Form 940 EZ Irs

What is the Form 940 EZ Irs

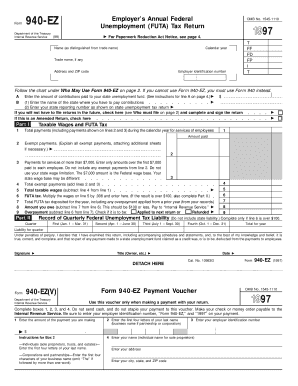

The Form 940 EZ is a simplified version of the IRS Form 940, which is used by employers to report their annual Federal Unemployment Tax Act (FUTA) tax. This form is designed for small businesses that meet specific eligibility criteria, allowing them to file their unemployment tax returns with less complexity. The primary purpose of the form is to calculate the amount of FUTA tax owed, which is essential for funding unemployment benefits for workers who lose their jobs. The Form 940 EZ streamlines the filing process, making it easier for eligible employers to comply with federal tax regulations.

How to use the Form 940 EZ Irs

Using the Form 940 EZ involves several straightforward steps. First, ensure that your business qualifies to use this simplified form, which typically includes having a limited number of employees and not owing any state unemployment taxes. Next, gather the necessary information, such as your total payroll for the year and any adjustments for prior payments. Once you have this data, you can fill out the form by entering your total taxable wages and calculating the FUTA tax owed. After completing the form, you can submit it electronically or by mail, depending on your preference and compliance requirements.

Steps to complete the Form 940 EZ Irs

Completing the Form 940 EZ involves a series of clear steps:

- Verify eligibility to use the Form 940 EZ.

- Gather payroll information for the year, including total wages paid to employees.

- Calculate any adjustments for prior payments or credits.

- Fill out the form by entering the required information accurately.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail to the IRS by the designated deadline.

Legal use of the Form 940 EZ Irs

The legal use of the Form 940 EZ is governed by IRS regulations, which stipulate that employers must accurately report their FUTA tax liability. To ensure compliance, businesses must maintain proper records of payroll and tax payments. Filing the Form 940 EZ correctly is crucial, as inaccuracies can lead to penalties or audits. Employers should also be aware of the deadlines for submission to avoid late fees and maintain good standing with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 940 EZ are critical for compliance. Employers must submit their completed forms by January 31 of the following year for the previous tax year. If you make timely payments of your FUTA tax, you can file the form by February 10. It is essential to keep track of these dates to avoid penalties and ensure that your unemployment tax obligations are met promptly.

Required Documents

To complete the Form 940 EZ, several documents and pieces of information are necessary:

- Total payroll records for the year.

- Details of any state unemployment tax payments made.

- Prior year Form 940, if applicable, for reference.

- Any relevant documentation supporting adjustments or credits.

Eligibility Criteria

Eligibility to use the Form 940 EZ is limited to certain businesses. To qualify, employers must have a total FUTA tax liability of $500 or less for the year. Additionally, the business should not have any state unemployment tax due or unpaid. This simplified form is typically intended for smaller employers, making it easier for them to fulfill their tax obligations without the complexity of the standard Form 940.

Quick guide on how to complete form 940 ez irs

Effortlessly Prepare Form 940 EZ Irs on Any Device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 940 EZ Irs on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign Form 940 EZ Irs

- Find Form 940 EZ Irs and click on Get Form to begin.

- Make use of the available tools to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specially provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 940 EZ Irs to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 940 ez irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 940 EZ Irs and why is it important for businesses?

Form 940 EZ Irs is a simplified version of the Form 940 used to report annual Federal Unemployment Tax Act (FUTA) liabilities. Businesses must file this form to ensure compliance and avoid penalties, making it essential for proper financial management.

-

How can airSlate SignNow help me with Form 940 EZ Irs?

airSlate SignNow offers a user-friendly platform that simplifies the process of preparing and signing Form 940 EZ Irs. With our eSigning features, you can streamline the submission process, ensuring timely compliance and reducing paperwork hassles.

-

What are the pricing options for using airSlate SignNow to handle Form 940 EZ Irs?

airSlate SignNow provides flexible pricing plans tailored to meet different business needs. Our packages are affordable and designed to offer comprehensive features, ensuring that all users can efficiently manage forms like the Form 940 EZ Irs without breaking the bank.

-

Can I integrate airSlate SignNow with other software for Form 940 EZ Irs?

Yes, airSlate SignNow supports integrations with various accounting and business applications, making it easier to manage Form 940 EZ Irs alongside your existing workflows. This connectivity enhances productivity and minimizes manual data entry.

-

What features does airSlate SignNow offer that benefit Form 940 EZ Irs users?

airSlate SignNow provides features such as templates, automated reminders, and secure cloud storage, particularly useful for users managing Form 940 EZ Irs. These features streamline the filing process, making it efficient and paperless.

-

Is it secure to use airSlate SignNow for filing Form 940 EZ Irs?

Absolutely! airSlate SignNow employs top-tier security measures, including encryption, to protect your sensitive information while filing Form 940 EZ Irs. Your data safety is our priority, ensuring peace of mind during the eSigning process.

-

Can I track the status of my Form 940 EZ Irs submissions with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Form 940 EZ Irs submissions in real time. You can receive notifications when documents are viewed and signed, ensuring you stay updated throughout the process.

Get more for Form 940 EZ Irs

Find out other Form 940 EZ Irs

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself