Castle Rock Sales Tax Online Form

What is the Castle Rock Sales Tax Online

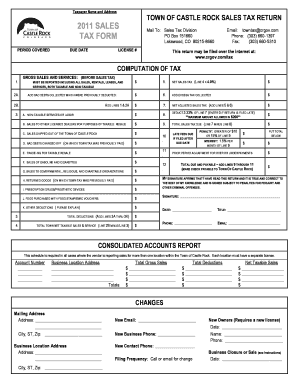

The Castle Rock Sales Tax Online refers to the digital platform that allows businesses and individuals in the Town of Castle Rock to file their sales tax returns electronically. This online system streamlines the process of reporting sales tax, making it easier for taxpayers to comply with local tax regulations. By utilizing this platform, users can complete their sales tax return forms efficiently, reducing the need for paper submissions and in-person visits to tax offices.

Steps to complete the Castle Rock Sales Tax Online

Completing the Castle Rock Sales Tax Online requires a few straightforward steps:

- Access the Castle Rock Sales Tax Online portal through a secure internet connection.

- Create an account or log in if you already have one.

- Gather necessary information, including sales data and previous tax filings.

- Fill out the sales tax return form accurately, ensuring all required fields are completed.

- Review the information for accuracy before submission.

- Submit the form electronically and save a copy for your records.

Legal use of the Castle Rock Sales Tax Online

The Castle Rock Sales Tax Online is designed to comply with local and federal regulations regarding electronic submissions. To ensure that your submission is legally binding, it is essential to follow the guidelines set forth by the Town of Castle Rock. This includes providing accurate information and utilizing a secure platform for submission. The use of electronic signatures, when required, must also meet the standards established by the ESIGN Act and UETA.

Required Documents

When filing the Castle Rock Sales Tax Online, certain documents may be necessary to support your submission. These typically include:

- Sales records for the reporting period.

- Previous sales tax returns, if applicable.

- Proof of exemption, if claiming any exemptions.

- Identification information for the business or individual filing.

Form Submission Methods (Online / Mail / In-Person)

The preferred method for submitting the Castle Rock Sales Tax return is online through the designated portal. However, alternative submission methods are available:

- Online: The most efficient way, allowing for immediate processing.

- Mail: Completed forms can be sent to the Town of Castle Rock's tax office, though this may result in longer processing times.

- In-Person: Taxpayers can also visit the tax office to submit their forms directly, if preferred.

Penalties for Non-Compliance

Failing to comply with the filing requirements for the Castle Rock Sales Tax can lead to various penalties. These may include:

- Late fees based on the amount of tax owed.

- Interest charges on unpaid taxes.

- Potential legal action for continued non-compliance.

It is crucial for taxpayers to adhere to filing deadlines to avoid these consequences.

Quick guide on how to complete castle rock sales tax online

Handle Castle Rock Sales Tax Online seamlessly on any device

Web-based document management has gained popularity among organizations and individuals alike. It serves as a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Castle Rock Sales Tax Online on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

How to adjust and eSign Castle Rock Sales Tax Online with ease

- Obtain Castle Rock Sales Tax Online and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Adjust and eSign Castle Rock Sales Tax Online and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the castle rock sales tax online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the town of Castle Rock sales tax return process?

The town of Castle Rock sales tax return process involves reporting and remitting the sales tax collected by businesses operating within the town. Businesses must complete the necessary forms and submit them by the deadline to avoid penalties. Using airSlate SignNow simplifies this process, allowing you to easily eSign documents and ensure timely submission.

-

How can airSlate SignNow assist with the town of Castle Rock sales tax return?

airSlate SignNow streamlines the completion and submission of the town of Castle Rock sales tax return by providing user-friendly tools for document management. You can create, eSign, and store all necessary documents securely in one place, reducing the risk of errors and enhancing overall efficiency.

-

What features does airSlate SignNow offer for handling sales tax returns?

airSlate SignNow offers features such as customizable templates, secure eSigning capabilities, and automated reminders for important deadlines related to the town of Castle Rock sales tax return. Additionally, you can easily track document status and manage your workflow, making the process more organized and efficient.

-

Is there a cost associated with using airSlate SignNow for sales tax returns?

Yes, there is a subscription cost for using airSlate SignNow; however, it is designed to be cost-effective for businesses of all sizes. Investing in airSlate SignNow can save you time and resources by simplifying the town of Castle Rock sales tax return process through its robust features and user-friendly interface.

-

Can airSlate SignNow integrate with my existing accounting software for sales tax returns?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and financial software, which can help you manage your sales tax records more effectively. By using airSlate SignNow in conjunction with your existing systems, you can ensure the accuracy of your town of Castle Rock sales tax return without duplicate data entry.

-

How secure is my information when using airSlate SignNow for sales tax returns?

AirSlate SignNow prioritizes the security of your information with advanced encryption protocols and secure data storage. When you use airSlate SignNow for the town of Castle Rock sales tax return, you can trust that your documents are protected and only accessible to authorized users.

-

How do I get started with airSlate SignNow for my sales tax returns?

Getting started with airSlate SignNow is simple. You can sign up for a free trial on our website, where you can explore features tailored for the town of Castle Rock sales tax return before making a commitment. Once registered, you can start uploading your documents and eSigning right away.

Get more for Castle Rock Sales Tax Online

- Retrospecto americanas form

- Biochemistry and molecular biology of plants buchanan pdf download form

- State of indiana pole line bond form

- Mawc application form

- Rds 410 delivery appointment form docx

- Colorado supreme court office of attorney registration 1560 broadway suite 1810 denver co 80202 303 866 6554 metrostlouis form

- I and me worksheet pdf form

- Nachweis der pers nlichen arbeitsbem hungen treffpunkt arbeit treffpunkt arbeit chdateienformularepdfd716 007dv5

Find out other Castle Rock Sales Tax Online

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online