Pt 401 Form

What is the Pt 401 Form

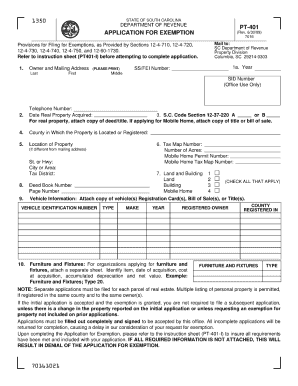

The Pt 401 Form is a specific document used primarily for tax purposes in the United States. It serves as a declaration for various financial activities and is crucial for individuals and businesses to report their income accurately. Understanding the purpose of this form is essential for compliance with IRS regulations. The Pt 401 Form helps ensure that all necessary information is documented, which is vital for both the taxpayer and the government.

How to use the Pt 401 Form

Using the Pt 401 Form involves several steps to ensure that all information is accurately reported. First, gather all necessary financial documents, including income statements and receipts. Next, carefully fill out each section of the form, ensuring that all entries are accurate and complete. It is important to double-check calculations and verify that all required fields are filled in. Once completed, the form can be submitted electronically or via mail, depending on the preferred method of submission.

Steps to complete the Pt 401 Form

Completing the Pt 401 Form requires attention to detail and a systematic approach. Follow these steps:

- Collect all relevant financial documents, such as W-2s, 1099s, and other income records.

- Read the instructions provided with the form carefully to understand each section's requirements.

- Fill out the form, ensuring that personal information, income details, and deductions are accurately reported.

- Review the completed form for any errors or omissions.

- Submit the form either electronically through an authorized platform or by mailing it to the appropriate IRS address.

Legal use of the Pt 401 Form

The legal use of the Pt 401 Form is governed by IRS regulations. It must be filled out accurately to reflect the taxpayer's financial situation. Misrepresentation or failure to file this form can lead to penalties, including fines and interest on unpaid taxes. To ensure compliance, it is advisable to consult with a tax professional if there are any uncertainties regarding the form's requirements or the information to be reported.

Filing Deadlines / Important Dates

Filing deadlines for the Pt 401 Form are crucial for maintaining compliance with IRS regulations. Typically, the form must be submitted by April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these deadlines, as they can impact the timely submission of tax documents.

Form Submission Methods (Online / Mail / In-Person)

The Pt 401 Form can be submitted through various methods, providing flexibility for taxpayers. The options include:

- Online Submission: Many taxpayers prefer to file electronically using IRS-approved software or platforms that facilitate e-filing.

- Mail: The form can also be printed and mailed to the appropriate IRS address. Ensure that sufficient postage is applied and consider using a tracking service.

- In-Person: For those who prefer direct interaction, visiting a local IRS office may be an option, though appointments may be required.

Quick guide on how to complete pt 401 form 17980

Complete Pt 401 Form seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Pt 401 Form on any device with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to alter and eSign Pt 401 Form effortlessly

- Locate Pt 401 Form and click Get Form to initiate the process.

- Utilize the tools we offer to finish your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Pt 401 Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pt 401 form 17980

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Pt 401 Form and why is it important?

The Pt 401 Form is a crucial document used for reporting income and taxes. Understanding its significance can help you ensure compliance with IRS requirements, making it essential for businesses and self-employed individuals alike.

-

How can airSlate SignNow help with the Pt 401 Form?

With airSlate SignNow, you can easily prepare, send, and eSign your Pt 401 Form securely. Our user-friendly platform streamlines the document management process, allowing for faster submissions and accurate record-keeping.

-

Is airSlate SignNow affordable for handling multiple Pt 401 Forms?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. You can manage multiple Pt 401 Forms without breaking the bank, while benefiting from features that enhance your productivity.

-

What features does airSlate SignNow provide for eSigning the Pt 401 Form?

airSlate SignNow provides an intuitive eSigning experience with features like customizable templates, real-time tracking, and secure cloud storage. These features ensure that your Pt 401 Form is signed quickly and kept safe.

-

Can I integrate airSlate SignNow with other applications for the Pt 401 Form?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive, Salesforce, and more. This allows you to seamlessly manage your Pt 401 Form alongside your other business tools.

-

How does airSlate SignNow ensure the security of my Pt 401 Form?

Security is a top priority at airSlate SignNow. We employ advanced encryption and authentication measures to protect your Pt 401 Form and sensitive information throughout the signing process.

-

What are the benefits of using airSlate SignNow for my Pt 401 Form?

Using airSlate SignNow for your Pt 401 Form ensures efficiency, accuracy, and legal compliance. You'll save time on document management, reduce errors, and have access to all your signed forms in one convenient location.

Get more for Pt 401 Form

- Bona fide marriage exemption letter sample form

- Stable hand license qld form

- Annual periodic vehicle inspection report name and address of inspecting company or agency registered owners name date street form

- Credit check authorization letter sample form

- Mississippi withholding form fillable

- 8048 auth for use or disclosure of health inforincoming records 090220 draft form

- Junior infantshowth road national school form

- Fannie mae form 1005 july 96

Find out other Pt 401 Form

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document