State of Hawaii Form N 110

What is the State Of Hawaii Form N-110

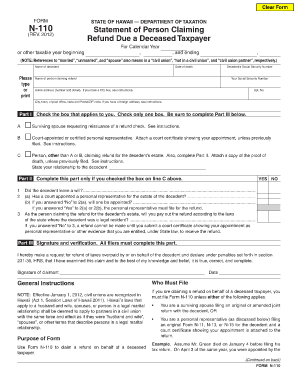

The State Of Hawaii Form N-110 is a tax form used by individuals and businesses to report income and calculate tax liabilities in Hawaii. This form is essential for residents and non-residents who earn income within the state. It is part of Hawaii's income tax filing requirements and helps ensure compliance with state tax laws. Understanding the purpose and requirements of Form N-110 is crucial for accurate tax reporting.

How to obtain the State Of Hawaii Form N-110

To obtain the State Of Hawaii Form N-110, individuals can visit the official Hawaii Department of Taxation website. The form is available for download in PDF format, allowing users to print it for completion. Additionally, physical copies may be available at local tax offices or libraries. Ensuring you have the most current version of the form is important to avoid any issues during the filing process.

Steps to complete the State Of Hawaii Form N-110

Completing the State Of Hawaii Form N-110 involves several key steps:

- Gather necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill in personal information, such as your name, address, and Social Security number.

- Report all sources of income accurately, ensuring that totals match your financial documents.

- Calculate your deductions and credits, if applicable, to reduce your taxable income.

- Review the form for accuracy and completeness before submission.

Legal use of the State Of Hawaii Form N-110

The State Of Hawaii Form N-110 is legally binding when completed accurately and submitted in accordance with state tax laws. It must be signed and dated by the taxpayer to affirm that the information provided is true and complete. Compliance with all filing requirements ensures that the form holds legal weight in any tax-related matters. Failure to adhere to these regulations may result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the State Of Hawaii Form N-110 typically align with the federal tax filing schedule. Generally, the deadline for submitting the form is April 20 for the previous tax year. However, it is advisable to check for any specific extensions or changes announced by the Hawaii Department of Taxation. Staying informed about important dates helps avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The State Of Hawaii Form N-110 can be submitted through various methods. Taxpayers have the option to file online using the Hawaii Department of Taxation’s e-filing system, which is convenient and efficient. Alternatively, the completed form can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has its own guidelines, so it is important to follow the instructions carefully.

Quick guide on how to complete state of hawaii form n 110

Effortlessly Complete State Of Hawaii Form N 110 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely archive it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents quickly and efficiently. Handle State Of Hawaii Form N 110 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign State Of Hawaii Form N 110 with Ease

- Find State Of Hawaii Form N 110 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with features specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious document searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs within a few clicks from any device you choose. Modify and eSign State Of Hawaii Form N 110 and guarantee excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of hawaii form n 110

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the State Of Hawaii Form N 110?

The State Of Hawaii Form N 110 is a crucial tax form used for reporting income and calculating tax liabilities. It is specifically designed for individuals and businesses to ensure compliance with Hawaii's tax regulations. Understanding how to properly fill out this form is essential for accurate tax submissions.

-

How can airSlate SignNow assist with the State Of Hawaii Form N 110?

airSlate SignNow simplifies the process of completing and submitting the State Of Hawaii Form N 110 by allowing users to eSign documents easily. Our platform provides templates and guidance to ensure that your form is filled out correctly and filed on time. This minimizes errors and streamlines your tax preparation process.

-

Are there any costs associated with using airSlate SignNow for the State Of Hawaii Form N 110?

Yes, airSlate SignNow offers a variety of pricing plans that are designed to accommodate different budgets while providing access to essential features. Our plans are cost-effective, making it easier for businesses and individuals to manage their documentation needs, including the State Of Hawaii Form N 110.

-

What features does airSlate SignNow offer for managing the State Of Hawaii Form N 110?

airSlate SignNow offers features like customizable templates, secure eSigning, and real-time collaboration to manage the State Of Hawaii Form N 110. These tools help you tailor the document to your needs and ensure it is completed efficiently. Additionally, our audit trails provide a clear record of all actions taken on the form.

-

Is airSlate SignNow compatible with other software for filing the State Of Hawaii Form N 110?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, which makes filing the State Of Hawaii Form N 110 smoother. Our integrations ensure that data can be transferred efficiently between systems, reducing the chance of errors and saving you time.

-

What are the benefits of using airSlate SignNow for the State Of Hawaii Form N 110?

Using airSlate SignNow for the State Of Hawaii Form N 110 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform enables you to electronically manage your documents, saving you time and hassle. Furthermore, eSigning ensures your forms are submitted swiftly and securely.

-

Can I access my completed State Of Hawaii Form N 110 on mobile devices?

Yes, airSlate SignNow is mobile-friendly, allowing you to access your completed State Of Hawaii Form N 110 from any device. This ensures you can review, sign, and send your documents on the go. Whether you're in the office or traveling, you can manage your paperwork seamlessly.

Get more for State Of Hawaii Form N 110

Find out other State Of Hawaii Form N 110

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online