documents, including the life insurance policy and any relevant identification.

- Provide accurate information about the deceased, including full name, date of birth, and date of death.

- Detail the cause of death and any pertinent medical history if required.

- List the beneficiaries and their relationship to the deceased.

- Sign and date the form, ensuring that all required signatures are included.

Key elements of the Lumico Life Insurance Claim Form

The Lumico Life Insurance Claim Form includes several key elements that are essential for processing a claim. These elements typically consist of:

- The policyholder's information, including name and contact details.

- The insured individual's details, such as name, date of birth, and policy number.

- Information regarding the death, including the date, cause, and any relevant medical records.

- Beneficiary details, including names and relationships to the insured.

- Signature of the claimant, confirming the accuracy of the information provided.

How to obtain the Lumico Life Insurance Claim Form

The Lumico Life Insurance Claim Form can be obtained through several methods. Policyholders can visit the Lumico website, where they may find downloadable versions of the form. Alternatively, individuals can contact Lumico customer service directly via the Lumico life insurance phone number to request a physical copy of the form. It is advisable to ensure that you are using the most current version of the form to avoid any processing delays.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Lumico Life Insurance Claim Form can be done through various methods to accommodate different preferences. The form can be submitted online via the Lumico website, where users can follow the prompts for electronic submission. Alternatively, the completed form can be mailed to the designated address provided on the form. For those who prefer a personal touch, in-person submission may also be an option at local Lumico offices, where assistance can be provided if needed.

Quick guide on how to complete lumico life insurance claim form

Complete Lumico Life Insurance Claim Form with ease on any gadget

Digital document management has become increasingly popular among enterprises and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can find the necessary form and securely save it online. airSlate SignNow provides you with all the resources needed to create, edit, and electronically sign your documents quickly and efficiently. Handle Lumico Life Insurance Claim Form on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and electronically sign Lumico Life Insurance Claim Form without hassle

- Find Lumico Life Insurance Claim Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of your documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and holds the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Edit and electronically sign Lumico Life Insurance Claim Form and ensure effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lumico life insurance claim form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Lumico Life Insurance and how does it work?

Lumico Life Insurance offers various life insurance products designed to provide financial security to policyholders and their beneficiaries. It typically provides coverage options ranging from term life to whole life insurance. When considering lumico life insurance reviews, prospective customers should assess the policy features and payout structures that align with their needs.

-

What are the pricing options for Lumico Life Insurance?

The pricing for Lumico Life Insurance varies based on the type of policy, the coverage amount, and the applicant's health status. Typically, term life policies are more affordable than permanent life insurance options. In reading lumico life insurance reviews, many customers highlight the competitive pricing that makes it accessible.

-

What features does Lumico Life Insurance offer?

Lumico Life Insurance offers features such as flexible coverage amounts, the option to convert term policies to whole life, and various riders that can be added for enhanced protection. Many lumico life insurance reviews point to these customizable features as a key benefit for individuals seeking tailored solutions.

-

What benefits can I expect from a Lumico Life Insurance policy?

The primary benefit of a Lumico Life Insurance policy is the financial protection it provides to loved ones in the event of the policyholder's passing. Additionally, many policies include cash value accumulation and potential dividends, which can be highlighted in lumico life insurance reviews as a signNow incentive for policyholders.

-

Are there any integrations available with Lumico Life Insurance?

While Lumico Life Insurance primarily focuses on life insurance products, they do partner with various financial and insurance service providers for a comprehensive approach to financial planning. Reading lumico life insurance reviews may reveal insights on how these integrations enhance customer experience and simplify policy management.

-

How can I file a claim with Lumico Life Insurance?

To file a claim with Lumico Life Insurance, beneficiaries typically need to submit a claim form along with the death certificate and any required documentation to verify the claim. The process can usually be initiated online, as indicated in several lumico life insurance reviews that praise the ease of the claims process.

-

What do customers say in their Lumico Life Insurance reviews?

Many customers in lumico life insurance reviews commend the company's straightforward application process and the clarity of policy options. Customer service is often highlighted as a positive aspect, providing assistance throughout the application and claims processes, which reassures potential buyers.

Get more for Lumico Life Insurance Claim Form

Find out other Lumico Life Insurance Claim Form

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter