Nyst121 Form

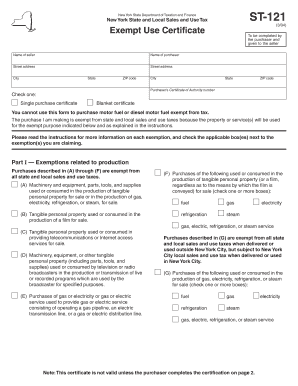

What is the Nyst121 Form

The Nyst121 Form is a specific document used in various legal and administrative processes within the United States. This form is often required for specific applications or compliance purposes, depending on the context in which it is used. Understanding its purpose is essential for ensuring proper completion and submission.

How to use the Nyst121 Form

Using the Nyst121 Form involves several steps to ensure that all necessary information is accurately provided. Begin by reviewing the form to understand the required fields. Fill in your personal information, ensuring accuracy to avoid delays. Once completed, you may need to sign the form electronically or in person, depending on the submission guidelines.

Steps to complete the Nyst121 Form

Completing the Nyst121 Form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from a reliable source.

- Read the instructions thoroughly to understand what information is required.

- Fill in all mandatory fields, ensuring that your information is accurate and up to date.

- Review the completed form for any errors or omissions.

- Sign the form as required, either electronically or by hand.

- Submit the form according to the specified guidelines, whether online, by mail, or in person.

Legal use of the Nyst121 Form

The Nyst121 Form must be used in compliance with relevant laws and regulations. This includes ensuring that all information provided is truthful and complete. Legal validity may depend on proper execution, including signatures and dates. Utilizing a trusted electronic signing solution can enhance the form's legal standing.

Key elements of the Nyst121 Form

Key elements of the Nyst121 Form typically include:

- Personal identification information, such as name and address.

- Specific details relevant to the purpose of the form.

- Signature fields for the applicant and any required witnesses.

- Date fields to indicate when the form was completed.

Form Submission Methods

The Nyst121 Form can usually be submitted through various methods, including:

- Online submission via a secure portal.

- Mailing a physical copy to the designated office.

- In-person submission at the relevant agency or office.

Who Issues the Form

The Nyst121 Form is typically issued by a specific government agency or organization that requires it for processing applications or compliance. Identifying the issuing body is crucial for ensuring that you are using the correct version of the form and following the appropriate procedures.

Quick guide on how to complete nyst121 form

Complete Nyst121 Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to easily find the correct form and store it securely online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Nyst121 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to modify and eSign Nyst121 Form effortlessly

- Find Nyst121 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Nyst121 Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyst121 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nyst121 Form and why is it important?

The Nyst121 Form is a critical document that enables organizations to collect necessary information and approvals securely. It is essential for ensuring compliance and facilitating efficient workflows in document management.

-

How can airSlate SignNow help with the Nyst121 Form?

airSlate SignNow provides an intuitive platform for creating, sending, and eSigning the Nyst121 Form. With its user-friendly interface, businesses can streamline their document processes, ensuring that important information is captured and approvals are obtained without delays.

-

Is airSlate SignNow cost-effective for managing the Nyst121 Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the Nyst121 Form, allowing businesses to save time and resources. With flexible pricing plans, companies can choose the option that best fits their needs and budget without compromising on features.

-

What features does airSlate SignNow offer for the Nyst121 Form?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure eSigning options for the Nyst121 Form. These functionalities enhance workflow efficiency and ensure that your documents are processed accurately and securely.

-

Can I integrate airSlate SignNow with other software for the Nyst121 Form?

Absolutely! airSlate SignNow easily integrates with various applications and platforms, helping you automate and enhance the workflow around the Nyst121 Form. Whether you use CRM systems, cloud storage, or other tools, you can connect them seamlessly with SignNow.

-

Is it easy to create a Nyst121 Form using airSlate SignNow?

Definitely! Creating a Nyst121 Form with airSlate SignNow is straightforward and user-friendly. You can quickly design your form using drag-and-drop functionality, ensuring your document meets specific requirements without any technical skills.

-

How secure is the Nyst121 Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The Nyst121 Form is protected with advanced encryption and compliance measures, ensuring that sensitive data remains confidential and secure throughout the signing process.

Get more for Nyst121 Form

Find out other Nyst121 Form

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online