Form 8867 Rev December IRS Irs

What is the Form 8867 Rev December IRS

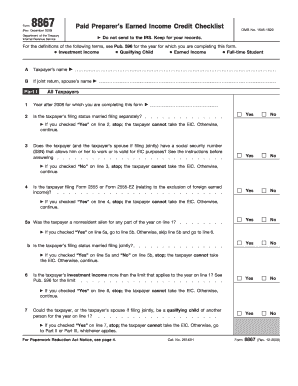

The Form 8867 Rev December IRS is a crucial document used by tax preparers to ensure compliance with the due diligence requirements when claiming certain tax credits, such as the Earned Income Tax Credit (EITC). This form helps verify that taxpayers meet the eligibility criteria for these credits. By completing this form, tax preparers affirm that they have taken the necessary steps to ensure that the information provided by the taxpayer is accurate and complete. This form is particularly important for those who prepare tax returns for clients, as it serves to protect both the taxpayer and the preparer from potential penalties associated with incorrect claims.

How to use the Form 8867 Rev December IRS

Using the Form 8867 Rev December IRS involves several steps to ensure that all necessary information is accurately reported. Tax preparers should first gather all relevant documentation from the taxpayer, such as income statements and proof of residency. Once the required information is collected, the preparer must complete the form by answering a series of questions regarding the taxpayer's eligibility for the credits. It is essential to ensure that all information is truthful and substantiated by the documentation provided. After completing the form, it should be submitted alongside the taxpayer's return to the IRS to demonstrate compliance with due diligence requirements.

Steps to complete the Form 8867 Rev December IRS

Completing the Form 8867 Rev December IRS requires careful attention to detail. Follow these steps for accurate completion:

- Gather necessary documentation, including income records and identification.

- Review the eligibility criteria for the credits being claimed.

- Fill out the form by providing accurate information about the taxpayer's situation.

- Answer each question honestly and ensure that all claims are supported by documentation.

- Double-check the completed form for any errors or omissions.

- Submit the form with the taxpayer's tax return to the IRS.

Legal use of the Form 8867 Rev December IRS

The legal use of the Form 8867 Rev December IRS is essential for maintaining compliance with IRS regulations. Tax preparers are legally obligated to complete this form when their clients claim certain tax credits. Failure to do so can result in penalties for both the taxpayer and the preparer. The form serves as a safeguard, ensuring that all claims are legitimate and that the preparer has exercised due diligence in verifying the taxpayer's eligibility. By adhering to the guidelines set forth by the IRS, tax preparers can protect themselves and their clients from potential legal issues.

Eligibility Criteria

To use the Form 8867 Rev December IRS effectively, it is essential to understand the eligibility criteria for the tax credits in question. Typically, these criteria include:

- Income limits based on the taxpayer's filing status.

- Residency requirements, including proof of living in the United States for a specified period.

- Dependent qualifications, which may include age and relationship to the taxpayer.

Tax preparers should ensure that their clients meet these criteria before completing the form, as incorrect claims can lead to penalties and delays in processing.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Form 8867 Rev December IRS is crucial for timely submission. Typically, tax returns, along with the completed form, must be filed by April fifteenth of each year. However, if the taxpayer is granted an extension, the deadline may be extended to October fifteenth. It is important for tax preparers to communicate these deadlines to their clients to avoid any late filing penalties. Additionally, being aware of any changes in deadlines due to IRS announcements or special circumstances can help ensure compliance.

Quick guide on how to complete form 8867 rev december irs irs

Prepare Form 8867 Rev December IRS Irs seamlessly on any gadget

Web-based document administration has become favored by businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct template and securely store it online. airSlate SignNow provides all the tools required to generate, modify, and electronically sign your documents swiftly without any hold-ups. Administer Form 8867 Rev December IRS Irs on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to modify and eSign Form 8867 Rev December IRS Irs effortlessly

- Locate Form 8867 Rev December IRS Irs and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your modifications.

- Select your preferred method for delivering your form, by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or dislocated files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Alter and eSign Form 8867 Rev December IRS Irs and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8867 rev december irs irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8867 Rev December IRS Irs?

Form 8867 Rev December IRS Irs is a tax form used by paid preparers to claim the Earned Income Tax Credit (EITC) on behalf of their clients. This form ensures that all eligibility requirements are met and is crucial for the accurate filing of federal tax returns.

-

How does airSlate SignNow assist with Form 8867 Rev December IRS Irs?

airSlate SignNow provides an efficient platform for businesses to facilitate the signing and management of Form 8867 Rev December IRS Irs. Our tool streamlines the process, reducing time and errors in document handling, which is vital for compliance.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans tailored to meet different business needs, starting from an affordable monthly rate. Each plan includes access to tools for managing forms like Form 8867 Rev December IRS Irs, providing excellent value for tax practitioners.

-

What features does airSlate SignNow have for managing forms?

airSlate SignNow boasts features like customizable templates, in-document eSignatures, and integration capabilities with popular accounting software. These features are designed to enhance workflows involving documents such as Form 8867 Rev December IRS Irs, ensuring efficiency and compliance.

-

Can airSlate SignNow integrate with other software to streamline my workflow?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications, including accounting and tax software. This allows users to easily manage documents like Form 8867 Rev December IRS Irs without leaving their preferred platforms.

-

What benefits does using airSlate SignNow offer for tax preparers?

Using airSlate SignNow provides tax preparers with a secure, efficient way to handle forms like Form 8867 Rev December IRS Irs. Benefits include improved turnaround times, reduced paperwork, and enhanced compliance with tax regulations.

-

Is airSlate SignNow secure for sensitive tax documents?

Absolutely. airSlate SignNow employs top-tier security measures, including encryption and secure cloud storage, to protect sensitive tax documents such as Form 8867 Rev December IRS Irs. Users can trust that their data is safe while using our platform.

Get more for Form 8867 Rev December IRS Irs

- Med 97 form in word format

- Lic ann 1 query form pdf download

- Portugal d7 visa application form pdf

- Tribel certificate form

- About this guide washington courts wa gov form

- Land partition application polk county oregon form

- Cpa form 1 application for licensure ampamp first registration

- Korean visa application form

Find out other Form 8867 Rev December IRS Irs

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself