Idaho State Tax Financial Statement Form

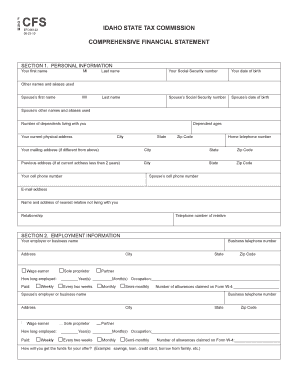

What is the Idaho State Tax Financial Statement Form

The Idaho State Tax Financial Statement Form is a crucial document utilized by taxpayers in Idaho to report their financial information to the state tax authorities. This form is typically required for various tax situations, including income tax filings, and provides a comprehensive overview of an individual's or business's financial status. It helps the Idaho State Tax Commission assess tax liabilities accurately and ensures compliance with state tax laws.

How to use the Idaho State Tax Financial Statement Form

Using the Idaho State Tax Financial Statement Form involves several steps. First, gather all necessary financial documents, such as income statements, expense records, and any other relevant financial data. Next, accurately complete the form by entering your financial information in the designated fields. Ensure that all figures are correct and that you have included any required attachments. Once completed, review the form for accuracy before submitting it to the appropriate tax authority.

Steps to complete the Idaho State Tax Financial Statement Form

Completing the Idaho State Tax Financial Statement Form requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documentation, including income and expense records.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, including wages, self-employment income, and other earnings.

- Detail your deductions and credits, ensuring you have supporting documents for each.

- Review the form thoroughly for any errors or omissions.

- Sign and date the form before submission.

Legal use of the Idaho State Tax Financial Statement Form

The Idaho State Tax Financial Statement Form holds legal significance as it serves as an official record of a taxpayer's financial information. To be considered legally binding, the form must be completed accurately and submitted in accordance with Idaho state laws. Electronic submissions are permissible, provided that they comply with eSignature regulations such as ESIGN and UETA, ensuring the document's validity in legal contexts.

Form Submission Methods

Taxpayers can submit the Idaho State Tax Financial Statement Form through several methods. Options include:

- Online submission via the Idaho State Tax Commission's website, which offers a secure platform for electronic filing.

- Mailing a physical copy of the completed form to the designated tax office.

- In-person submission at local tax offices, where assistance may be available for any questions or concerns.

Required Documents

When completing the Idaho State Tax Financial Statement Form, certain documents are essential for accurate reporting. These include:

- W-2 forms or 1099 forms to report income.

- Receipts or statements for deductible expenses.

- Any prior year tax returns, if applicable.

- Documentation supporting tax credits claimed.

Quick guide on how to complete idaho state tax financial statement form

Complete Idaho State Tax Financial Statement Form seamlessly on any device

Digital document management has gained signNow traction among companies and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can locate the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Idaho State Tax Financial Statement Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to alter and eSign Idaho State Tax Financial Statement Form effortlessly

- Obtain Idaho State Tax Financial Statement Form and then click Get Form to initiate the process.

- Make use of the tools we provide to fill out your document.

- Emphasize essential sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that intent.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and then click on the Done button to save your modifications.

- Select how you would like to send your form, by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Idaho State Tax Financial Statement Form and ensure excellent communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the idaho state tax financial statement form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Idaho State Tax Financial Statement Form?

The Idaho State Tax Financial Statement Form is a document required by the state for various tax-related purposes, including financial disclosures. It helps in assessing your financial situation for tax liability. Understanding this form is essential for accurate tax filing and compliance in Idaho.

-

How can airSlate SignNow help with the Idaho State Tax Financial Statement Form?

airSlate SignNow offers a seamless platform to create, fill out, and eSign the Idaho State Tax Financial Statement Form. Our user-friendly interface makes managing your tax documents simple and efficient. With secure eSigning options, you can ensure that your tax forms are processed quickly.

-

Is airSlate SignNow suitable for businesses filing the Idaho State Tax Financial Statement Form?

Yes, airSlate SignNow is tailored for businesses of all sizes needing to file the Idaho State Tax Financial Statement Form. Our solutions streamline document management and eSigning, making compliance easier. Businesses can save time and reduce paperwork with our effective digital tools.

-

What features does airSlate SignNow offer for the Idaho State Tax Financial Statement Form?

airSlate SignNow provides various features, including customizable templates, secure eSigning, and the ability to track document status. These tools allow you to complete the Idaho State Tax Financial Statement Form efficiently. Our platform also supports document sharing and collaboration among teams.

-

Are there any costs associated with using airSlate SignNow for the Idaho State Tax Financial Statement Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including those requiring the Idaho State Tax Financial Statement Form. Our plans are tailored to provide cost-effective solutions without sacrificing quality. You can choose the option that best suits your usage frequency and team size.

-

Can I integrate airSlate SignNow with other software for my Idaho State Tax Financial Statement Form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, simplifying the process of filling out the Idaho State Tax Financial Statement Form. With integrations available for CRM, document management systems, and productivity tools, you can streamline your workflow. This helps keep your tax documentation organized and accessible.

-

Is customer support available when using airSlate SignNow for the Idaho State Tax Financial Statement Form?

Yes, we provide excellent customer support to assist you with any questions related to the Idaho State Tax Financial Statement Form and our services. Our support team is available via chat, email, or phone to ensure you have a smooth experience. We are committed to helping you navigate any challenges that arise.

Get more for Idaho State Tax Financial Statement Form

- Burger king application online form

- Credit investigation form

- Reinigungsnachweis pdf kostenlos form

- Mmu vehicle sticker form

- Florida probation community service form

- Charles jones 1099 s reporting form

- Declaration of deceased estate form e172 declaration of deceased estate form e172

- Familienname und vorname der kindergeldberechtigten person form

Find out other Idaho State Tax Financial Statement Form

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter