Declination Executor Form

What is the declination executor form?

The declination executor form, often referred to as the renunciation of nominated executor form, is a legal document that allows an individual who has been nominated as an executor of an estate to formally decline the role. This form is essential when the nominated executor does not wish to serve, whether due to personal reasons, conflicts of interest, or other circumstances. By completing this form, the individual ensures that their declination is documented, which can help prevent potential disputes among heirs or beneficiaries regarding the administration of the estate.

Steps to complete the declination executor form

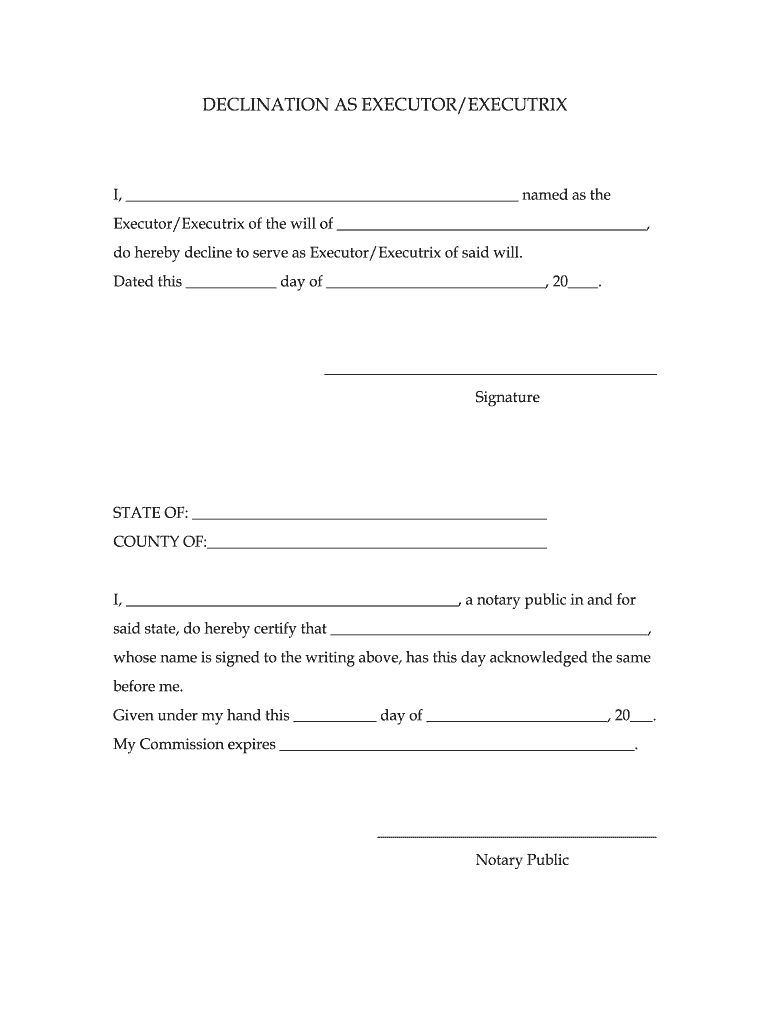

Completing the declination executor form involves several straightforward steps:

- Obtain the appropriate form, which may vary by state.

- Fill in your personal information, including your name, address, and relationship to the deceased.

- Clearly state your intent to decline the role of executor.

- Sign and date the form, ensuring that your signature is notarized if required by state law.

- Submit the completed form to the probate court handling the estate.

Legal use of the declination executor form

The declination executor form serves a critical legal function in the estate administration process. When a nominated executor declines to serve, it is crucial for the estate to have a clear record of this decision. This form helps to establish that the individual has formally renounced their responsibilities, thereby allowing the court to appoint an alternative executor if necessary. Legal requirements for the use of this form may vary by state, so it is important to consult local regulations to ensure compliance.

State-specific rules for the declination executor form

Each state in the U.S. may have its own rules and regulations regarding the declination executor form. For instance, some states require that the form be filed within a specific timeframe after the death of the testator, while others may have additional documentation requirements. It is essential to check the specific laws in your state to ensure that the form is completed correctly and submitted in accordance with local probate procedures.

Examples of using the declination executor form

There are various scenarios in which an individual might choose to use the declination executor form. For example:

- A nominated executor may have moved out of state and finds it impractical to manage the estate from a distance.

- Personal circumstances, such as health issues or family obligations, may prevent someone from taking on the responsibilities of an executor.

- Conflicts of interest, such as a business relationship with one of the beneficiaries, might lead an individual to decline the role to avoid potential disputes.

Who issues the declination executor form?

The declination executor form is typically issued by state probate courts or can be obtained from legal resource websites. Some states may provide a standardized form, while others may require individuals to draft their own based on specific legal requirements. It is advisable to consult with a legal professional or check the official state court website to ensure that the correct form is used.

Quick guide on how to complete declination as executor or executrix

The simplest method to locate and sign Declination Executor Form

On the scale of your whole enterprise, ineffective procedures surrounding document approval can consume a signNow amount of working hours. Signing documents such as Declination Executor Form is an inherent aspect of operations across any sector, which is why the effectiveness of each agreement's lifecycle signNowly impacts the company's overall productivity. With airSlate SignNow, signing your Declination Executor Form can be as straightforward and prompt as possible. You’ll discover with this platform the most recent version of nearly any form. Even better, you can sign it instantly without the need to install third-party applications on your computer or print anything as physical copies.

Steps to obtain and sign your Declination Executor Form

- Search our repository by category or use the search box to find the form you require.

- Check the form preview by clicking Learn more to confirm it is the correct one.

- Click Get form to begin editing right away.

- Fill out your form and include any necessary information using the toolbar.

- When you’re finished, click the Sign tool to sign your Declination Executor Form.

- Choose the signing method that works best for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to complete editing and move on to document-sharing options if required.

With airSlate SignNow, you have everything necessary to handle your documents effectively. You can find, fill out, modify, and even send your Declination Executor Form all in one tab without any trouble. Enhance your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

As a Canadian working in the US on a TN-1 visa should I fill out the IRS Form W-8BEN or W9?

Use the W-9. The W-8BEN is used for cases where you are not working in the U.S., but receiving income relating to a U.S. Corporation, Trust or Partnership.

-

How is it that when you fill out a form, "Asian" is somehow listed as one race?

It’s worse than that: on most forms that have only a few options (Joseph Boyle is right that the US Census now gets more specific), Asians-and-Pacific-Islanders is all one group. That means from the Maori through Indonesia and Polynesia, then Vietnam, straight up past Mongolia, and east out to Japan and west right out past India — all one “race”. Why?Because racism, that’s why.To be specific, because historically in the US the only racial difference that counted was white/black — that is, white and and not-white. For centuries that was how distinctions of race and (implied) class were made. There were quite a few court cases where light-skinned Japanese (etc) petitioned to be declared white — they usually weren’t — and where dark-skinned South Asians (etc) petitioned to be declared non-black — which sometimes worked. In fact, it worked so well that some American Blacks donned turbans and comic-opera inaccurate “Eastern” garb to perform more widely as an “Indian” musician than they’d ever be allowed to do in their original identity.So in the 1800s, there was white and Black. Period. Well, ok, and Native Americans, but to the people that mattered, they hardly counted (and were all dead, anyhow, right?). As colonialism and rising globalization brought more and more people who were neither white nor black to North America, there became an increasing dilemma about how to classify this cacophonous mob of confusing non-white people.Eventually the terms “Arab” and “Asian” came to be widely used, and some classifiers (see also Why is "Caucasian" a term used to label white people of European descent? ) also separated Pacific islander from the general morass of “Asian”. But in general, everyone from the Mysteeeeerious East was just called one thing, unless you felt you needed to specify a country.So, like I said: racism. And a racist tendency to dismiss as unimportant distinctions between different groups of “unimportant” people.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

There is curfew in my area and Internet service is blocked, how can I fill my exam form as today is the last day to fill it out?

Spend less time using your blocked Internet to ask questions on Quora, andTravel back in time to when there was no curfew and you were playing Super Mario Kart, and instead, fill out your exam form.

-

In Missouri, how much of an estate can an executor take out as compensation? What is the most an executor may keep as payment? And does the Will have to state how much the executor is to be paid?

