Oregon Tax Compliance Form

What is the Oregon Tax Compliance

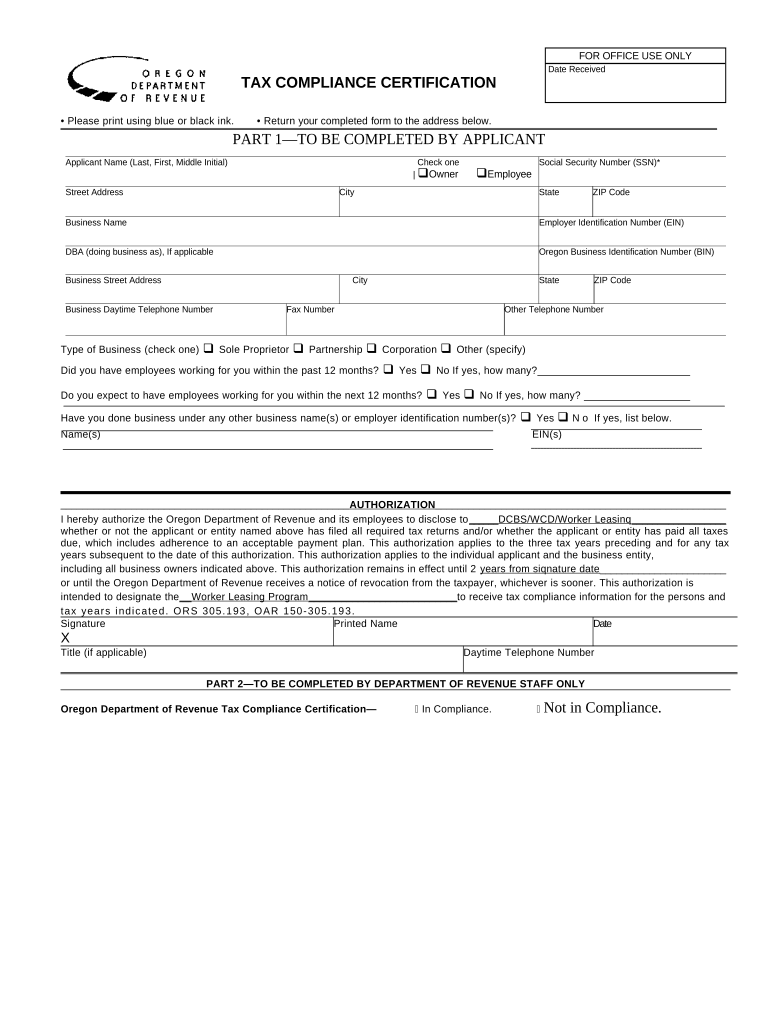

The Oregon tax compliance form is a document required by the state of Oregon to ensure that individuals and businesses meet their tax obligations. This form serves as a declaration of compliance with state tax laws, allowing the Oregon Department of Revenue to assess tax liabilities accurately. It is essential for maintaining good standing with the state and avoiding potential penalties.

How to use the Oregon Tax Compliance

Using the Oregon tax compliance form involves several steps. First, individuals or businesses must gather all necessary financial information, including income statements, deductions, and credits. Once the required data is compiled, the form can be filled out accurately. It is crucial to follow the specific instructions provided with the form to ensure proper completion. After filling out the form, it can be submitted electronically or via mail, depending on the preferences and requirements of the filer.

Steps to complete the Oregon Tax Compliance

Completing the Oregon tax compliance form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including W-2s, 1099s, and previous tax returns.

- Fill out the form with accurate information, ensuring that all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the form electronically through the state’s online portal or mail it to the appropriate address.

Legal use of the Oregon Tax Compliance

The legal use of the Oregon tax compliance form is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. Failure to comply with these requirements may result in penalties or legal consequences. It is important to ensure that all information provided is truthful and complete, as discrepancies can lead to audits or further scrutiny by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Oregon tax compliance form are critical to avoid penalties. Typically, the form must be submitted by April 15 for individual taxpayers. Businesses may have different deadlines based on their fiscal year. Staying informed about these dates is essential for maintaining compliance and avoiding late fees.

Required Documents

To complete the Oregon tax compliance form, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Previous year’s tax return for reference

Penalties for Non-Compliance

Failure to comply with Oregon tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is vital for individuals and businesses to understand their obligations and ensure timely submission of the Oregon tax compliance form to avoid these consequences.

Quick guide on how to complete oregon tax compliance

Effortlessly Prepare Oregon Tax Compliance on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an optimal eco-friendly substitute to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the features necessary to create, modify, and electronically sign your documents promptly without delays. Manage Oregon Tax Compliance on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

Easily Modify and eSign Oregon Tax Compliance

- Locate Oregon Tax Compliance and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive details with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Modify and eSign Oregon Tax Compliance and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the importance of Oregon tax compliance for businesses?

Oregon tax compliance is crucial for businesses operating in the state, as it helps avoid penalties and ensures adherence to local tax laws. By maintaining compliance, companies can focus on growth and efficiency, rather than facing potential legal issues. Understanding the nuances of Oregon tax compliance is essential for seamless business operations.

-

How can airSlate SignNow assist with Oregon tax compliance documentation?

airSlate SignNow streamlines the process of managing tax-related documents required for Oregon tax compliance. Our platform allows businesses to send and eSign documents securely, ensuring that all necessary forms are completed accurately and promptly. This simplifies record-keeping and helps maintain compliance with Oregon tax regulations.

-

What features does airSlate SignNow offer for managing Oregon tax compliance?

airSlate SignNow offers features such as custom document workflows, templates for tax forms, and secure e-signature capabilities to enhance Oregon tax compliance. These tools ensure that businesses can create, send, and sign essential documents efficiently while remaining compliant with state regulations. Additionally, automated reminders help ensure timely submissions of tax documents.

-

Is airSlate SignNow cost-effective for small businesses focused on Oregon tax compliance?

Yes, airSlate SignNow provides a cost-effective solution for small businesses navigating Oregon tax compliance. Our pricing structure is designed to accommodate various business sizes, ensuring that essential features are accessible without breaking the bank. Investing in our platform helps businesses save time and reduce costs associated with tax compliance.

-

Can airSlate SignNow integrate with accounting software for Oregon tax compliance?

Absolutely! airSlate SignNow easily integrates with popular accounting software, allowing seamless management of documents needed for Oregon tax compliance. This integration ensures that all financial records and tax documentation are in sync, helping users to maintain accurate and compliant records with minimal effort.

-

What are the benefits of using airSlate SignNow for Oregon tax compliance?

Using airSlate SignNow for Oregon tax compliance offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. Our platform simplifies the document signing process, empowering businesses to manage their taxes effectively. Ultimately, this leads to a smoother compliance experience while freeing up resources for other business activities.

-

How does airSlate SignNow ensure the security of documents related to Oregon tax compliance?

airSlate SignNow prioritizes the security of documents required for Oregon tax compliance by implementing advanced encryption technologies and secure storage solutions. Our platform ensures that all transactions and signatures are protected, maintaining confidentiality and integrity of sensitive tax information. Users can trust that their compliance information is safe with us.

Get more for Oregon Tax Compliance

Find out other Oregon Tax Compliance

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online