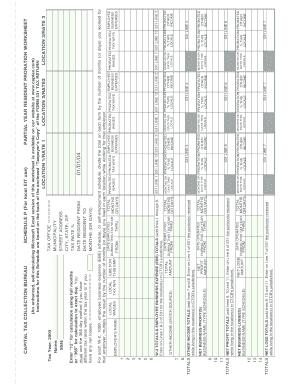

Captax Form

What is the Captax?

The Captax, or capital tax, is a tax levied on the value of capital assets owned by individuals and businesses within a specific jurisdiction. In the United States, this tax is often administered by local municipalities or counties, such as the Capital Tax Collection Bureau in Somerset, Pennsylvania. The purpose of the Captax is to generate revenue for local governments, which can then be used to fund public services and infrastructure projects. Understanding the Captax is essential for residents and business owners to ensure compliance and avoid potential penalties.

Steps to Complete the Captax

Completing the Captax involves several key steps that ensure accurate reporting and compliance with local regulations. Here’s a straightforward process to follow:

- Gather necessary documentation, including financial statements and asset valuations.

- Obtain the appropriate form, such as Form 531, from the Capital Tax Collection Bureau.

- Carefully fill out the form, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form either online, by mail, or in person, depending on local guidelines.

Legal Use of the Captax

The legal use of the Captax is governed by state and local laws that outline the obligations of taxpayers. To ensure that the Captax is legally binding, it is crucial to comply with the established regulations regarding eSignatures and document submission. Utilizing a reliable electronic signature solution, such as signNow, can help ensure that your submission meets legal standards. Compliance with laws like the ESIGN Act and UETA is essential for the validity of your eDocument.

Required Documents

When preparing to file the Captax, certain documents are typically required to support your submission. These may include:

- Financial statements detailing your capital assets.

- Previous tax returns that provide context for your current filing.

- Any applicable exemption certificates or supporting documentation.

Having these documents ready will streamline the process and help ensure that your Captax is filed correctly.

Form Submission Methods

Submitting the Captax can be done through various methods, allowing flexibility for taxpayers. The common submission methods include:

- Online: Many jurisdictions offer online portals for easy submission.

- Mail: You can send your completed form and supporting documents via postal service.

- In-Person: Some taxpayers may prefer to submit their forms directly at the local Capital Tax Collection Bureau office.

Choosing the right submission method can depend on personal preference and the specific requirements of your local tax authority.

Penalties for Non-Compliance

Failure to comply with Captax regulations can result in significant penalties. These penalties may include:

- Monetary fines based on the amount of tax owed.

- Interest charges on late payments.

- Potential legal action for continued non-compliance.

Understanding these penalties underscores the importance of timely and accurate filing of the Captax.

Quick guide on how to complete captax

Prepare Captax effortlessly on any device

Online document handling has gained popularity among organizations and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Captax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to alter and eSign Captax with ease

- Locate Captax and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or downloadable to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Captax and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the captax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 531 and how does it work with airSlate SignNow?

Form 531 is a standard document used for specific business transactions. With airSlate SignNow, you can easily create, send, and eSign your Form 531 digitally, streamlining the process and reducing the time spent on paperwork.

-

Is airSlate SignNow compliant with legal requirements for Form 531?

Yes, airSlate SignNow ensures that your Form 531 is compliant with legal standards for electronic signatures. Our platform adheres to the ESIGN Act and UETA, providing you with peace of mind that your documents are legally binding.

-

What are the pricing plans for using airSlate SignNow with Form 531?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes. You can choose a plan based on your needs, which includes features for managing Form 531 effectively without breaking the bank.

-

What features does airSlate SignNow provide for managing Form 531?

airSlate SignNow offers various features such as customizable templates, document tracking, and automated reminders for Form 531. These features enhance the efficiency of handling important documents, ensuring nothing gets overlooked.

-

Can I integrate airSlate SignNow with other applications for Form 531?

Absolutely! airSlate SignNow supports seamless integrations with popular applications like Google Drive, Salesforce, and more. This allows you to efficiently manage your Form 531 alongside your other business tools.

-

What are the benefits of using airSlate SignNow for Form 531?

Using airSlate SignNow for Form 531 brings numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform allows you to obtain signatures quickly, improving your workflow and overall productivity.

-

Is customer support available for assistance with Form 531 on airSlate SignNow?

Yes, airSlate SignNow provides reliable customer support to assist you with any questions regarding Form 531. Our team is ready to help ensure that you maximize the benefits of our eSigning solution.

Get more for Captax

- 101 reasons to use legalshield form

- Publications forms link dpf 44s

- Box and whisker plot worksheet form

- Fl 306 form

- Heavy driver experience certificate format

- Drug incident report form alberta college of pharmacists

- Department of inspections licenses and permits form

- Seller information sheet template

Find out other Captax

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form