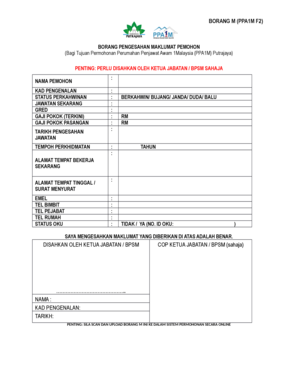

Borang M Form

What is the Borang M

The Borang M is a specific form used primarily for tax purposes in the United States. It is essential for individuals and businesses to report certain financial information accurately. This form plays a crucial role in ensuring compliance with federal and state tax regulations. Understanding its purpose and requirements is vital for effective tax management.

How to use the Borang M

Using the Borang M involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents and information relevant to the reporting period. Next, carefully fill out each section of the form, ensuring that all data is accurate and complete. Once the form is filled out, review it for any errors before submission. It can be submitted electronically or via mail, depending on the specific requirements set forth by the IRS or relevant state authorities.

Steps to complete the Borang M

Completing the Borang M requires a systematic approach. Follow these steps for a smooth process:

- Gather all relevant financial records, including income statements and expense receipts.

- Access the Borang M form, either online or in printed format.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Report your income and any deductions or credits applicable to your situation.

- Double-check all entries for accuracy.

- Submit the form through the appropriate channel, ensuring you meet any deadlines.

Legal use of the Borang M

The Borang M must be used in accordance with U.S. tax laws to be considered legally valid. This includes adhering to guidelines set forth by the IRS and ensuring that all reported information is truthful and accurate. Failure to comply with these regulations can result in penalties or legal ramifications. It is essential to understand the legal implications of submitting this form and to maintain records that support the information provided.

Key elements of the Borang M

Key elements of the Borang M include personal identification information, income details, and applicable deductions or credits. Each section of the form is designed to capture specific financial data that the IRS requires for accurate tax assessment. Understanding these elements is crucial for ensuring that the form is completed correctly and that all necessary information is included.

Required Documents

To complete the Borang M, several documents are typically required. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous tax returns for reference.

- Any relevant financial statements that support your claims.

Having these documents ready will facilitate a smoother completion process and help ensure compliance with tax regulations.

Quick guide on how to complete borang m

Complete Borang M effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without holdups. Manage Borang M on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Borang M with minimal effort

- Find Borang M and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Borang M and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the borang m

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is borang m and how does it work with airSlate SignNow?

Borang m is a specific document format used for various administrative purposes. With airSlate SignNow, users can easily upload, send, and eSign borang m documents securely from anywhere. Our platform simplifies the process, making it to fill out and manage borang m forms efficiently.

-

Is airSlate SignNow suitable for my business if I frequently use borang m?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes that need to use borang m frequently. Our solution allows for quick eSigning and document management, streamlining your workflow and ensuring compliance with industry standards.

-

What are the pricing options for using borang m services with airSlate SignNow?

airSlate SignNow offers competitive pricing plans to suit various business needs. Depending on your usage of borang m and required features, you can choose from several subscription tiers that provide an affordable solution for document management and eSigning.

-

Can I integrate airSlate SignNow with other applications to manage borang m?

Yes, airSlate SignNow offers seamless integrations with many popular applications to enhance your workflow. This means you can manage borang m documents alongside your existing software solutions, ensuring a smooth and efficient process.

-

What features does airSlate SignNow offer for managing borang m documents?

airSlate SignNow provides essential features such as secure eSigning, document templates, and real-time tracking for borang m documents. These tools help increase efficiency and ensure that your documents are handled correctly and safely.

-

How does eSigning borang m with airSlate SignNow benefit my business?

ESigning borang m with airSlate SignNow saves time and reduces the hassle of manual paperwork. You can streamline approvals and enhance collaboration within your team, ultimately leading to improved productivity and customer satisfaction.

-

What industries commonly use borang m and how can airSlate SignNow assist them?

Borang m is commonly used in industries such as education, healthcare, and finance. airSlate SignNow assists these sectors by providing efficient document management solutions, ensuring compliance, and simplifying eSigning procedures for borang m forms.

Get more for Borang M

Find out other Borang M

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT