1st Copy for the Hellenic Tax Authority Form United Kingdom

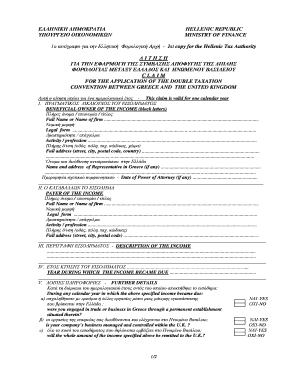

What is the 1st Copy for the Hellenic Tax Authority Form United Kingdom?

The 1st copy for the Hellenic Tax Authority form from the United Kingdom serves as an essential document for individuals and businesses needing to comply with tax regulations. This form is typically required for reporting income, deductions, and other pertinent financial information to the Hellenic Tax Authority. Understanding its purpose is crucial for ensuring compliance and avoiding potential penalties.

How to Obtain the 1st Copy for the Hellenic Tax Authority Form United Kingdom

Obtaining the 1st copy for the Hellenic Tax Authority form from the United Kingdom can be done through several channels. Individuals can visit the official website of the Hellenic Tax Authority to download the form directly. Alternatively, local tax offices may provide physical copies. It is important to ensure that you are accessing the most current version of the form to meet all legal requirements.

Steps to Complete the 1st Copy for the Hellenic Tax Authority Form United Kingdom

Completing the 1st copy for the Hellenic Tax Authority form involves several key steps:

- Gather necessary financial documents, including income statements and receipts.

- Carefully read the instructions provided with the form to understand each section.

- Fill out the form accurately, ensuring all information is complete and truthful.

- Review the form for any errors or omissions before submission.

- Sign and date the form where required, ensuring compliance with eSignature regulations if submitting electronically.

Legal Use of the 1st Copy for the Hellenic Tax Authority Form United Kingdom

The legal use of the 1st copy for the Hellenic Tax Authority form is crucial for ensuring that it is recognized by tax authorities. For the form to be legally binding, it must be completed in accordance with relevant laws and regulations. This includes providing accurate information, adhering to deadlines, and utilizing secure methods for submission, such as eSignatures that comply with legal standards like ESIGN and UETA.

Key Elements of the 1st Copy for the Hellenic Tax Authority Form United Kingdom

Several key elements must be included in the 1st copy for the Hellenic Tax Authority form to ensure its validity:

- Personal identification information, such as name, address, and tax identification number.

- Financial details, including income sources, deductions, and credits.

- Signature of the individual or authorized representative.

- Date of submission and any additional required documentation.

Form Submission Methods

The 1st copy for the Hellenic Tax Authority form can be submitted through various methods, depending on individual preferences and requirements:

- Online submission via the Hellenic Tax Authority's secure portal.

- Mailing a physical copy to the designated tax office.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete 1st copy for the hellenic tax authority form united kingdom

Effortlessly Manage 1st Copy For The Hellenic Tax Authority Form United Kingdom on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle 1st Copy For The Hellenic Tax Authority Form United Kingdom on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to Modify and Electronically Sign 1st Copy For The Hellenic Tax Authority Form United Kingdom with Ease

- Acquire 1st Copy For The Hellenic Tax Authority Form United Kingdom and click Get Form to initiate the process.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and electronically sign 1st Copy For The Hellenic Tax Authority Form United Kingdom and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1st copy for the hellenic tax authority form united kingdom

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1st copy for the hellenic tax authority form united kingdom?

The 1st copy for the hellenic tax authority form united kingdom is an official document required for tax submissions in the UK. This form ensures compliance with the regulatory requirements mandated by the Hellenic Tax Authority and helps streamline your tax processes.

-

How does airSlate SignNow facilitate the eSigning of the 1st copy for the hellenic tax authority form united kingdom?

airSlate SignNow provides a user-friendly platform that allows you to eSign the 1st copy for the hellenic tax authority form united kingdom quickly and securely. With our easy-to-use tools, you can send documents for signature and receive them back in no time, ensuring timely submission to tax authorities.

-

What pricing plans does airSlate SignNow offer for the 1st copy for the hellenic tax authority form united kingdom?

airSlate SignNow offers flexible pricing plans that cater to various business needs and sizes. You can choose from our basic, professional, or enterprise plans, all designed to provide excellent value for handling the 1st copy for the hellenic tax authority form united kingdom.

-

What are the key features of airSlate SignNow related to the 1st copy for the hellenic tax authority form united kingdom?

Key features of airSlate SignNow include customizable templates, automated workflows, and secure cloud storage to manage your 1st copy for the hellenic tax authority form united kingdom efficiently. These features help reduce paperwork and streamline your tax-filing processes.

-

Can I integrate airSlate SignNow with other applications for managing the 1st copy for the hellenic tax authority form united kingdom?

Yes, airSlate SignNow offers integrations with a variety of applications, enhancing your ability to manage the 1st copy for the hellenic tax authority form united kingdom. You can connect with CRM systems, document management tools, and more to streamline your workflow and improve efficiency.

-

How does airSlate SignNow ensure the security of the 1st copy for the hellenic tax authority form united kingdom?

Security is a top priority at airSlate SignNow. Our platform employs encryption methods and secure access protocols to protect your sensitive data, including the 1st copy for the hellenic tax authority form united kingdom, ensuring compliance with privacy regulations.

-

What benefits can I expect when using airSlate SignNow for the 1st copy for the hellenic tax authority form united kingdom?

Using airSlate SignNow for the 1st copy for the hellenic tax authority form united kingdom provides numerous benefits, including time savings and improved accuracy. You can manage your documentation efficiently, reducing the risk of errors and ensuring timely filings that align with regulatory requirements.

Get more for 1st Copy For The Hellenic Tax Authority Form United Kingdom

- Remplissable automating report writing how financial services is yseop form

- Printable tax exempt form for wisconsin

- V0901 form

- Contractors license board form

- Sample supervised visitation notes form

- 200 hour yoga teacher training application form

- Trust account authority form

- City of north bay official receipt request taxes andor water form

Find out other 1st Copy For The Hellenic Tax Authority Form United Kingdom

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe