Rev Proc 96 30 Form

What is the Rev Proc 96 30

The Rev Proc 96 30 is an important IRS revenue procedure that outlines the rules and guidelines for certain tax-related matters. This procedure specifically addresses the treatment of certain transactions and provides clarity on how taxpayers should report these transactions for tax purposes. Understanding the Rev Proc 96 30 is crucial for ensuring compliance with IRS regulations and avoiding potential penalties.

How to use the Rev Proc 96 30

Using the Rev Proc 96 30 involves following specific guidelines set forth by the IRS. Taxpayers must review the requirements outlined in the procedure to determine if their transactions fall under its provisions. Proper documentation and adherence to the outlined steps are essential for ensuring that the transactions are treated correctly for tax purposes. This may involve completing specific forms or providing additional information as required by the IRS.

Steps to complete the Rev Proc 96 30

Completing the Rev Proc 96 30 involves several key steps. First, identify whether your transaction qualifies under the procedure. Next, gather all necessary documentation to support your claim. This may include financial statements, transaction records, and any relevant correspondence with the IRS. Once you have all the required information, complete the necessary forms accurately, ensuring that all details are correct. Finally, submit the forms to the appropriate IRS office by the specified deadlines.

Legal use of the Rev Proc 96 30

The legal use of the Rev Proc 96 30 is essential for taxpayers to ensure compliance with federal tax laws. By adhering to the guidelines set forth in the procedure, taxpayers can avoid legal issues and potential penalties. It is important to understand that failure to comply with the requirements may lead to audits or disputes with the IRS, potentially resulting in financial consequences.

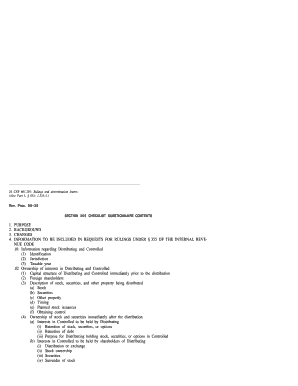

Key elements of the Rev Proc 96 30

Key elements of the Rev Proc 96 30 include the specific transactions covered, the documentation required, and the reporting procedures mandated by the IRS. Understanding these elements is critical for taxpayers to navigate the complexities of tax compliance. Additionally, the procedure outlines the consequences of non-compliance, emphasizing the importance of following the established guidelines.

Filing Deadlines / Important Dates

Filing deadlines and important dates related to the Rev Proc 96 30 are crucial for taxpayers to keep track of. These dates dictate when forms must be submitted to the IRS and can vary based on the nature of the transaction. Missing a deadline can result in penalties or complications with tax filings. Therefore, it is advisable to maintain a calendar of these key dates to ensure timely compliance.

Eligibility Criteria

Eligibility criteria for the Rev Proc 96 30 determine which taxpayers can utilize its provisions. Generally, these criteria include specific conditions related to the nature of the transaction and the taxpayer's status. Understanding these criteria is vital for determining whether a taxpayer can benefit from the procedures outlined in the Rev Proc 96 30, ensuring that they are in compliance with IRS regulations.

Quick guide on how to complete rev proc 96 30

Complete Rev Proc 96 30 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can locate the right form and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly without delays. Handle Rev Proc 96 30 on any device with airSlate SignNow's Android or iOS applications and simplify any document-focused process today.

The easiest way to modify and eSign Rev Proc 96 30 without hassle

- Find Rev Proc 96 30 and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Rev Proc 96 30 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rev proc 96 30

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rev proc 96 30 and how does it relate to electronic signatures?

Rev proc 96 30 sets guidelines for electronic signatures' legal validity, ensuring compliance during document signing. By utilizing airSlate SignNow, businesses can easily leverage this procedure to ensure that their eSignatures meet legal standards, making document transactions secure and efficient.

-

How does airSlate SignNow ensure compliance with rev proc 96 30?

AirSlate SignNow adheres to the guidelines of rev proc 96 30 by providing secure and verifiable eSignatures. Our platform incorporates features such as audit trails and timestamping that affirm compliance, ensuring your documents are legally binding every time.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers several pricing packages tailored to various business needs, starting at an affordable rate designed to maximize value. Each package includes essential features, enabling businesses to fully leverage electronic signatures while ensuring compliance with rev proc 96 30.

-

What features does airSlate SignNow offer to support rev proc 96 30 compliance?

Our platform comes with comprehensive features including secure document storage, detailed audit logs, and custom workflows. These features not only facilitate ease of use but also ensure full compliance with rev proc 96 30, safeguarding your documents and signatures.

-

Can airSlate SignNow integrate with other applications?

Yes, airSlate SignNow seamlessly integrates with a variety of business applications such as Google Workspace, Salesforce, and more. These integrations enhance your workflow while ensuring your documents adhere to rev proc 96 30 compliance as part of your broader digital transformation.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow not only saves time and reduces paper usage but also enhances security in document transactions. By ensuring compliance with rev proc 96 30, businesses can trust that their eSignatures are secure, legally recognized, and efficient in facilitating agreements.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! AirSlate SignNow provides small businesses with an accessible, cost-effective solution for electronic signatures. The platform's compliance with rev proc 96 30 ensures that even the smallest organizations can engage in legally binding contracts with confidence.

Get more for Rev Proc 96 30

- Mail in rebate 50 max value bonus get up to 1000 form

- Main street radiology referral form

- Vermont dmv form vg 168

- Patients name date of birth dob ct gov form

- Gd11 excavations checklist citb form

- How to fill beneficiary nomination form

- Venue challenge letter file lacounty form

- The ocp field guide operation college promise form

Find out other Rev Proc 96 30

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed