Form 2307

What is the Form 2307

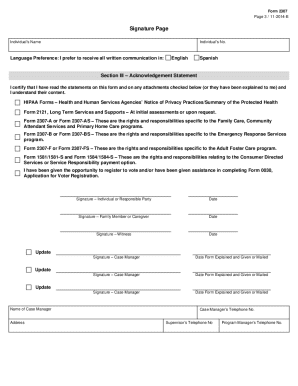

The Form 2307, also known as the 2307 form dads, is a document primarily used in the United States to outline the rights and responsibilities of parties involved in certain transactions. It serves as a formal agreement that clarifies the terms under which services or goods are provided. This form is particularly relevant for individuals and businesses engaging in contractual relationships, ensuring that all parties are aware of their obligations and entitlements.

How to use the Form 2307

Using the Form 2307 involves several straightforward steps. First, ensure that you have the correct version of the form, which can typically be obtained from official sources or legal templates. Next, fill in the necessary details, including the names and addresses of the involved parties, the nature of the agreement, and any specific terms that need to be included. Once completed, all parties should review the document for accuracy and completeness before signing. Utilizing electronic signature tools can streamline this process, ensuring that the form is signed securely and efficiently.

Steps to complete the Form 2307

Completing the Form 2307 requires careful attention to detail to ensure its legality and effectiveness. Follow these steps:

- Gather necessary information about all parties involved, including full names and contact details.

- Clearly define the purpose of the form and the specific rights and responsibilities of each party.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the document to confirm that all information is correct and that it reflects the agreed-upon terms.

- Sign the form using a reliable electronic signature platform to ensure compliance with eSignature laws.

Legal use of the Form 2307

The legal use of the Form 2307 is crucial for ensuring that the agreement it represents is enforceable in a court of law. To be considered legally binding, the form must be filled out completely and accurately, with all parties providing their signatures. It is essential to comply with relevant laws governing contracts and electronic signatures, such as the ESIGN Act and UETA. By using a trusted eSignature solution, you can ensure that the form meets these legal requirements, providing peace of mind that your agreement is valid.

Key elements of the Form 2307

Several key elements must be included in the Form 2307 to ensure its effectiveness:

- Identification of Parties: Clearly state the names and addresses of all parties involved.

- Description of Agreement: Provide a detailed description of the rights and responsibilities outlined in the form.

- Signatures: Ensure that all parties sign the document, either physically or electronically.

- Date: Include the date of signing to establish the timeline of the agreement.

- Witness or Notary (if required): Some agreements may require a witness or notarization for added legal validity.

IRS Guidelines

When dealing with the Form 2307, it is important to be aware of IRS guidelines that may apply, especially if the form relates to tax obligations. The IRS provides specific instructions on how to report income and expenses associated with transactions outlined in the form. Familiarizing yourself with these guidelines can help ensure compliance and avoid potential penalties. It is advisable to consult with a tax professional if you have questions about how the Form 2307 interacts with your tax responsibilities.

Quick guide on how to complete form 2307

Effortlessly Prepare Form 2307 on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and eSign your documents promptly without delays. Manage Form 2307 on any device using airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

How to Edit and eSign Form 2307 with Ease

- Find Form 2307 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you want to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 2307 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2307

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 2307 and why is it important for businesses?

The form 2307 is a vital tax document used in the Philippines to track withholding tax paid by businesses. It ensures compliance with tax regulations and is essential for proper accounting practices. Understanding its importance allows companies to avoid penalties and streamline their financial processes.

-

How can airSlate SignNow help with the management of form 2307?

airSlate SignNow simplifies the management of form 2307 by allowing businesses to digitally sign and send the document securely. This not only enhances efficiency but also helps ensure that the forms are processed in a timely manner. With our platform, you'll never worry about misplaced or lost documents again.

-

Is airSlate SignNow cost-effective for handling form 2307?

Yes, airSlate SignNow offers a cost-effective solution for handling form 2307, which can help businesses save time and money. Our pricing plans are designed to cater to various business sizes, ensuring that everyone can benefit from our digital signing capabilities. Ultimately, investing in our services can reduce operational costs related to document management.

-

What features does airSlate SignNow provide for form 2307 processing?

airSlate SignNow offers features such as secure eSigning, customizable templates, and real-time tracking for form 2307 processing. These functionalities facilitate effortless collaboration and ensure that all parties are in sync. Additionally, our user-friendly interface makes it easy for anyone in your team to manage important documents.

-

Are there any integrations available with airSlate SignNow for form 2307?

Absolutely! airSlate SignNow integrates seamlessly with various applications and platforms, streamlining the process of managing form 2307. Whether it's connecting with CRM systems or cloud storage, our integrations ensure that your workflow remains uninterrupted. This flexibility allows businesses to incorporate our solution into their existing processes effortlessly.

-

Can airSlate SignNow assist with compliance related to form 2307?

Yes, airSlate SignNow helps businesses maintain compliance with regulations surrounding form 2307 through secure eSigning and proper document management. Our system ensures that all electronic signatures are legally binding, which is crucial for compliance. Moreover, our audit trails provide essential records that can support your compliance efforts.

-

What benefits does airSlate SignNow offer for companies using form 2307?

The primary benefits of using airSlate SignNow for form 2307 include increased efficiency, enhanced security, and reduced paper use. By digitizing the signing process, businesses can reduce turnaround times and minimize errors. Moreover, our platform's security features protect sensitive information, giving companies peace of mind.

Get more for Form 2307

Find out other Form 2307

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile