STATEMENT of PAY RECORD FORM Rev 5 20 10 DOCX Tax Exempt Declaration for Nonresident Dealers

What is the Statement of Pay Record Form Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers

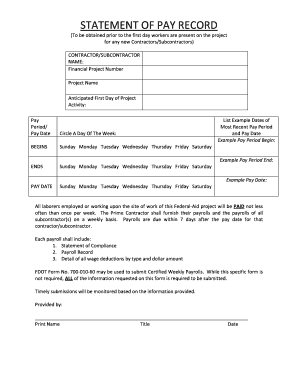

The Statement of Pay Record Form Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers is a crucial document used primarily for tax purposes. This form serves to declare tax-exempt status for nonresident dealers, allowing them to operate without incurring certain tax liabilities. It is essential for businesses and individuals engaged in transactions that may be subject to taxation in the United States. Understanding the purpose of this form is vital for compliance with tax regulations and ensuring proper documentation during financial transactions.

How to Use the Statement of Pay Record Form Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers

Using the Statement of Pay Record Form Rev 5 20 10 docx involves several straightforward steps. First, ensure that you have the correct version of the form, as updates may affect its validity. Fill out the required fields accurately, providing all necessary information related to your tax-exempt status. After completing the form, it is advisable to review it for any errors or omissions. Once verified, you can submit the form electronically, ensuring compliance with relevant eSignature laws for legal acceptance.

Steps to Complete the Statement of Pay Record Form Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers

Completing the Statement of Pay Record Form Rev 5 20 10 docx requires careful attention to detail. Follow these steps:

- Download the latest version of the form from a reliable source.

- Fill in your personal or business information, including name, address, and tax identification number.

- Indicate your nonresident dealer status and provide any supporting documentation as required.

- Review the completed form for accuracy and completeness.

- Sign the form electronically, ensuring compliance with eSignature regulations.

- Submit the form through the designated method, whether online or via mail.

Legal Use of the Statement of Pay Record Form Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers

The legal use of the Statement of Pay Record Form Rev 5 20 10 docx is governed by U.S. tax laws. This form must be accurately completed and submitted to ensure that nonresident dealers can claim their tax-exempt status. It is essential to adhere to the guidelines set forth by the IRS and other regulatory bodies to avoid penalties. The form serves as a formal declaration and should be treated with the same importance as any other legal document in financial transactions.

Key Elements of the Statement of Pay Record Form Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers

Understanding the key elements of the Statement of Pay Record Form Rev 5 20 10 docx is vital for effective completion. Important components include:

- Identification Information: This includes the name and address of the nonresident dealer.

- Tax Identification Number: Essential for tax processing and verification.

- Tax Exempt Status Declaration: A clear statement indicating the nonresident dealer's tax-exempt status.

- Signature Section: Where the signer affirms the accuracy of the information provided.

Eligibility Criteria for the Statement of Pay Record Form Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers

Eligibility for using the Statement of Pay Record Form Rev 5 20 10 docx is primarily based on the individual's or business's status as a nonresident dealer. Nonresident dealers must demonstrate that they meet specific criteria set forth by tax authorities, such as engaging in business activities that qualify for tax exemption. It is important to review these criteria thoroughly to ensure compliance and avoid potential issues during form submission.

Quick guide on how to complete statement of pay record form rev 5 20 10 docx tax exempt declaration for nonresident dealers

Effortlessly Prepare STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to rapidly create, modify, and electronically sign your documents without delays. Manage STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

Easily Modify and Electronically Sign STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers

- Obtain STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the statement of pay record form rev 5 20 10 docx tax exempt declaration for nonresident dealers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers?

The STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers is a document used by nonresident dealers to declare their tax-exempt status. It allows businesses to streamline their tax reporting and ensure compliance with tax regulations. Utilizing this form helps avoid unnecessary tax deductions on applicable transactions.

-

How can I access the STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers?

You can easily access the STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers through the airSlate SignNow platform. Simply create an account, and you will find the form available for use in the document library. It's user-friendly and designed to minimize the time needed for document preparation.

-

What are the benefits of using the STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers?

Using the STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers provides several benefits, including simplification of tax documentation processes and assurance of compliance. Additionally, this form enables nonresident dealers to claim their tax-exempt status effectively, reducing the amount of taxes that may be withheld. With airSlate SignNow, you can also electronically sign and store your documents securely.

-

Is there a cost to use the STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers?

Accessing the STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers on airSlate SignNow is part of our subscription services, which are designed to be cost-effective. We offer various pricing plans tailored to meet the needs of businesses of any size. This ensures that you have access to important forms without straining your budget.

-

Can the STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers be integrated with other software?

Yes, airSlate SignNow allows for seamless integration of the STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers with various software solutions. This compatibility enables users to import and export data effortlessly, enhancing workflow efficiency. Popular integrations include CRM platforms, accounting software, and more.

-

How does airSlate SignNow ensure the security of my STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers?

At airSlate SignNow, we prioritize security for all documents, including the STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers. Our platform utilizes advanced encryption methods and secure cloud storage to protect your documents. Additionally, we provide user authentication to ensure that only authorized personnel have access.

-

What features make airSlate SignNow the best choice for the STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers?

AirSlate SignNow stands out for its intuitive interface and robust features specifically designed for document handling, such as the STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers. Features like electronic signatures, templates, and real-time tracking enhance the user experience. Our solution simplifies the document management process signNowly.

Get more for STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers

Find out other STATEMENT OF PAY RECORD FORM Rev 5 20 10 docx Tax Exempt Declaration For Nonresident Dealers

- Sign California Banking Claim Online

- Sign Arkansas Banking Affidavit Of Heirship Safe

- How To Sign Arkansas Banking Forbearance Agreement

- Sign Arizona Banking Permission Slip Easy

- Can I Sign California Banking Lease Agreement Template

- How Do I Sign Colorado Banking Credit Memo

- Help Me With Sign Colorado Banking Credit Memo

- How Can I Sign Colorado Banking Credit Memo

- Sign Georgia Banking Affidavit Of Heirship Myself

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online