Form 8736

What is the Form 8736

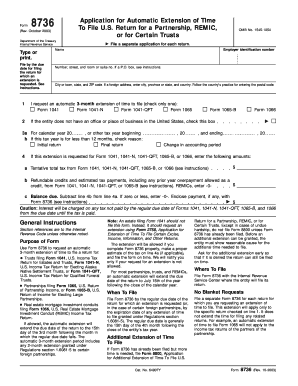

The Form 8736 is an application used by taxpayers in the United States to request an extension of time to file certain tax returns. This form is particularly relevant for those who need additional time beyond the standard deadline to prepare their tax documents. Understanding the purpose of the form is essential for ensuring compliance with IRS regulations and avoiding potential penalties.

How to use the Form 8736

To effectively use the Form 8736, individuals must accurately complete all required fields. This includes providing personal information, such as name, address, and taxpayer identification number. Additionally, the form requires details about the type of tax return for which an extension is being requested. Once completed, the form should be submitted to the IRS according to the specified guidelines to ensure it is processed correctly.

Steps to complete the Form 8736

Completing the Form 8736 involves several key steps:

- Gather necessary information, including your tax identification number and details about the tax return.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the form to the IRS by the appropriate deadline, either electronically or by mail.

Legal use of the Form 8736

The legal use of the Form 8736 hinges on its proper completion and timely submission. When filed correctly, the form grants taxpayers an extension to file their returns without incurring penalties for late submission. It is crucial to adhere to IRS guidelines to ensure that the extension is recognized legally.

Filing Deadlines / Important Dates

Understanding filing deadlines is vital when working with the Form 8736. Generally, the form must be submitted before the original due date of the tax return for which the extension is requested. Missing this deadline may result in penalties or interest charges. It is advisable to check the IRS website for specific dates relevant to the current tax year.

Form Submission Methods (Online / Mail / In-Person)

The Form 8736 can be submitted through various methods, depending on the taxpayer's preference and circumstances. Options include:

- Online submission through the IRS e-file system, which provides immediate confirmation of receipt.

- Mailing a paper copy of the form to the appropriate IRS address, ensuring it is postmarked by the deadline.

- In-person submission at designated IRS offices, if necessary.

Quick guide on how to complete form 8736

Complete Form 8736 effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 8736 on any device using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Form 8736 without difficulty

- Find Form 8736 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Underline important sections of the documents or black out sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal force as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device you prefer. Modify and eSign Form 8736 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8736

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8736 and how is it used?

Form 8736 is used for requesting an extension of time to file certain tax-related documents. With airSlate SignNow, you can easily eSign and send form 8736 electronically, ensuring that your submission is both timely and secure.

-

How can airSlate SignNow help me with form 8736?

airSlate SignNow provides a streamlined way to complete and eSign form 8736. Our platform allows you to fill in the necessary information quickly, reducing the chances of errors and facilitating a smoother filing process.

-

What are the pricing options for using airSlate SignNow for form 8736?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you're a small business or a large enterprise, you can choose a plan that allows you to manage form 8736 efficiently without breaking the bank.

-

Is it secure to eSign form 8736 with airSlate SignNow?

Yes, airSlate SignNow prioritizes security and compliance. When eSigning form 8736, you can rest assured that your data is protected with advanced encryption and secure storage, ensuring your documents remain confidential.

-

Can I integrate airSlate SignNow with other tools for managing form 8736?

Absolutely! airSlate SignNow offers integrations with various platforms, allowing you to seamlessly use form 8736 within your existing workflow. This compatibility enhances productivity and streamlines document management processes.

-

What features does airSlate SignNow offer for completing form 8736?

airSlate SignNow includes features like templating, real-time tracking, and automated reminders that facilitate the completion of form 8736. These tools help ensure that your documents are filled out correctly and submitted on time.

-

How does airSlate SignNow improve the efficiency of filing form 8736?

By using airSlate SignNow, you can signNowly reduce the time required to complete form 8736. Our user-friendly interface and streamlined processes allow you to quickly navigate through the form and obtain necessary signatures with minimal hassle.

Get more for Form 8736

Find out other Form 8736

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online