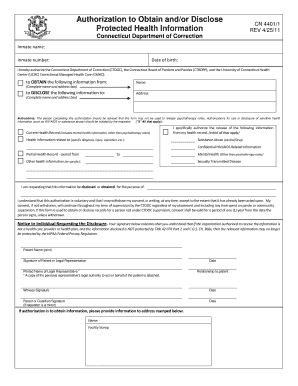

Connecticut Form Cn 4401

What is the Connecticut Form CN 4401

The Connecticut Form CN 4401 is a specific tax form used by businesses operating in Connecticut. It is primarily utilized for reporting certain tax-related information to the state. This form is essential for ensuring compliance with state tax regulations and is often required for various business entities, including corporations and partnerships. Understanding the purpose of this form is crucial for maintaining proper tax records and fulfilling legal obligations.

How to use the Connecticut Form CN 4401

Using the Connecticut Form CN 4401 involves several steps to ensure accurate completion and submission. First, gather all necessary financial information and documentation related to your business operations. Next, carefully fill out each section of the form, ensuring that all entries are accurate and complete. It is important to review the form for any errors before submission. Once completed, the form can be submitted to the appropriate state agency as per the guidelines provided.

Steps to complete the Connecticut Form CN 4401

Completing the Connecticut Form CN 4401 requires a systematic approach:

- Gather necessary documents, including financial statements and previous tax filings.

- Fill in the business information section, including the legal name and address.

- Provide accurate financial data, including income and deductions.

- Review the form for accuracy, ensuring all calculations are correct.

- Sign and date the form before submission.

Legal use of the Connecticut Form CN 4401

The Connecticut Form CN 4401 is legally binding when completed and submitted according to state regulations. It must be filled out accurately to reflect the business's financial status. Compliance with the relevant tax laws is essential, as inaccuracies can lead to penalties or audits. Ensuring that the form is signed and dated by an authorized representative adds to its legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the Connecticut Form CN 4401 are critical for compliance. Typically, businesses must submit this form by a specific date each year, often aligned with the end of the fiscal year. It is important to check the official state guidelines for the exact deadlines, as late submissions may incur penalties or interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Connecticut Form CN 4401 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through the Connecticut Department of Revenue Services website.

- Mailing a hard copy of the completed form to the designated state address.

- In-person submission at local state offices, if applicable.

Choosing the right submission method depends on the business's preferences and the urgency of the filing.

Quick guide on how to complete connecticut form cn 4401

Effortlessly Prepare Connecticut Form Cn 4401 on Any Device

The management of documents online has become widely accepted by both organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly and without delay. Handle Connecticut Form Cn 4401 on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to Modify and eSign Connecticut Form Cn 4401 with Ease

- Find Connecticut Form Cn 4401 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive details using tools that airSlate SignNow provides specifically for that function.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Decide how you wish to share your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Connecticut Form Cn 4401 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the connecticut form cn 4401

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the connecticut form cn 4401?

The connecticut form cn 4401 is a specific document used for filing certain taxes in the state of Connecticut. It is important for businesses and individuals to understand its requirements to ensure compliance with state regulations. airSlate SignNow can facilitate the eSigning of this form, making the process faster and more efficient.

-

How can I fill out the connecticut form cn 4401 using airSlate SignNow?

Filling out the connecticut form cn 4401 with airSlate SignNow is simple. You can upload the form to our platform, fill in the necessary details online, and utilize our eSigning feature to sign the document digitally. This ensures your form is completed accurately and securely.

-

Is there a cost associated with using airSlate SignNow for the connecticut form cn 4401?

Yes, airSlate SignNow offers various pricing plans tailored to business needs. The cost may vary depending on how many documents you need to sign or manage, including the connecticut form cn 4401. Our plans are designed to be cost-effective, providing value for your document signing needs.

-

What features does airSlate SignNow provide for managing the connecticut form cn 4401?

airSlate SignNow offers a host of features for managing the connecticut form cn 4401, including document templates, collaborative editing, and automated workflows. You can track document status, set reminders for signatures, and store completed forms securely. These tools streamline the filing process and enhance productivity.

-

Are there integrations available for the connecticut form cn 4401?

Absolutely! airSlate SignNow integrates with various platforms and applications, allowing you to connect workflows involving the connecticut form cn 4401 seamlessly. This includes CRM systems, cloud storage solutions, and more, ensuring that you can work within your existing tools.

-

Can I use airSlate SignNow on mobile devices for the connecticut form cn 4401?

Yes, airSlate SignNow is fully responsive and accessible on mobile devices. This means you can fill out and eSign the connecticut form cn 4401 from your smartphone or tablet, allowing for convenience and flexibility to manage documents on the go.

-

What are the benefits of using airSlate SignNow for the connecticut form cn 4401?

Using airSlate SignNow for the connecticut form cn 4401 offers numerous benefits, including faster processing times, reduced paper usage, and enhanced security. Digital signatures are legally binding, ensuring your form is compliant and reliable. Plus, our support team is available to assist you whenever needed.

Get more for Connecticut Form Cn 4401

Find out other Connecticut Form Cn 4401

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed