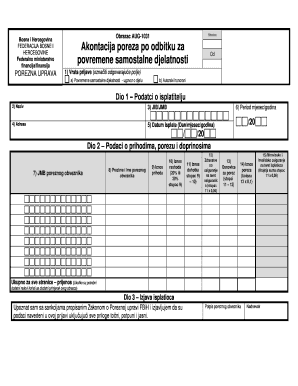

Aug 1031 Form

What is the Aug 1031

The Aug 1031 form is a crucial document used in the context of real estate transactions, specifically related to 1031 exchanges. This form facilitates the deferral of capital gains taxes when a property owner sells one investment property and reinvests the proceeds into another similar property. The Aug 1031 form is essential for taxpayers looking to maximize their investment potential while adhering to IRS regulations.

How to use the Aug 1031

Using the Aug 1031 form involves several steps to ensure compliance with IRS guidelines. First, the property owner must identify the property being sold and the replacement property. It is important to complete the form accurately, detailing the necessary information regarding both properties. Once filled out, the form should be submitted to the appropriate tax authorities as part of the tax return process. Utilizing digital tools can streamline this process, making it easier to manage and submit the form electronically.

Steps to complete the Aug 1031

Completing the Aug 1031 form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the properties involved, including addresses and purchase dates.

- Clearly outline the nature of the transaction, specifying the sale and acquisition details.

- Ensure all required signatures are obtained, as this validates the form.

- Review the completed form for accuracy before submission.

- Submit the form electronically or via mail to the relevant tax authority.

Legal use of the Aug 1031

The legal use of the Aug 1031 form is governed by specific IRS regulations. To be considered valid, the form must meet the criteria set forth for 1031 exchanges, including the identification of properties and adherence to timelines. Proper execution of the form ensures that the taxpayer can defer capital gains taxes legally, thus avoiding potential penalties associated with non-compliance.

Filing Deadlines / Important Dates

Timeliness is critical when dealing with the Aug 1031 form. The IRS stipulates specific deadlines for identifying replacement properties and completing the exchange. Typically, the taxpayer has 45 days from the sale of the original property to identify potential replacements and must complete the purchase of the new property within 180 days. Adhering to these deadlines is essential to maintain the tax-deferral benefits.

Examples of using the Aug 1031

There are various scenarios in which the Aug 1031 form can be utilized effectively. For instance, a property owner selling a rental property may choose to reinvest in a commercial property to expand their investment portfolio. Another example includes an individual selling a single-family home to purchase a multi-family building, allowing them to increase rental income. These examples illustrate the versatility of the Aug 1031 form in facilitating tax-deferred exchanges.

Quick guide on how to complete aug 1031

Complete Aug 1031 effortlessly on any device

Digital document management has become increasingly favored by both organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage Aug 1031 on any device with airSlate SignNow's Android or iOS applications and simplify any document-based task today.

The simplest way to alter and eSign Aug 1031 without hassle

- Locate Aug 1031 and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Aug 1031 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the aug 1031

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the aug 1031 feature available in airSlate SignNow?

The aug 1031 feature within airSlate SignNow simplifies the process for 1031 exchange transactions. It allows users to securely send and eSign essential documents required for these exchanges, ensuring compliance and efficiency. This feature is specifically designed to cater to real estate investors looking to make the most of their 1031 exchange opportunities.

-

How does airSlate SignNow support 1031 exchange transactions?

airSlate SignNow supports 1031 exchange transactions by providing a streamlined platform for document management. Users can easily create, send, and sign documents related to their aug 1031 exchanges. This functionality helps ensure that all necessary paperwork is completed accurately and on time, reducing the risk of errors.

-

What are the pricing options for using airSlate SignNow for aug 1031?

airSlate SignNow offers competitive pricing plans tailored to different business needs, including options that are ideal for those involved in aug 1031 transactions. Users can choose from monthly or annual subscriptions that best fit their requirements. Whether you're a small real estate firm or a larger organization, there's a plan that suits your budget.

-

Are there any integrations available for aug 1031 in airSlate SignNow?

Yes, airSlate SignNow offers multiple integrations with popular applications that can enhance the aug 1031 process. Users can connect to CRM tools, payment platforms, and other business software to streamline their workflows. These integrations help maintain an efficient system for managing 1031 exchange documentation.

-

What benefits does airSlate SignNow provide for aug 1031 users?

airSlate SignNow provides numerous benefits for aug 1031 users, including ease of use, security, and cost-effectiveness. The platform allows for quick document preparation and efficient signing processes, which is crucial for timely 1031 exchanges. Additionally, its secure environment ensures that sensitive information remains protected throughout the transaction.

-

How can I ensure compliance with aug 1031 using airSlate SignNow?

Using airSlate SignNow for aug 1031 transactions helps ensure compliance by providing templates and workflows that adhere to 1031 exchange regulations. The platform allows users to customize documents based on specific compliance needs. This feature helps prevent potential issues and ensures that all forms are correctly filled out and submitted.

-

Is there customer support for users involving aug 1031?

Absolutely! airSlate SignNow offers dedicated customer support to assist users with any aug 1031-related queries. Our support team is available to guide users in leveraging the platform efficiently for their 1031 exchanges and to answer questions regarding specific features and functionalities.

Get more for Aug 1031

Find out other Aug 1031

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile