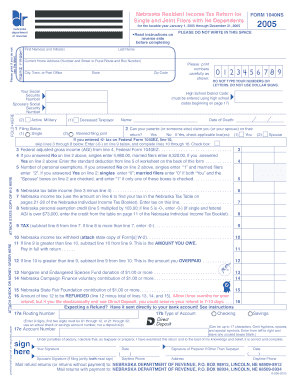

Nebraska Fillable 1040n Form

What is the Nebraska Fillable 1040n Form

The Nebraska Fillable 1040n Form is a state income tax return specifically designed for residents of Nebraska. This form allows individuals to report their income, claim deductions, and calculate their tax liability for the year. It is essential for anyone earning income in Nebraska to complete this form accurately to ensure compliance with state tax laws. The fillable format enables users to enter their information directly into the document, streamlining the process and reducing the likelihood of errors.

How to use the Nebraska Fillable 1040n Form

Using the Nebraska Fillable 1040n Form involves several straightforward steps. First, download the form from a reliable source. Next, fill in your personal information, including your name, address, and Social Security number. After completing the personal details, report your income from various sources, such as wages, interest, and dividends. Be sure to include any applicable deductions and credits to accurately calculate your tax liability. Finally, review the completed form for accuracy before submitting it to the Nebraska Department of Revenue.

Steps to complete the Nebraska Fillable 1040n Form

Completing the Nebraska Fillable 1040n Form requires careful attention to detail. Follow these steps:

- Download the form from a trusted website.

- Fill in your personal information, including your full name, address, and Social Security number.

- Report all sources of income, ensuring to include wages, interest, and any other relevant income.

- Claim deductions and credits that apply to your situation, such as education credits or property tax deductions.

- Calculate your total tax liability based on the information provided.

- Double-check all entries for accuracy and completeness.

- Submit the form electronically or by mail to the appropriate state department.

Legal use of the Nebraska Fillable 1040n Form

The Nebraska Fillable 1040n Form is legally recognized for filing state income taxes. To ensure its legal validity, it must be completed accurately and submitted by the designated deadline. The form must be signed, either electronically or with a handwritten signature, depending on the submission method. Compliance with state tax laws is crucial, as failure to file or inaccuracies can result in penalties or legal repercussions.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Nebraska Fillable 1040n Form. Typically, the deadline for submitting your state income tax return is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers may request an extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Nebraska Fillable 1040n Form can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file online using approved e-filing services, which can expedite processing and provide immediate confirmation of receipt. Alternatively, the form can be printed and mailed to the Nebraska Department of Revenue. For those who prefer in-person interactions, visiting a local tax office is also an option, although appointments may be required.

Quick guide on how to complete nebraska fillable 1040n form

Effortlessly Prepare Nebraska Fillable 1040n Form on Any Device

Web-based document administration has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Nebraska Fillable 1040n Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Alter and Electronically Sign Nebraska Fillable 1040n Form with Ease

- Obtain Nebraska Fillable 1040n Form and then click Get Form to initiate the process.

- Utilize the tools available to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign function, which takes just moments and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or mislaid documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and electronically sign Nebraska Fillable 1040n Form to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nebraska fillable 1040n form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska Fillable 1040n Form?

The Nebraska Fillable 1040n Form is a state tax form designed for residents of Nebraska to report their income and calculate their tax liability. This fillable form allows taxpayers to complete their returns online, ensuring accuracy and compliance with tax regulations. Utilizing this form simplifies the filing process and can decrease the chances of errors.

-

How can I obtain the Nebraska Fillable 1040n Form?

You can easily obtain the Nebraska Fillable 1040n Form through our website, where it is readily available for download. The form is user-friendly and can be completed electronically for your convenience. Simply visit our platform to access and fill out the form as needed.

-

Are there any costs associated with the Nebraska Fillable 1040n Form?

Using the Nebraska Fillable 1040n Form through our platform is a cost-effective solution. There are no hidden fees, and you can access the form without any initial investment. Check our pricing page for any subscription options that might suit your business needs.

-

What features come with the Nebraska Fillable 1040n Form?

The Nebraska Fillable 1040n Form comes equipped with features such as auto-calculation, eSignature capability, and easy storage options. Our platform ensures that your data is securely processed while providing a seamless experience to users. Additionally, users can track their submissions in real-time.

-

Can I eSign the Nebraska Fillable 1040n Form electronically?

Yes, the Nebraska Fillable 1040n Form supports electronic signatures, making it convenient to sign and submit your tax returns. This feature minimizes the need for printing, saving time and resources. Users can confidently eSign their forms directly within our platform, ensuring a smoother filing experience.

-

What are the benefits of using the Nebraska Fillable 1040n Form through airSlate SignNow?

Using the Nebraska Fillable 1040n Form on airSlate SignNow brings numerous benefits, including increased efficiency and reduced filing errors. Our platform allows for a simplified filing process with electronic features, helping users save time. Additionally, you'll have access to customer support for any questions that may arise during completion.

-

Is the Nebraska Fillable 1040n Form compatible with other software?

Yes, the Nebraska Fillable 1040n Form is designed to integrate seamlessly with other software applications. This compatibility ensures that users can easily transfer and manage their tax data across different platforms. Our integration options enhance the overall efficiency of your filing process.

Get more for Nebraska Fillable 1040n Form

- Workshop attendance verification form california state university fresnostate

- Osceola county quit claim deed form

- How much does a bpqy cost form

- Dump truck load count sheet form

- T327 apartment lease form pdf

- Ldss 486t 16832725 form

- Protected when completed bpage 1 of 1schedule 4ec form

- Standard 507 flight authority and certificate of noise form

Find out other Nebraska Fillable 1040n Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors