Mississippi Withholding Form Fillable

What is the Mississippi Withholding Form Fillable

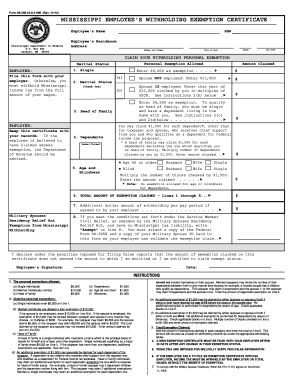

The Mississippi withholding form, often referred to as the MS withholding form, is a crucial document used by employers to report state income tax withheld from employees' wages. This form ensures that the correct amount of state tax is deducted and remitted to the Mississippi Department of Revenue. It is essential for compliance with state tax regulations and helps employees manage their tax obligations effectively.

How to Use the Mississippi Withholding Form Fillable

Using the Mississippi withholding form fillable involves several straightforward steps. First, access the form online through a reliable source. Fill in the required fields, including personal information such as name, address, and Social Security number. Additionally, specify the withholding allowances you are claiming. Once completed, review the form for accuracy before submitting it to your employer or the appropriate tax authority.

Steps to Complete the Mississippi Withholding Form Fillable

Completing the Mississippi withholding form fillable requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from a trusted source.

- Enter your personal details, including your full name and contact information.

- Indicate your filing status and the number of allowances you wish to claim.

- Review the entries for accuracy, ensuring all required fields are filled.

- Sign and date the form before submitting it to your employer.

Legal Use of the Mississippi Withholding Form Fillable

The legal use of the Mississippi withholding form fillable is governed by state tax laws. Employers are required to use this form to withhold the appropriate amount of state income tax from employees' paychecks. Proper completion and submission of the form ensure compliance with the Mississippi Department of Revenue regulations, helping avoid potential penalties for both employers and employees.

Key Elements of the Mississippi Withholding Form Fillable

Several key elements must be included in the Mississippi withholding form fillable to ensure its validity:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Indicate whether you are single, married, or head of household.

- Withholding Allowances: Specify the number of allowances you are claiming.

- Signature: Your signature is required to validate the form.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Mississippi withholding form fillable. Typically, employers must submit the completed form to the Mississippi Department of Revenue by the end of the tax year. Additionally, employees should ensure that their forms are submitted promptly to avoid any discrepancies in tax withholding throughout the year.

Quick guide on how to complete mississippi withholding form fillable

Complete Mississippi Withholding Form Fillable effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without unnecessary delays. Handle Mississippi Withholding Form Fillable on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign Mississippi Withholding Form Fillable with ease

- Locate Mississippi Withholding Form Fillable and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searching, or errors requiring new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device of your choice. Edit and electronically sign Mississippi Withholding Form Fillable and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mississippi withholding form fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ms withholding form and why is it important?

The ms withholding form is a critical document used by employers in Mississippi to report and withhold state income tax from employee wages. This form ensures that the correct amount of tax is collected and submitted to the state, helping businesses stay compliant with tax regulations. By using airSlate SignNow to manage your ms withholding form, you can streamline the completion and submission process.

-

How can airSlate SignNow help with filling out the ms withholding form?

airSlate SignNow provides an intuitive platform for easily filling out the ms withholding form. With our user-friendly interface, you can input necessary information effortlessly and ensure that all fields are completed correctly. This not only saves time but also reduces the likelihood of errors in your documentation.

-

What features does airSlate SignNow offer for managing the ms withholding form?

airSlate SignNow offers features such as document templates, eSigning capabilities, and real-time collaboration to make managing your ms withholding form easy and efficient. These features allow you to create, sign, and share documents conveniently, which can enhance your team's productivity. Additionally, our platform supports secure document storage for streamlined access when needed.

-

Is there a cost associated with using airSlate SignNow for the ms withholding form?

Yes, there are different pricing plans available for using airSlate SignNow, including options that cater to different business sizes and needs. Each plan allows you to take full advantage of our features while managing documents like the ms withholding form. Our solutions are designed to be cost-effective, ensuring that you get value for your investment.

-

Can I integrate airSlate SignNow with other software for the ms withholding form?

Absolutely! airSlate SignNow offers seamless integrations with various software platforms, allowing you to connect your tools easily while managing the ms withholding form. This integration capability can enhance your workflow efficiency by allowing data to flow freely between systems, thus eliminating duplicative efforts and manual entry.

-

What are the benefits of using airSlate SignNow for the ms withholding form compared to traditional methods?

Using airSlate SignNow for the ms withholding form offers numerous benefits over traditional paper methods, including increased efficiency, speed, and security. Our electronic signature feature allows documents to be signed and processed in minutes, signNowly reducing turnaround time. Additionally, the digital approach minimizes the risk of lost paperwork and ensures compliance with state regulations.

-

How secure is my information when using airSlate SignNow for the ms withholding form?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the ms withholding form. We employ advanced encryption technologies and compliance measures to protect your data, ensuring that your information remains confidential and secure during transmission and storage. This commitment to security gives our users peace of mind when managing important documents.

Get more for Mississippi Withholding Form Fillable

- United states district court eastern district summons in a civil action 2009 form

- Spouse if filing uscourts form

- Letter travel template form

- Form involuntary petition

- Ao to fill serche warrant 2009 form

- C program files cmc opinion processing opineditarea coxmemo ustaxcourt form

- Non dispositive order form

- Application leave file pdf form

Find out other Mississippi Withholding Form Fillable

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form