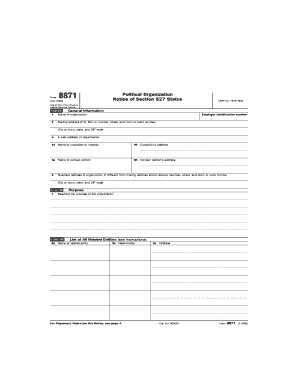

Irs F8871 Form

What is the Irs F8871 Form

The Irs F8871 Form is a tax form used by organizations to apply for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This form is essential for non-profit organizations seeking to obtain federal tax exemption, allowing them to operate without paying certain federal taxes. By completing this form, organizations can demonstrate their eligibility based on their charitable purpose, governance structure, and operational activities.

How to use the Irs F8871 Form

To use the Irs F8871 Form effectively, organizations must first gather necessary documentation that supports their application for tax-exempt status. This includes details about the organization’s mission, programs, and financial information. After collecting the required documents, organizations should accurately fill out the form, ensuring all sections are completed thoroughly. Once completed, the form must be submitted to the IRS along with the appropriate fee, if applicable.

Steps to complete the Irs F8871 Form

Completing the Irs F8871 Form involves several key steps:

- Gather necessary documents, including articles of incorporation and bylaws.

- Provide detailed information about the organization’s mission and activities.

- Complete the form accurately, paying attention to each section's requirements.

- Review the form for completeness and accuracy before submission.

- Submit the form to the IRS, ensuring to include any required fees.

Key elements of the Irs F8871 Form

The Irs F8871 Form consists of several key elements that organizations must address. These include:

- Organization Information: Basic details about the organization, including name, address, and contact information.

- Purpose: A clear statement of the organization’s mission and goals.

- Governance: Information about the organization’s governing body and its structure.

- Financial Information: Projections of the organization’s budget and funding sources.

Legal use of the Irs F8871 Form

The legal use of the Irs F8871 Form is crucial for organizations seeking tax-exempt status. By accurately completing and submitting this form, organizations can ensure compliance with IRS regulations. This legal process protects the organization’s ability to receive tax-deductible donations and operate without federal income tax obligations. Failure to submit the form correctly may result in delays or denial of tax-exempt status.

Filing Deadlines / Important Dates

Organizations must be aware of filing deadlines associated with the Irs F8871 Form. Generally, the form should be filed within 27 months of the organization’s formation to qualify for retroactive tax-exempt status. If the form is submitted after this period, the organization may only receive tax-exempt status from the date of submission. It is essential to keep track of these deadlines to avoid complications in obtaining tax-exempt status.

Quick guide on how to complete irs f8871 form

Effortlessly Prepare Irs F8871 Form on Any Device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Irs F8871 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

Efficiently Edit and eSign Irs F8871 Form with Ease

- Locate Irs F8871 Form and select Get Form to begin.

- Use the tools we provide to fill out your form.

- Mark important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to confirm your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Irs F8871 Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs f8871 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Irs F8871 Form?

The Irs F8871 Form is a tax document used for reporting or requesting a tax-exempt status for organizations. Understanding this form is crucial if you are involved in managing tax-exempt entities. airSlate SignNow can help you efficiently eSign and send the Irs F8871 Form to streamline your tax compliance process.

-

How can airSlate SignNow help with the Irs F8871 Form?

airSlate SignNow offers an easy-to-use platform that allows you to electronically sign and send the Irs F8871 Form. Our solution not only simplifies the eSigning process but also ensures that your documents remain secure and compliant with IRS standards. With airSlate SignNow, managing tax-related documents becomes seamless.

-

What features does airSlate SignNow provide for managing the Irs F8871 Form?

airSlate SignNow provides various features for managing the Irs F8871 Form, including customizable templates, automated workflows, and secure cloud storage. These features help you streamline document management and ensure quick access to your forms. Additionally, the platform is designed for ease of use, enabling you to focus more on your business and less on paperwork.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to different business needs, allowing you to choose a plan that suits your budget. Our competitive pricing ensures that you get the best value for facilitating the eSigning of important documents like the Irs F8871 Form. Check our website for detailed pricing information and find a plan that works for you.

-

Is airSlate SignNow compliant with IRS regulations for the Irs F8871 Form?

Yes, airSlate SignNow is designed to comply with IRS regulations, ensuring that your eSigned Irs F8871 Form is accepted by the IRS. Our platform follows industry-standard security protocols to protect sensitive information, so you can confidently manage your tax documentation. This compliance is critical for maintaining your organization's tax-exempt status.

-

Can I integrate airSlate SignNow with other software for handling the Irs F8871 Form?

Absolutely! airSlate SignNow offers integration capabilities with various software platforms, making it easy to manage the Irs F8871 Form alongside your existing tools. This means you can sync data, automate workflows, and improve efficiency when handling tax documents. Check our integration options to see how you can enhance your existing processes.

-

How secure is airSlate SignNow when handling sensitive documents like the Irs F8871 Form?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and comply with security standards to protect sensitive documents, including the Irs F8871 Form. You can confidently eSign and store your documents knowing that your data is secure and protected from unauthorized access.

Get more for Irs F8871 Form

Find out other Irs F8871 Form

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form