Less Than 50 Employees Certificate 2013-2026

What is the Less Than 50 Employees Certificate

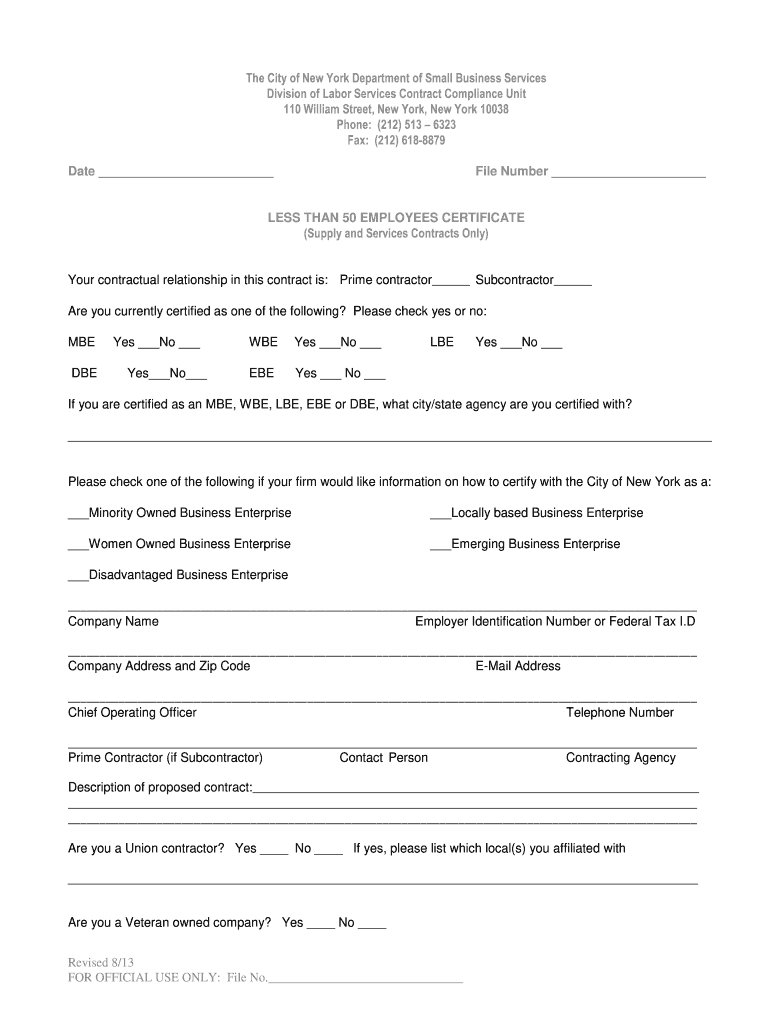

The less than 50 employees certificate is a document that verifies a business employs fewer than fifty individuals. This certificate is often required for compliance with various regulations, including those related to health insurance and employee benefits. It serves as proof for businesses seeking to qualify for specific programs or exemptions that apply to smaller enterprises. Understanding the significance of this certificate is essential for businesses operating within the United States, particularly in states like New York, where specific regulations may apply.

How to Obtain the Less Than 50 Employees Certificate

To obtain the less than 50 employees certificate, businesses typically need to follow a straightforward process. First, ensure that your business meets the eligibility criteria, which generally includes having fewer than fifty employees. Next, gather the necessary documentation that demonstrates your employee count, such as payroll records or tax filings. Once you have the required information, you can complete the appropriate application form, which may vary by state. After submitting the form, it may take some time for processing, so it's advisable to apply well in advance of any deadlines.

Steps to Complete the Less Than 50 Employees Certificate

Completing the less than 50 employees certificate involves several key steps:

- Gather employee data: Compile accurate records of all employees, including full-time, part-time, and temporary staff.

- Choose a compliant template: Use a verified template for the certificate that meets state requirements.

- Fill out the form: Input all necessary information, ensuring accuracy to avoid delays.

- Sign electronically: Utilize a secure eSignature solution to sign the document, ensuring it is legally valid.

- Submit the certificate: Follow the submission guidelines specific to your state, whether online or by mail.

Legal Use of the Less Than 50 Employees Certificate

The legal use of the less than 50 employees certificate is critical for businesses to ensure compliance with federal and state regulations. This certificate can be required for various purposes, such as applying for health insurance subsidies or demonstrating eligibility for specific tax credits. It is essential to keep the certificate updated and accurate, as any discrepancies may lead to legal issues or penalties. Businesses should also be aware of the specific laws in their state regarding the use of this certificate to avoid non-compliance.

Key Elements of the Less Than 50 Employees Certificate

Several key elements must be included in the less than 50 employees certificate to ensure its validity:

- Business name and address: Clearly state the legal name of the business and its physical location.

- Employee count: Provide an accurate count of all employees, including part-time and temporary workers.

- Signature: Include an electronic signature of an authorized representative of the business.

- Date of issuance: Indicate the date the certificate is issued to maintain accurate records.

- Compliance statement: A declaration that the business complies with relevant laws and regulations.

State-Specific Rules for the Less Than 50 Employees Certificate

State-specific rules for the less than 50 employees certificate can vary significantly across the United States. Each state may have its own requirements regarding the documentation needed, the format of the certificate, and the submission process. For example, New York might have additional stipulations for businesses operating within its jurisdiction. It is crucial for business owners to familiarize themselves with their state's regulations to ensure compliance and avoid potential penalties. Consulting with a legal professional or a compliance expert can provide valuable guidance in navigating these state-specific rules.

Quick guide on how to complete less than 50 employees certificate nyc

Simplify Your HR Functions with Less Than 50 Employees Certificate Template

Every HR professional understands the importance of keeping employee information organized and tidy. With airSlate SignNow, you can access a vast collection of state-specific employment forms that signNowly simplify the management, administration, and storage of all job-related documents in a single location. airSlate SignNow is designed to assist you in handling Less Than 50 Employees Certificate management from start to finish, featuring comprehensive editing and eSignature tools available whenever required. Enhance your precision, document security, and eliminate minor manual mistakes in just a few clicks.

Steps to Edit and eSign Less Than 50 Employees Certificate:

- Choose the relevant state and search for the form you need.

- Access the form page and click Get Form to start working on it.

- Allow Less Than 50 Employees Certificate to load in the editor and follow the prompts highlighting required fields.

- Input your details or add additional fillable sections to the document.

- Utilize our tools and features to adjust your form as necessary: annotate, redact sensitive information, and create an eSignature.

- Review your document for mistakes before proceeding with its submission.

- Click Done to save your changes and download the form.

- Alternatively, send your documents directly to your recipients to gather signatures and information.

- Securely store completed documents within your airSlate SignNow account and access them whenever needed.

Employing a flexible eSignature solution is essential when managing Less Than 50 Employees Certificate. Make even the most complicated workflows as seamless as possible with airSlate SignNow. Start your free trial today to discover the possibilities for your department.

Create this form in 5 minutes or less

FAQs

-

What tax form do I have to fill out for the money I made on Quora?

For 2018, there is only form 1040. Your income is too low to file. Quora will issue you a 1099 Misc only if you made over $600

-

Is it necessary to fill out Form 15G/Form 15H if my service is less than 5 years? I need to withdraw the amount.

Purposes for which Form 15G or Form 15H can be submitted. While these forms can be submitted to banks to make sure TDS is not deducted on interest, there a few other places too where you can submit them. TDS on EPF withdrawal – TDS is deducted on EPF balances if withdrawn before 5 years of continuous service.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

When employees work in a different state than they live, do they need to fill out state withholding certificates for both states?

Ohio borders on 5 states (MI, IN, KY, WV, PA). With each state there is an agreement that provides cross border employees are only taxed in one state. This makes it simpler for both employees and employers.I don’t know that this is true with all states but if Ohio and Michigan can get along on this, the other states have no excuse.

Create this form in 5 minutes!

How to create an eSignature for the less than 50 employees certificate nyc

How to generate an eSignature for your Less Than 50 Employees Certificate Nyc online

How to make an electronic signature for the Less Than 50 Employees Certificate Nyc in Google Chrome

How to create an eSignature for putting it on the Less Than 50 Employees Certificate Nyc in Gmail

How to create an eSignature for the Less Than 50 Employees Certificate Nyc right from your smart phone

How to make an electronic signature for the Less Than 50 Employees Certificate Nyc on iOS devices

How to generate an electronic signature for the Less Than 50 Employees Certificate Nyc on Android

People also ask

-

What is the 'less than 50 employees certificate' offered by airSlate SignNow?

The 'less than 50 employees certificate' is a specific offering designed for small businesses with fewer than 50 employees. It certifies that your organization complies with essential eSignature regulations, allowing you to legally sign documents electronically. This certificate supports streamlined operations and enhances your business's credibility.

-

How much does the 'less than 50 employees certificate' cost?

Pricing for the 'less than 50 employees certificate' varies depending on your organization's specific needs and usage. However, airSlate SignNow is known for its cost-effective solutions tailored for small businesses. To get a precise quote, contact our sales team for more information regarding pricing options.

-

What features are included with the 'less than 50 employees certificate'?

With the 'less than 50 employees certificate,' your business gains access to a suite of powerful features, including customizable templates, secure eSignature capabilities, and cloud storage options. These features are designed to simplify document management for small teams. The solution enhances productivity by ensuring all processes are efficient and legally compliant.

-

How can a 'less than 50 employees certificate' benefit my business?

Obtaining a 'less than 50 employees certificate' can signNowly benefit your business by streamlining your document signing processes. This certification helps increase the efficiency of transactions and can shorten turnaround times for contracts and agreements. Additionally, it builds trust with clients, as they can be assured of compliance with eSignature laws.

-

Is the 'less than 50 employees certificate' compliant with eSignature laws?

Yes, the 'less than 50 employees certificate' ensures compliance with important eSignature laws, such as the ESIGN Act and UETA. airSlate SignNow prioritizes security and legal standards, providing peace of mind as you conduct business. This compliance allows you to utilize electronic signatures that hold up in court and facilitate seamless transactions.

-

Can the 'less than 50 employees certificate' be integrated with other tools?

Absolutely! The 'less than 50 employees certificate' can seamlessly integrate with a variety of business tools, such as CRM systems, document management platforms, and cloud storage services. This integration enables your team to work efficiently by organizing, signing, and tracking documents from one central location. Check our website for a list of compatible integrations.

-

What types of documents can I sign with the 'less than 50 employees certificate'?

You can sign a wide range of documents using the 'less than 50 employees certificate,' including contracts, agreements, applications, and more. This versatility allows your small business to transition smoothly from paper to digital, improving efficiency in document handling. Secure and compliant eSigning supports various file formats, ensuring you can manage documents easily.

Get more for Less Than 50 Employees Certificate

Find out other Less Than 50 Employees Certificate

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free