Mr. Puckett, Esq’s response to this question is very specific… Good for him. Interesting that a Will in Missouri does not have to list these executor fees… Of course the Missouri statue dictates the executor’s minimum, and it’s also interesting that the personal representative or the executor has the option to petition the court for more money if it seems appropriate to do so. That’s good to know, that it can be flexible. So we find out from Mr. Puckett that the first $5000 is a 5% fee… The next $20,000 is 4%… The next $75,000 is 3%… etc. So on and so forth. Not bad. But — in my view, it’s a thankless job. You couldn’t pay me enough to do it! The probate attorney of record is the one who makes the real bucks anyway. And in my opinion he/she deserves it. It’s a huge responsibility.Even so, a lot of heirs resent the executor for the fee he or she gets… and they surely resent the attorney for his big fee. Well, like I said — he deserves it! And heirs will ask, what’s in it for them, other than their (usually for middle class heirs these days) small inheritance — however thankfully many heirs these days find out early in the game, soon after probate commences, that they can pull some money out of the probate process, so to speak — but usually only from a third party… generally not from the estate before probate closes, unless they are lucky and get granted an advance on inheritance from the estate, which rarely happens unfortunately… Instead, I find that more and more heirs or beneficiaries borrow against inheritance… are getting an advance on inheritance, or a loan on inheritance, from one of more established boutique inheritance loan companies, or probate loan companies, after getting inheritance advance rates or inheritance advance fees, or probate loan fees, to nail down the lowest rates for an inheritance advance or inheritance loan.I find that more and more middle class heirs these days are getting approved early on in the probate process for an inheritance cash advance, inheritance advance or inheritance loans cash-assignment, from their online inheritance loan or inheritance advance company of choice — for a super fast probate advance loan, or large probate loan or even small estate loan, whichever inheritance cash advance they get approved for – maybe a 72 hour probate loan or loan on inheritance, or a 48 hour inheritance loan advance or probate cash advance on a trust, or whatever inheritance advance or advance inheritance, probate loan, estate loan or inheritance advance assignment they do eventually get — their inheritance loan, probate cash advance or probate loan typically is accomplished in a matter of days, from company like www.heiradvance.com, or www.inheritanceadvance.com, or maybe www.inheritancenow.com. A windfall like this of inheritance money, from loans while waiting for an inheritance, loans against an inheritance, loans based on inheritance, or inheritance loan advances seems to make most heirs feel a lot better, especially if their inheritance is lower than they expected — which, for middle class heirs, usually is.And even though inheritance money like this may not surface immediate 8-figure wealth for these heirs... it does at least make the estate process seem more worthwhile, in the short term anyway. Which I suppose we could say is an improvement on going through the entire probate process, which could last a year or two, or three — without seeing a dime! So some fast cash in advance of the usual distribution schedule, as I see it, is a far more positive outcome that NOT pulling in a bunch of cash as probate crawls by. Cash in hand, as opposed to being in the bush, as they say…

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

How do you fill out a form scanned as a PDF?

If you have Acrobat Reader or Foxit Phantom, you can add form to the PDF file you want to fill in. Refer to the screenshot here (Phantom). First click on Form, then you can pick option you want for your form (Text Field, Check box…) and draw it where you want to input your data. You can also change font and size of it to fit the existing text. When you are done adding the fields, you can just click on the hand icon, and you can now fill in your form and then save it as.

Create this form in 5 minutes!

How to create an eSignature for the declination as executor or executrix

How to make an eSignature for the Declination As Executor Or Executrix in the online mode

How to create an eSignature for the Declination As Executor Or Executrix in Chrome

How to create an eSignature for signing the Declination As Executor Or Executrix in Gmail

How to generate an electronic signature for the Declination As Executor Or Executrix straight from your mobile device

How to create an eSignature for the Declination As Executor Or Executrix on iOS devices

How to generate an eSignature for the Declination As Executor Or Executrix on Android devices

People also ask

-

What is a Declination Executor Form?

A Declination Executor Form is a legal document used to formally decline the role of an executor in a will. This form is essential for individuals who have been named executors but choose not to accept the responsibility, allowing for a smooth transition to an alternate executor. Using airSlate SignNow makes completing and eSigning your Declination Executor Form simple and efficient.

-

How can I create a Declination Executor Form using airSlate SignNow?

Creating a Declination Executor Form with airSlate SignNow is straightforward. You can start by selecting a customizable template from our library, fill in the necessary details, and then eSign the document securely. Our user-friendly interface ensures that you can create this form without any hassle.

-

Is airSlate SignNow compliant with legal standards for the Declination Executor Form?

Yes, airSlate SignNow ensures that all documents, including the Declination Executor Form, comply with legal standards. Our platform adheres to electronic signature laws and regulations, providing you with the confidence that your signed documents are legally binding and enforceable.

-

What are the pricing options for using airSlate SignNow to manage my Declination Executor Form?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose from monthly or annual subscriptions, with options that provide unlimited document sending and eSigning. This cost-effective solution makes it easy to manage your Declination Executor Form and other important documents.

-

Can I integrate airSlate SignNow with other applications for my Declination Executor Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications such as Google Drive, Dropbox, and CRM systems. This allows you to easily access and manage your Declination Executor Form alongside your other documents, streamlining your workflow.

-

What features does airSlate SignNow provide for handling the Declination Executor Form?

airSlate SignNow provides a range of features to enhance your experience with the Declination Executor Form. These include customizable templates, secure eSigning, real-time tracking, and document storage. These features simplify the process and ensure you can manage your legal documents efficiently.

-

How secure is my Declination Executor Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and secure servers to protect your Declination Executor Form and other sensitive documents. You can trust that your data is safe with us throughout the signing process.

Get more for Declination Executor Form

Find out other Declination Executor Form

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate