Hdfc Ergo Kyc Form Filled Sample

What is the Hdfc Ergo Kyc Form Filled Sample

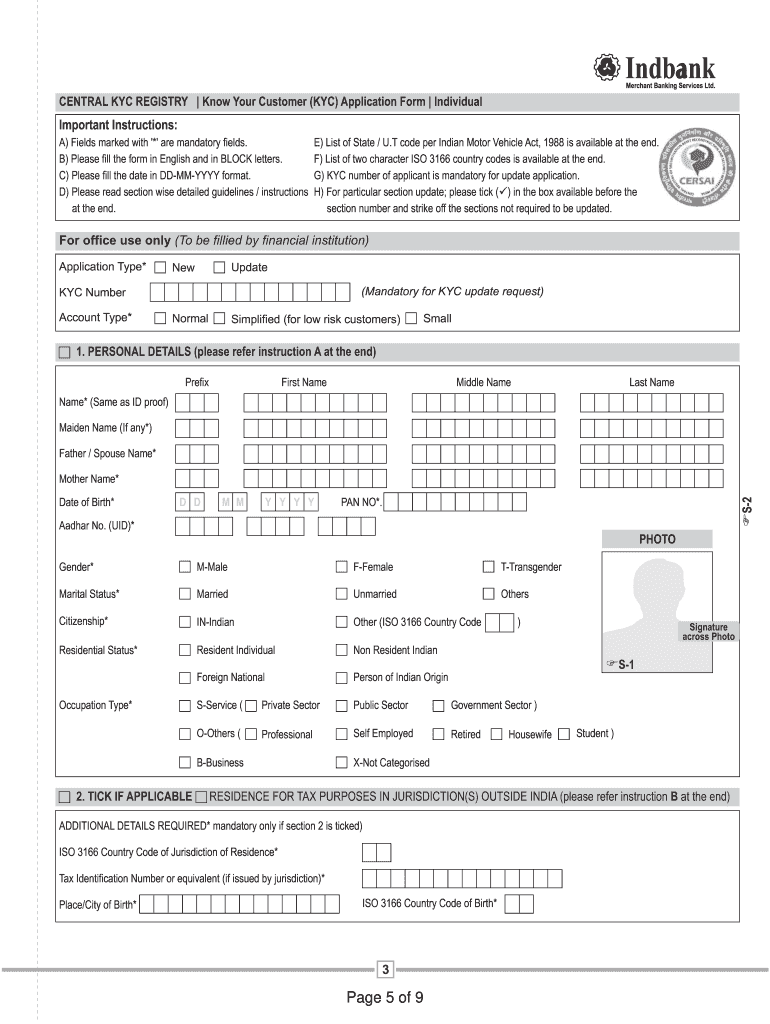

The Hdfc Ergo Kyc form filled sample is a crucial document that facilitates the Know Your Customer (KYC) process for clients of HDFC Ergo. This form collects essential personal information, including identification details, contact information, and financial background. It serves as a verification tool to ensure that the institution complies with regulatory requirements while also safeguarding customer interests. By providing a filled sample, users can better understand the necessary information and structure required for successful submission.

Steps to Complete the Hdfc Ergo Kyc Form Filled Sample

Completing the Hdfc Ergo Kyc form involves several important steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather Required Documents: Collect necessary identification documents, such as a government-issued ID, proof of address, and financial statements.

- Fill in Personal Information: Enter your full name, date of birth, and contact details accurately in the designated fields.

- Provide Financial Information: Include details regarding your income, employment status, and any other relevant financial data.

- Review for Accuracy: Double-check all entries for correctness to avoid delays in processing.

- Submit the Form: Follow the submission guidelines provided by HDFC Ergo, whether online or via physical mail.

Legal Use of the Hdfc Ergo Kyc Form Filled Sample

The Hdfc Ergo Kyc form filled sample is legally recognized as part of the compliance framework established to prevent fraud and money laundering. It adheres to regulations set forth by financial authorities, ensuring that customer identities are verified before engaging in financial transactions. This legal backing not only protects the institution but also enhances consumer trust. Proper completion of this form is essential for maintaining compliance with laws such as the Bank Secrecy Act and Anti-Money Laundering regulations.

Key Elements of the Hdfc Ergo Kyc Form Filled Sample

Understanding the key elements of the Hdfc Ergo Kyc form is vital for effective completion. The main components include:

- Personal Identification: This section requires details like your name, date of birth, and address.

- Contact Information: You must provide current phone numbers and email addresses.

- Financial Details: Information regarding your income sources, employment status, and any other financial obligations is necessary.

- Signature: A signature is required to validate the information provided and confirm consent for data processing.

How to Obtain the Hdfc Ergo Kyc Form Filled Sample

To obtain the Hdfc Ergo Kyc form filled sample, users can visit the official HDFC Ergo website or contact customer service for assistance. Additionally, many financial institutions provide templates or examples that can be used as a reference. It is advisable to ensure that the sample reflects the most current version of the form to comply with updated regulations. Users may also find resources in local branches or through authorized agents who assist with KYC processes.

Examples of Using the Hdfc Ergo Kyc Form Filled Sample

Utilizing the Hdfc Ergo Kyc form filled sample can enhance understanding and streamline the application process. For instance, a user preparing to apply for an insurance policy can refer to a filled sample to ensure they include all necessary information. Similarly, businesses seeking to establish a corporate account with HDFC Ergo can use the sample to guide their documentation process, ensuring compliance with KYC requirements. These examples illustrate the practical application of the filled sample in various scenarios.

Quick guide on how to complete hdfc ergo kyc form filled sample

Effortlessly Prepare Hdfc Ergo Kyc Form Filled Sample on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to acquire the correct documents and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Hdfc Ergo Kyc Form Filled Sample on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign Hdfc Ergo Kyc Form Filled Sample with Ease

- Locate Hdfc Ergo Kyc Form Filled Sample and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, unnecessary form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign Hdfc Ergo Kyc Form Filled Sample to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hdfc ergo kyc form filled sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How to fill HDFC ergo claim form?

SECTION G - DETAILS OF PRIMARY INSURED'S BANK ACCOUNT a) PAN b) Account Number c) Bank Name and Branch Enter the permanent account number Enter the bank account number Enter the bank name along with the branch As allotted by the Income Tax department As allotted by the bank Name of the Bank in full d) Cheque/ DD ...

-

How to fill KYC form step by step?

Generally, this is what goes into physical KYC verification: Step 1: Contact the Bank. ... Step 2: Gather the Required Documents: ... Step 3: Visit the ICICI Bank Branch: ... Step 4: Fill out the KYC Application Form: ... Step 5: Submit the Required Documents: ... Step 6: Verification Process: ... Step 7: Confirmation and Completion:

-

How to upload KYC for HDFC credit card online?

Filling HDFC KYC Updation Form Online Step 1: If you wish to fill the KYC updation form online, click and open the link. Step 2: Enter the required details in the relevant fields. Step 3: Select the 'Address Proof' and 'Identify Proof' you wish to attach. Step 4: Check the authorisation box.

-

How to fill KYC form step by step?

Generally, this is what goes into physical KYC verification: Step 1: Contact the Bank. ... Step 2: Gather the Required Documents: ... Step 3: Visit the ICICI Bank Branch: ... Step 4: Fill out the KYC Application Form: ... Step 5: Submit the Required Documents: ... Step 6: Verification Process: ... Step 7: Confirmation and Completion:

-

What should I fill in a KYC form?

Information such as Aadhaar number, proof of address, and income proof is noted. This helps financial institutions understand the source of an applicant's income. Data collected from the KYC form helps observe the customer's activities. This in turn helps in assessing the risk of money laundering.

-

How to fill HDFC credit card KYC form?

Filling the HDFC KYC Updation Downloadable Form Step 1: Click here to see the form, download and print it. Step 2: Fill the form manually with all the required details. Step 3: Affix a recent passport size photo on the form. Step 4: Mention the address proof and ID proof you have attached in the required field.

-

What should I fill in KYC form?

Information such as Aadhaar number, proof of address, and income proof is noted. This helps financial institutions understand the source of an applicant's income. Data collected from the KYC form helps observe the customer's activities. This in turn helps in assessing the risk of money laundering.

-

How to fill extended KYC in HDFC?

Login to NetBanking - Go to 'Accounts' > Click on 'Request' > Update Extended KYC. Email a scanned self-certified copy of the Extended KYC Annexure/ Curing Declaration to rekychdfcbank@hdfcbank.com from your registered email id.

Get more for Hdfc Ergo Kyc Form Filled Sample

- Label the cross section of a leaf form

- Secretary of state considation for refund fom form

- Reframing the authentic photography mobile technologies and inter disciplinary form

- Cms exhibit 286 form

- Inverse functions worksheet with answers pdf form

- Pw2help ford com form

- Va form 27 application for united states flag for burial purposes

- Application for permit driver license or non driver id card use to apply for a learner permit driver license or non driver id form

Find out other Hdfc Ergo Kyc Form Filled Sample

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast