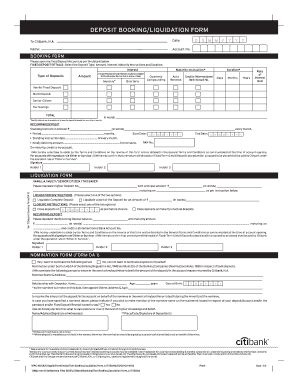

Liquidation Form

What is the liquidation form?

The liquidation form is a legal document used by businesses to formally declare their intent to dissolve and liquidate their assets. This process typically involves settling debts and distributing any remaining assets to shareholders or owners. The form serves as an official record of the decision to cease operations and is often required by state authorities to ensure compliance with local regulations. Understanding the purpose and implications of the liquidation form is essential for any business considering this route.

Steps to complete the liquidation form

Completing the liquidation form involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the business, including its legal name, address, and tax identification number. Next, outline the reasons for liquidation and detail the process for settling debts and distributing assets. Once the information is compiled, fill out the form carefully, ensuring all sections are completed. After reviewing for accuracy, the form must be signed by the appropriate parties, typically the business owners or board members, before submission to the relevant state authority.

Legal use of the liquidation form

The liquidation form must be used in accordance with state laws to be considered legally binding. It is crucial to follow the specific requirements outlined by the state where the business is registered. This includes adhering to deadlines for submission and ensuring that all creditors are notified of the liquidation process. Proper legal use of the form helps protect the business owners from potential liabilities and ensures that the liquidation process is conducted transparently and fairly.

Key elements of the liquidation form

Several key elements must be included in the liquidation form to ensure its validity. These include:

- Business Information: Legal name, address, and tax identification number.

- Reason for Liquidation: A clear statement explaining why the business is being liquidated.

- Debt Settlement Plan: Details on how outstanding debts will be addressed.

- Asset Distribution Plan: Information on how remaining assets will be distributed among shareholders.

- Signatures: Required signatures from business owners or board members.

Who issues the form?

The liquidation form is typically issued by the state government where the business is registered. Each state may have its own specific form and requirements for liquidation. It is important for business owners to consult their state’s business regulatory agency or website to obtain the correct form and ensure compliance with local laws. This ensures that the liquidation process is handled properly and legally.

Form submission methods

Submitting the liquidation form can be done through various methods, depending on state regulations. Common submission methods include:

- Online: Many states offer electronic submission options through their official websites.

- Mail: The form can often be printed and mailed to the appropriate state office.

- In-Person: Some states allow for in-person submissions at designated government offices.

It is essential to verify the preferred submission method for the specific state to ensure timely processing.

Quick guide on how to complete liquidation form

Complete Liquidation Form seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, amend, and eSign your documents quickly without delays. Handle Liquidation Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to amend and eSign Liquidation Form with ease

- Locate Liquidation Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Craft your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to secure your changes.

- Choose how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form retrieval, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Liquidation Form to ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the liquidation form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a liquidation form and how is it used?

A liquidation form is a legal document that outlines the process of dissolving a business and distributing its assets. It is vital for companies that are closing down to ensure compliance with local regulations. By using airSlate SignNow, you can easily create and eSign your liquidation form, streamlining the closure process.

-

How do I create a liquidation form using airSlate SignNow?

Creating a liquidation form with airSlate SignNow is simple. You can choose from our customizable templates or start from scratch. With our intuitive interface, you can add necessary fields, and once your form is complete, it can be sent out for eSigning in just a few clicks.

-

Is airSlate SignNow cost-effective for small businesses needing a liquidation form?

Yes, airSlate SignNow offers competitive pricing plans tailored to small businesses. Our subscription packages include access to the tools needed to create and eSign your liquidation form without breaking the bank. Plus, the time saved in managing documents translates to cost savings for your operations.

-

What features does airSlate SignNow offer for managing a liquidation form?

airSlate SignNow provides robust features for managing a liquidation form, including customizable templates, automated workflows, and secure eSigning. You can easily track the status of your documents and ensure timely completion, which is crucial during the liquidation process.

-

Can I integrate airSlate SignNow with other tools for my liquidation form?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and productivity tools, making it easy to incorporate your liquidation form into existing workflows. This integration helps maintain organizational efficiency during the liquidation process.

-

What security measures are in place for signing a liquidation form?

When you use airSlate SignNow to eSign a liquidation form, your documents are protected by industry-standard encryption and security protocols. We prioritize your data's safety, ensuring that your liquidation forms are securely managed and stored.

-

How can airSlate SignNow improve the liquidation process for my business?

With airSlate SignNow, the liquidation process becomes more efficient and straightforward. By automating document management and allowing for quick eSigning, you can focus on the essential aspects of winding down your business rather than getting bogged down by paperwork.

Get more for Liquidation Form

Find out other Liquidation Form

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free