Find Form Titled Tax Exempt Return

What is the Find Form Titled Tax Exempt Return

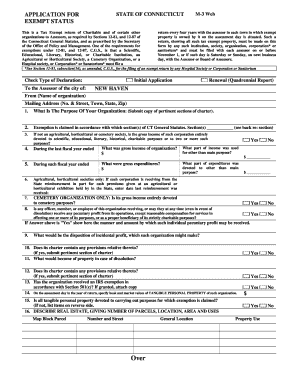

The Find Form Titled Tax Exempt Return is a crucial document used by various organizations to report their income and expenses while claiming tax-exempt status. This form is typically required for non-profit organizations, charities, and other entities that qualify for tax exemption under specific sections of the Internal Revenue Code. By submitting this form, organizations can maintain their tax-exempt status and ensure compliance with federal regulations.

How to Obtain the Find Form Titled Tax Exempt Return

To obtain the Find Form Titled Tax Exempt Return, organizations can visit the official IRS website, where the form is available for download. It is important to ensure that you are using the most current version of the form, as outdated versions may not be accepted. Additionally, some organizations may choose to consult with a tax professional to ensure they have the correct form and understand the requirements for completion.

Steps to Complete the Find Form Titled Tax Exempt Return

Completing the Find Form Titled Tax Exempt Return involves several key steps:

- Gather necessary documentation: Collect all relevant financial records, including income statements, expense reports, and any previous tax returns.

- Fill out the form: Carefully enter all required information, ensuring accuracy to avoid delays or penalties.

- Review for completeness: Double-check all entries for errors or omissions before submission.

- Submit the form: Follow the designated submission method, whether online, by mail, or in person, as per IRS guidelines.

Legal Use of the Find Form Titled Tax Exempt Return

The legal use of the Find Form Titled Tax Exempt Return is essential for maintaining compliance with federal tax laws. Organizations must ensure that they accurately report their financial activities and adhere to the requirements set forth by the IRS. Failure to properly complete and submit this form can result in penalties, loss of tax-exempt status, or other legal consequences.

Key Elements of the Find Form Titled Tax Exempt Return

Key elements of the Find Form Titled Tax Exempt Return include:

- Organization Information: Name, address, and tax identification number of the organization.

- Financial Data: Detailed reporting of income, expenses, and any changes in financial status.

- Compliance Statements: Affirmations regarding adherence to tax-exempt regulations.

- Signature: Required signatures from authorized representatives of the organization.

Filing Deadlines / Important Dates

Filing deadlines for the Find Form Titled Tax Exempt Return vary depending on the organization's tax year. Generally, the form must be submitted by the fifteenth day of the fifth month after the end of the organization’s tax year. It is crucial to be aware of these deadlines to avoid penalties and ensure continued compliance with IRS regulations.

Quick guide on how to complete find form titled tax exempt return

Effortlessly Complete [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-based procedure today.

How to Edit and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional ink signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text (SMS), invitation link, or downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure effective communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Find Form Titled Tax Exempt Return

Create this form in 5 minutes!

How to create an eSignature for the find form titled tax exempt return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the form titled Tax Exempt Return?

The form titled Tax Exempt Return is designed for tax-exempt organizations to report their financial activities. By understanding how to find and complete this form, nonprofits can ensure compliance with IRS requirements. Using airSlate SignNow, organizations can easily manage and eSign their Tax Exempt Returns securely.

-

How can I find the form titled Tax Exempt Return using airSlate SignNow?

To find the form titled Tax Exempt Return, simply log into your airSlate SignNow account and use the search bar feature. You can quickly locate templates and forms necessary for your organization, including the Tax Exempt Return. This streamlined process saves time and increases efficiency.

-

What features does airSlate SignNow offer for completing the Tax Exempt Return?

airSlate SignNow provides several features to aid in completing the Tax Exempt Return, such as eSigning, document templates, and collaboration tools. These features facilitate a seamless experience in preparing and submitting forms. Moreover, the platform ensures all documents are securely stored and easily accessible.

-

Is airSlate SignNow a cost-effective solution for managing Tax Exempt Returns?

Yes, airSlate SignNow offers competitive pricing plans that cater to various budgets, making it a cost-effective solution for managing Tax Exempt Returns. Users benefit from a range of features without incurring heavy costs, allowing organizations to allocate resources more efficiently. Affordable plans ensure that all tax-exempt businesses can access essential tools.

-

Can airSlate SignNow integrate with other applications for easier tax management?

Absolutely! airSlate SignNow integrates seamlessly with various other applications to enhance tax management processes. Whether you're using accounting software or CRM systems, these integrations allow for easier data sharing and management while working on your Tax Exempt Return. This connectivity helps streamline workflows.

-

What are the benefits of using airSlate SignNow for my Tax Exempt Return?

Using airSlate SignNow for your Tax Exempt Return offers numerous benefits, including enhanced efficiency, secure eSigning, and paperless documentation. These advantages lead to faster processing times and reduced errors. Furthermore, the user-friendly interface enables quick document preparation and submission.

-

How can I ensure my Tax Exempt Return is compliant with IRS regulations?

To ensure your Tax Exempt Return is compliant with IRS regulations, it's crucial to use reliable resources and accurate information. airSlate SignNow provides templates that are updated to reflect current guidelines, ensuring that users stay compliant. Regular audits and reviews of your completed forms can further help maintain compliance.

Get more for Find Form Titled Tax Exempt Return

- Foreclosure letter template form

- Price escalation addendum to agreement of sale pea pennsylvania parealtor form

- Fixed term lease agreement sa gov au sa gov form

- Deployment letter pdf form

- Replacement medicaid card arkansas form

- I 94 form pdf

- Waiver of prosecution form florida

- Florida residential landlord and tenant act part ii chapter 83 pdf form

Find out other Find Form Titled Tax Exempt Return

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter