Elective Deferral Form

What is the Elective Deferral

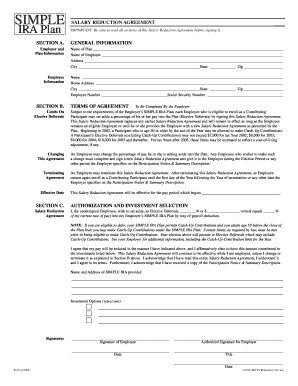

The simple IRA elective deferral agreement allows employees to choose to defer a portion of their salary into a retirement account. This agreement is essential for individuals who want to save for retirement while benefiting from tax advantages. Contributions made through elective deferrals are typically pre-tax, meaning they reduce the employee's taxable income for the year. This form is particularly useful for small businesses and self-employed individuals looking to establish a straightforward retirement savings plan.

How to use the Elective Deferral

To utilize the simple IRA elective deferral agreement, employees must first complete the necessary form provided by their employer. This form outlines the specific percentage or dollar amount the employee wishes to defer from each paycheck. Once completed, the form must be submitted to the employer's payroll department for processing. The employer will then set up the automatic deductions from the employee's paycheck, ensuring that contributions are deposited directly into the simple IRA account.

Steps to complete the Elective Deferral

Completing the simple IRA elective deferral agreement involves several straightforward steps:

- Obtain the elective deferral agreement form from your employer.

- Fill in personal information, including your name, address, and Social Security number.

- Indicate the amount or percentage of your salary you wish to defer.

- Review the form for accuracy and completeness.

- Submit the signed form to your employer's payroll department.

Legal use of the Elective Deferral

The simple IRA elective deferral agreement must comply with IRS regulations to ensure its legal standing. This includes adhering to contribution limits set by the IRS, which are subject to change annually. Additionally, the agreement should be executed properly, with both the employee and employer retaining copies for their records. Compliance with these legal requirements helps protect both parties and ensures that the retirement savings plan remains valid and effective.

Key elements of the Elective Deferral

Several key elements define the simple IRA elective deferral agreement:

- Contribution Limits: The IRS sets annual limits on how much can be deferred into a simple IRA.

- Eligibility: Both employees and employers must meet specific criteria to participate in this retirement plan.

- Withdrawal Rules: There are guidelines regarding when and how funds can be withdrawn from the account.

- Employer Matching: Employers may choose to match employee contributions, enhancing the savings potential.

IRS Guidelines

The IRS provides specific guidelines for the simple IRA elective deferral agreement, including contribution limits, eligibility requirements, and withdrawal rules. It is essential for both employers and employees to familiarize themselves with these guidelines to ensure compliance. Regularly reviewing IRS publications related to simple IRAs can help individuals stay informed about any changes that may affect their retirement savings strategy.

Quick guide on how to complete elective deferral

Effortlessly Prepare Elective Deferral on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the necessary form and securely keep it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents swiftly and without any holdups. Handle Elective Deferral on any device with the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to Alter and eSign Elective Deferral with Ease

- Find Elective Deferral and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or obscure sensitive information with the tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Elective Deferral and guarantee excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the elective deferral

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a simple IRA elective deferral agreement?

A simple IRA elective deferral agreement is a document that allows employees to choose to defer a portion of their salary into a Simple IRA retirement account. This agreement is crucial for both employers and employees to understand the contribution limits and options available to maximize retirement savings.

-

How does airSlate SignNow facilitate the creation of a simple IRA elective deferral agreement?

AirSlate SignNow provides an intuitive platform that allows users to create, customize, and manage a simple IRA elective deferral agreement with ease. The platform enables seamless document editing and sharing, ensuring all necessary details are included for compliance and clarity.

-

What are the benefits of using airSlate SignNow for a simple IRA elective deferral agreement?

Using airSlate SignNow for a simple IRA elective deferral agreement streamlines the entire process, reducing paperwork and administrative burdens. Additionally, the platform enhances security and provides tracking features, ensuring that all parties are informed and in compliance with the agreement terms.

-

Is there a cost associated with using airSlate SignNow for a simple IRA elective deferral agreement?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. The cost includes access to all features necessary for creating and managing a simple IRA elective deferral agreement, ensuring businesses can efficiently handle their documentation.

-

Can I integrate airSlate SignNow with my existing payroll systems for simple IRA elective deferral agreements?

Absolutely! AirSlate SignNow allows for seamless integrations with various payroll and HR systems, making it easy to implement a simple IRA elective deferral agreement directly into your existing workflow. This integration helps maintain accurate records and simplifies the contribution process.

-

What features does airSlate SignNow offer for managing a simple IRA elective deferral agreement?

AirSlate SignNow offers a range of features for managing a simple IRA elective deferral agreement, including eSigning capabilities, document templates, and real-time collaboration tools. These features help expedite the agreement process while ensuring all stipulations are clearly documented.

-

How secure is airSlate SignNow when handling simple IRA elective deferral agreements?

AirSlate SignNow prioritizes security, implementing robust encryption and compliance measures to protect sensitive documents like simple IRA elective deferral agreements. With advanced security protocols, businesses can trust that their information remains confidential and secure.

Get more for Elective Deferral

Find out other Elective Deferral

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe