To See Mary's Form 1099 a IRS Irs

What is the To See Mary's Form 1099 A IRS Irs

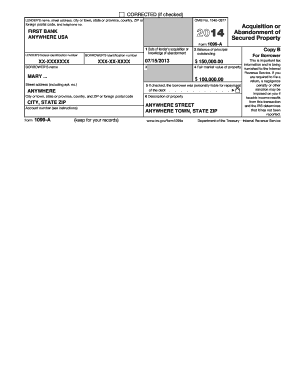

The To See Mary's Form 1099 A IRS Irs is a tax form used to report the acquisition or abandonment of secured property. This form is primarily issued by lenders to borrowers when a property is foreclosed, or when a borrower relinquishes the property. It provides essential information regarding the outstanding loan balance and the fair market value of the property at the time of the transaction. Understanding this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to obtain the To See Mary's Form 1099 A IRS Irs

To obtain the To See Mary's Form 1099 A IRS Irs, you can follow several methods. First, if you are a borrower, your lender is responsible for providing you with this form. Typically, lenders send it out by January thirty-first of the year following the transaction. If you do not receive it, you can contact your lender directly to request a copy. Additionally, you can access the form through the IRS website or consult a tax professional for assistance in obtaining it.

Steps to complete the To See Mary's Form 1099 A IRS Irs

Completing the To See Mary's Form 1099 A IRS Irs involves several key steps. Begin by entering the borrower's information, including name, address, and taxpayer identification number. Next, provide details about the lender, including their name and address. Then, input the loan balance as of the date of the transaction and the fair market value of the property. Ensure that all information is accurate to avoid any potential issues with the IRS. Finally, review the completed form for any errors before submission.

Legal use of the To See Mary's Form 1099 A IRS Irs

The legal use of the To See Mary's Form 1099 A IRS Irs is essential for compliance with federal tax laws. This form must be accurately completed and submitted to the IRS to report any cancellation of debt or property transfer. Failure to report this information can lead to penalties and interest charges. It is important to keep a copy of the form for your records, as it may be needed for future tax filings or audits.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the To See Mary's Form 1099 A IRS Irs. According to IRS regulations, the form must be filed by the lender and provided to the borrower by January thirty-first. Additionally, the lender must submit the form to the IRS by the end of February if filing by paper or by the end of March if filing electronically. It is important to adhere to these deadlines to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the To See Mary's Form 1099 A IRS Irs are crucial for compliance. The lender must provide the form to the borrower by January thirty-first of the year following the transaction. The form must then be filed with the IRS by February twenty-eighth if submitted by paper or by March thirty-first if filed electronically. Keeping track of these dates ensures that all parties remain compliant with IRS regulations.

Quick guide on how to complete to see marys form 1099 a irs irs

Complete To See Mary's Form 1099 A IRS Irs seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage To See Mary's Form 1099 A IRS Irs on any platform using airSlate SignNow Android or iOS apps and enhance any document-based procedure today.

The easiest way to modify and eSign To See Mary's Form 1099 A IRS Irs effortlessly

- Find To See Mary's Form 1099 A IRS Irs and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign To See Mary's Form 1099 A IRS Irs and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the to see marys form 1099 a irs irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help me to see Mary's Form 1099 A IRS Irs?

airSlate SignNow is a user-friendly eSignature platform that simplifies the process of sending and signing documents. If you need to see Mary's Form 1099 A IRS Irs, our platform allows you to easily send and receive this important tax document electronically, ensuring security and compliance.

-

How much does it cost to use airSlate SignNow to access documents like Mary's Form 1099 A IRS Irs?

airSlate SignNow offers various pricing plans that are both accessible and budget-friendly. This means you can effectively manage documents like Mary's Form 1099 A IRS Irs without breaking the bank. Check our website for detailed pricing information.

-

What features does airSlate SignNow provide for managing tax documents like Mary's Form 1099 A IRS Irs?

airSlate SignNow has robust features including easy document creation, electronic signatures, and real-time tracking. These functionalities are essential when dealing with tax forms such as Mary's Form 1099 A IRS Irs, ensuring an efficient signing process.

-

Can I integrate airSlate SignNow with other tools to handle Mary's Form 1099 A IRS Irs?

Yes, airSlate SignNow integrates effortlessly with a variety of tools and platforms, enhancing your workflow. This means you can easily manage and view documents like Mary's Form 1099 A IRS Irs alongside your existing applications for added convenience.

-

Is airSlate SignNow compliant with IRS regulations when handling Form 1099 A?

Absolutely! airSlate SignNow prioritizes compliance and security, making it suitable for handling sensitive documents such as Form 1099 A IRS Irs. You can trust that your transactions are secure and meet IRS standards.

-

How can airSlate SignNow help speed up the process of obtaining Mary's Form 1099 A IRS Irs?

Using airSlate SignNow allows for the rapid sending and signing of documents, drastically reducing the turnaround time. When you need to see Mary's Form 1099 A IRS Irs quickly, our platform streamlines the process, making it efficient and hassle-free.

-

What benefits does airSlate SignNow offer for small businesses looking to manage 1099 forms?

For small businesses, airSlate SignNow provides an economical solution for document management, including 1099 forms. By using our service, you can ensure that you can see Mary's Form 1099 A IRS Irs and other important documents quickly and securely without costly overhead.

Get more for To See Mary's Form 1099 A IRS Irs

- Gatlinburg tn gross receipts tax return mixing bar tax form

- Wwwsignnowcomfill and sign pdf form113901oklahoma form ef oklahoma income tax declaration for fill

- Quarterly tax and wage report department of labor and form

- Sales ampamp excise formsri division of taxation rhode island

- Form st 81011908 os 114 schedule ct schedule for new york

- Pptc 140 e adult general passport application in the usa form

- Imm 1344 e application to sponsor sponsorship agreement and undertaking imm1344epdf form

- Print licenses online ksbnkansasgovprint a form microsoft supportset up print management for a modulemicrosoft learnprint

Find out other To See Mary's Form 1099 A IRS Irs

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF