NC 4 Web 11 13 Form

What is the NC 4 Web 11 13

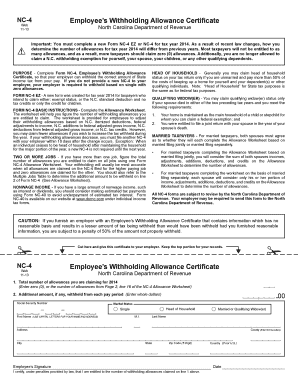

The NC 4 Web 11 13 form is a tax document used by employers in North Carolina to report the amount of state income tax withheld from employees' wages. This form is essential for both employers and employees as it ensures compliance with state tax regulations. It provides a clear record of the tax withheld, which is crucial for employees when filing their annual tax returns.

How to use the NC 4 Web 11 13

Using the NC 4 Web 11 13 form involves a straightforward process. Employers must first complete the form by entering the necessary details, including the total wages paid and the amount of state income tax withheld. Once completed, the form should be submitted to the North Carolina Department of Revenue. This can typically be done online, ensuring a quick and efficient filing process.

Steps to complete the NC 4 Web 11 13

Completing the NC 4 Web 11 13 form requires careful attention to detail. Here are the steps involved:

- Gather all necessary payroll information for the reporting period.

- Fill in the employer's details, including name, address, and identification number.

- Enter the total wages paid to employees during the period.

- Calculate and input the total amount of state income tax withheld.

- Review the information for accuracy before submission.

- Submit the completed form to the North Carolina Department of Revenue.

Legal use of the NC 4 Web 11 13

The NC 4 Web 11 13 form is legally recognized as a valid document for reporting state tax withholdings. To ensure its legal standing, employers must adhere to the guidelines set forth by the North Carolina Department of Revenue. This includes timely submission and accurate reporting of withheld amounts. Failure to comply with these regulations can result in penalties and interest on unpaid taxes.

Required Documents

To complete the NC 4 Web 11 13 form, employers should have the following documents on hand:

- Payroll records for the reporting period.

- Employee tax withholding information, including W-4 forms.

- Any previous NC 4 forms submitted for reference.

Form Submission Methods

The NC 4 Web 11 13 form can be submitted through various methods to accommodate different preferences:

- Online submission through the North Carolina Department of Revenue's website.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated state offices.

Quick guide on how to complete nc 4 web 11 13

Complete NC 4 Web 11 13 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle NC 4 Web 11 13 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and electronically sign NC 4 Web 11 13 with ease

- Locate NC 4 Web 11 13 and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Mark important sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and then select the Done button to save your modifications.

- Decide how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, exhausting form searches, or mistakes that require printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and electronically sign NC 4 Web 11 13 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nc 4 web 11 13

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NC 4 Web 11 13 and how does it relate to airSlate SignNow?

NC 4 Web 11 13 is a powerful feature of airSlate SignNow that offers advanced document management capabilities. It enables businesses to easily send, sign, and manage documents online, ensuring a seamless workflow. With NC 4 Web 11 13, users can expect a more efficient process for handling electronic signatures.

-

What pricing plans are available for NC 4 Web 11 13 on airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored for different business needs, including those using NC 4 Web 11 13. The pricing structure is designed to accommodate small businesses to larger enterprises. You can choose a plan that fits your requirements and budget while utilizing NC 4 Web 11 13's features.

-

What are the key features of NC 4 Web 11 13?

NC 4 Web 11 13 includes features like customizable templates, real-time tracking, and collaborative editing. These functionalities streamline the eSigning process, making it more intuitive for users. Additionally, NC 4 Web 11 13 integrates seamlessly with existing workflows to enhance productivity.

-

How does NC 4 Web 11 13 enhance document security?

AirSlate SignNow's NC 4 Web 11 13 utilizes advanced encryption and secure cloud storage to protect sensitive document data. This ensures that your signed documents are safe and compliant with industry regulations. With NC 4 Web 11 13, you can have peace of mind knowing your documents are secure.

-

Can NC 4 Web 11 13 integrate with other software platforms?

Yes, NC 4 Web 11 13 is designed to integrate with a range of popular software applications such as CRM systems, project management tools, and more. This integration capability helps create a comprehensive digital ecosystem for your business. You can enhance your workflow efficiency with NC 4 Web 11 13 by connecting it to your existing tools.

-

What are the benefits of using NC 4 Web 11 13 for my business?

Using NC 4 Web 11 13 can signNowly reduce turnaround times for document signing and improve overall productivity. This feature enables team collaboration while ensuring compliance and secure transactions. Adopting NC 4 Web 11 13 ultimately leads to enhanced operational efficiency.

-

Is there a free trial available for NC 4 Web 11 13?

Yes, airSlate SignNow offers a free trial for users interested in experiencing NC 4 Web 11 13's capabilities. This allows prospective customers to evaluate the features and determine if the solution meets their business needs. The free trial is a great opportunity to explore everything NC 4 Web 11 13 has to offer.

Get more for NC 4 Web 11 13

Find out other NC 4 Web 11 13

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF