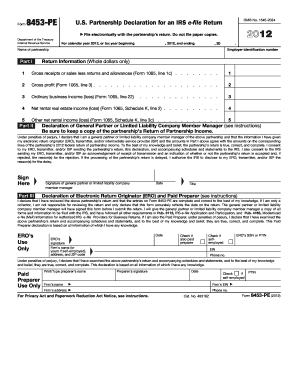

Form 8453 PE Internal Revenue Service Irs

What is the Form 8453 PE Internal Revenue Service IRS

The Form 8453 PE is a document used by the Internal Revenue Service (IRS) for electronic filing of certain tax returns. Specifically, it serves as a declaration for taxpayers who are submitting their forms electronically but are required to send a paper copy of certain supporting documents. This form is essential for ensuring that the IRS receives all necessary information to process the electronic return accurately.

How to use the Form 8453 PE Internal Revenue Service IRS

To use the Form 8453 PE, taxpayers must complete it after filling out their electronic tax return. This form acts as a cover sheet that must be signed and submitted along with any required paper documents. It is important to follow the IRS guidelines for submission to ensure compliance and avoid delays in processing. Taxpayers should ensure that all information is accurate and complete before sending it to the IRS.

Steps to complete the Form 8453 PE Internal Revenue Service IRS

Completing the Form 8453 PE involves several steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate the type of tax return you are submitting electronically.

- Provide details about any attachments or supporting documents that are being submitted with the form.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed Form 8453 PE along with any required documents to the IRS.

Legal use of the Form 8453 PE Internal Revenue Service IRS

The Form 8453 PE is legally binding when completed and signed according to IRS regulations. It serves as a formal declaration that the taxpayer is submitting their return electronically and acknowledges the requirements for paper documentation. Compliance with eSignature laws, such as the ESIGN Act, ensures that the electronic submission is recognized as valid by the IRS.

Key elements of the Form 8453 PE Internal Revenue Service IRS

Key elements of the Form 8453 PE include:

- Taxpayer identification information, such as name and Social Security number.

- Details of the electronic return being filed.

- Signature of the taxpayer or authorized representative.

- List of any supporting documents that must accompany the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8453 PE align with the deadlines for the associated tax return. Typically, individual tax returns are due by April 15 each year, unless an extension is filed. It is crucial for taxpayers to be aware of these dates to avoid penalties and ensure timely processing of their returns.

Quick guide on how to complete form 8453 pe internal revenue service irs

Complete Form 8453 PE Internal Revenue Service Irs effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without hindrances. Handle Form 8453 PE Internal Revenue Service Irs on any system with airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

The optimal method to modify and eSign Form 8453 PE Internal Revenue Service Irs with ease

- Locate Form 8453 PE Internal Revenue Service Irs and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specially provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Revise and eSign Form 8453 PE Internal Revenue Service Irs to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8453 pe internal revenue service irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8453 PE Internal Revenue Service Irs?

Form 8453 PE Internal Revenue Service Irs is a Declaration for Electronic Filing of a Partnership Return. It allows partnerships to authorize an electronic submission of their tax documents, ensuring compliance and timely filing with the IRS.

-

How can airSlate SignNow help with Form 8453 PE Internal Revenue Service Irs?

airSlate SignNow streamlines the process of filling and eSigning Form 8453 PE Internal Revenue Service Irs. Our platform provides a user-friendly interface to send, sign, and manage required documents, making tax season hassle-free for businesses.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans to fit various business sizes and needs. Pricing is designed to be cost-effective while providing access to powerful features, including those necessary for completing Form 8453 PE Internal Revenue Service Irs efficiently.

-

What features does airSlate SignNow offer for document management?

Our platform includes features such as customizable templates, bulk sending, real-time tracking, and secure storage. These features ensure that users can manage important documents like Form 8453 PE Internal Revenue Service Irs with ease and professionalism.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow supports integrations with various popular software such as CRM systems and cloud storage services. This allows for seamless workflow management, especially when dealing with important documents like Form 8453 PE Internal Revenue Service Irs.

-

Is airSlate SignNow secure for sending sensitive documents?

Absolutely. airSlate SignNow ensures the highest levels of security for all documents, including Form 8453 PE Internal Revenue Service Irs. With features like encryption and secure access controls, users can confidently send sensitive tax documents.

-

How can I track the status of my Form 8453 PE Internal Revenue Service Irs submission?

With airSlate SignNow, users can easily track the status of their Form 8453 PE Internal Revenue Service Irs submission in real time. Notifications and updates keep you informed of when documents are viewed and signed.

Get more for Form 8453 PE Internal Revenue Service Irs

- 403b withdrawal request form metlife

- Prior authorization medical injectable for non pardocx form

- Outgoing rollovertransferexchange request fixedvariable form

- Fillable online kid s cooking class registration form fax

- Study requisition form cardiology health in code

- Use this form to authorize an individual to file an internal uha appeal and communicate on your behalf with uha on

- Distributor resignation form 089 instructions

- To be used by counsel or pro se plaintiff to indicate the category of the case for the purpose of assignment to the appropriate form

Find out other Form 8453 PE Internal Revenue Service Irs

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free

- Can I eSign Virginia Recruitment Proposal Template

- How To eSign Texas Temporary Employment Contract Template

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free