Forms$challanitns 280 Rtf Incometaxindia Gov

What is the Forms$challanitns 280 rtf Incometaxindia Gov

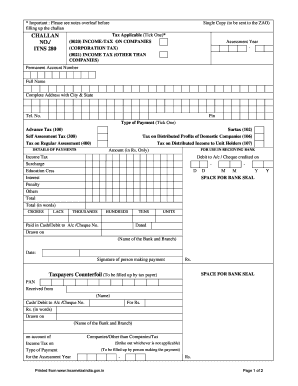

The Forms$challanitns 280 rtf Incometaxindia Gov is a specific document used for tax-related purposes within the Indian tax system. This form is essential for individuals and businesses to report their income accurately to the tax authorities. It serves as a means to ensure compliance with tax regulations and facilitates the assessment of tax liabilities. Understanding the purpose and requirements of this form is crucial for anyone involved in the tax filing process.

How to use the Forms$challanitns 280 rtf Incometaxindia Gov

Using the Forms$challanitns 280 rtf Incometaxindia Gov involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form with precise information, ensuring that all figures are accurate and reflect your financial situation. Once completed, review the form for any errors before submission. Utilizing digital tools can streamline this process, allowing for easier edits and secure storage of your completed forms.

Steps to complete the Forms$challanitns 280 rtf Incometaxindia Gov

Completing the Forms$challanitns 280 rtf Incometaxindia Gov requires a systematic approach:

- Gather all relevant financial documents, including income sources and deductions.

- Fill in personal information, ensuring accuracy in names, addresses, and identification numbers.

- Report income details, including salaries, business income, and any other earnings.

- Detail deductions and credits applicable to your situation.

- Review the completed form for accuracy before submission.

Legal use of the Forms$challanitns 280 rtf Incometaxindia Gov

The legal use of the Forms$challanitns 280 rtf Incometaxindia Gov hinges on its compliance with tax regulations. It is important that the information provided is truthful and complete, as inaccuracies can lead to penalties or legal consequences. The form must be submitted within the designated time frame to avoid issues with tax authorities. Ensuring that the form is filled out correctly and submitted on time is essential for maintaining legal compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Forms$challanitns 280 rtf Incometaxindia Gov are critical to avoid penalties. Typically, tax returns must be filed by April 15 of the following year for individual taxpayers. Businesses may have different deadlines based on their structure and fiscal year. Staying informed about these dates is essential for timely submissions and compliance with tax regulations.

Required Documents

To complete the Forms$challanitns 280 rtf Incometaxindia Gov, several documents are required:

- Income statements, such as W-2 forms or 1099s.

- Records of deductible expenses, including receipts and invoices.

- Previous year’s tax return for reference.

- Identification documents, such as Social Security numbers.

Quick guide on how to complete formschallanitns 280 rtf incometaxindia gov

Effortlessly prepare Forms$challanitns 280 rtf Incometaxindia Gov on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the proper form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage Forms$challanitns 280 rtf Incometaxindia Gov on any system using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Forms$challanitns 280 rtf Incometaxindia Gov with ease

- Locate Forms$challanitns 280 rtf Incometaxindia Gov and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal position as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign Forms$challanitns 280 rtf Incometaxindia Gov to ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formschallanitns 280 rtf incometaxindia gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Forms$challanitns 280 rtf Incometaxindia Gov?

Forms$challanitns 280 rtf Incometaxindia Gov refers to a specific tax form used in India for income tax purposes. It helps taxpayers report their income and claim deductions effectively. Using airSlate SignNow, you can easily eSign and send this form for quick processing.

-

How does airSlate SignNow simplify using Forms$challanitns 280 rtf Incometaxindia Gov?

airSlate SignNow makes it simple to eSign Forms$challanitns 280 rtf Incometaxindia Gov by providing an intuitive interface. Users can quickly upload, edit, and send the form, ensuring compliance and accuracy. The platform streamlines document workflows, saving you valuable time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to fit different business needs. Each plan includes comprehensive features that support processes involving Forms$challanitns 280 rtf Incometaxindia Gov. You can select a plan based on the volume of documents you handle to maximize your investment.

-

Can I integrate airSlate SignNow with other software for Forms$challanitns 280 rtf Incometaxindia Gov?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your productivity when dealing with Forms$challanitns 280 rtf Incometaxindia Gov. Popular integrations include platforms like Google Drive, Dropbox, and CRM systems, allowing for efficient document management.

-

What features of airSlate SignNow assist with Forms$challanitns 280 rtf Incometaxindia Gov?

Key features of airSlate SignNow include customizable templates, real-time tracking, and secure storage, which are crucial for managing Forms$challanitns 280 rtf Incometaxindia Gov. These tools ensure that your documents are compliant, organized, and easy to access when needed.

-

Are there any benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like Forms$challanitns 280 rtf Incometaxindia Gov offers numerous benefits, including faster processing and enhanced security. The platform allows for electronic signatures, which expedites approval times and ensures that your documents are legally binding.

-

Is it easy to get started with airSlate SignNow for Forms$challanitns 280 rtf Incometaxindia Gov?

Absolutely! Starting with airSlate SignNow is user-friendly and requires just a few steps to set up. Once you have an account, you can quickly upload your Forms$challanitns 280 rtf Incometaxindia Gov and begin eSigning with minimal training.

Get more for Forms$challanitns 280 rtf Incometaxindia Gov

Find out other Forms$challanitns 280 rtf Incometaxindia Gov

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form