PTAX 343 R Annual Verification of Eligibility for Lake County Form

What is the PTAX 343 R Annual Verification Of Eligibility For Lake County

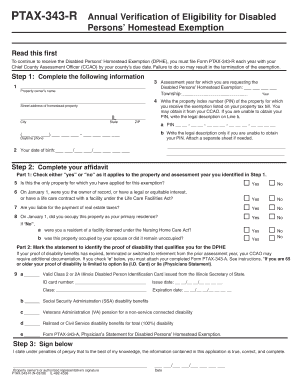

The PTAX 343 R Annual Verification Of Eligibility For Lake County is a form used to verify the eligibility of property owners for certain tax exemptions in Lake County, Illinois. This form is essential for ensuring that individuals or entities claiming exemptions meet the necessary criteria set forth by local tax authorities. It is typically required for property tax assessment purposes and helps maintain the integrity of the tax exemption process.

How to use the PTAX 343 R Annual Verification Of Eligibility For Lake County

Using the PTAX 343 R form involves several key steps. First, property owners must gather relevant information, including property details and personal identification. Next, the form should be filled out accurately, ensuring that all required fields are completed. Once the form is filled, it can be submitted either electronically or by mail, depending on the preferred submission method. It is crucial to keep a copy of the submitted form for personal records.

Steps to complete the PTAX 343 R Annual Verification Of Eligibility For Lake County

Completing the PTAX 343 R form involves the following steps:

- Gather necessary documentation, such as proof of ownership and identification.

- Download or obtain the PTAX 343 R form from the appropriate local tax authority.

- Fill out the form with accurate information, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the completed form via the chosen method, either electronically or by mail.

Key elements of the PTAX 343 R Annual Verification Of Eligibility For Lake County

Key elements of the PTAX 343 R form include the property owner's name, property address, and the specific tax exemption being claimed. Additionally, the form may require details about the property's use and any relevant income information. Providing accurate and complete information is vital for the successful processing of the form.

Eligibility Criteria

Eligibility for the PTAX 343 R Annual Verification Of Eligibility For Lake County typically includes criteria such as ownership of the property, the primary use of the property, and compliance with local tax laws. Specific exemptions may have additional requirements, so it is important for applicants to review the guidelines provided by the Lake County tax authority.

Form Submission Methods (Online / Mail / In-Person)

The PTAX 343 R form can be submitted through various methods, including:

- Online: Many local tax authorities offer electronic submission options for convenience.

- Mail: Completed forms can be sent to the designated tax office address.

- In-Person: Individuals may also choose to deliver the form directly to the tax office for immediate processing.

Quick guide on how to complete ptax 343 r annual verification of eligibility for lake county

Accomplish PTAX 343 R Annual Verification Of Eligibility For Lake County seamlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage PTAX 343 R Annual Verification Of Eligibility For Lake County across any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign PTAX 343 R Annual Verification Of Eligibility For Lake County without any hassle

- Locate PTAX 343 R Annual Verification Of Eligibility For Lake County and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you prefer to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Alter and electronically sign PTAX 343 R Annual Verification Of Eligibility For Lake County and ensure outstanding communication at any point of the form drafting process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 343 r annual verification of eligibility for lake county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is PTAX 343 R Annual Verification Of Eligibility For Lake County?

The PTAX 343 R Annual Verification Of Eligibility For Lake County is a form used to confirm eligibility for property tax exemptions. It helps property owners ensure they are receiving the correct tax benefits. Submitting this form is essential for maintaining eligibility for certain exemptions in Lake County.

-

How can airSlate SignNow assist with the PTAX 343 R Annual Verification Of Eligibility For Lake County?

airSlate SignNow simplifies the process of completing the PTAX 343 R Annual Verification Of Eligibility For Lake County by allowing users to easily fill out, eSign, and send documents. Our platform ensures secure and efficient documentation management. This helps streamline your property tax exemption process.

-

What features does airSlate SignNow offer for managing PTAX 343 R documents?

airSlate SignNow offers features such as document templates, eSignature capabilities, and automated reminders. These tools make it easy to manage your PTAX 343 R Annual Verification Of Eligibility For Lake County documents. Users can track the status of their submissions, ensuring timely completion.

-

How much does airSlate SignNow cost for submitting the PTAX 343 R form?

airSlate SignNow offers competitive pricing that makes it a cost-effective solution for submitting the PTAX 343 R Annual Verification Of Eligibility For Lake County. Subscription plans are available to fit various business needs, providing access to a range of features. Pricing details can be found on our website or by contacting our sales team.

-

Can airSlate SignNow integrate with other tools for handling PTAX 343 R forms?

Yes, airSlate SignNow can integrate with various tools and applications, enhancing the process of handling PTAX 343 R Annual Verification Of Eligibility For Lake County. These integrations allow users to streamline paperwork and maintain organized records. Our platform supports integrations with popular apps such as Google Drive and Dropbox.

-

What are the benefits of using airSlate SignNow for the PTAX 343 R form?

Using airSlate SignNow for the PTAX 343 R Annual Verification Of Eligibility For Lake County ensures a more efficient and stress-free process. Benefits include quick turnaround times, enhanced security through encrypted signatures, and user-friendly access to all documentation. This helps property owners focus on what matters most—securing their tax benefits.

-

Is airSlate SignNow secure for submitting the PTAX 343 R form?

Absolutely! airSlate SignNow prioritizes security when handling sensitive information like the PTAX 343 R Annual Verification Of Eligibility For Lake County. Our platform uses advanced encryption technology to protect all documents and signatures, ensuring compliance with legal standards and safeguarding user data.

Get more for PTAX 343 R Annual Verification Of Eligibility For Lake County

Find out other PTAX 343 R Annual Verification Of Eligibility For Lake County

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free