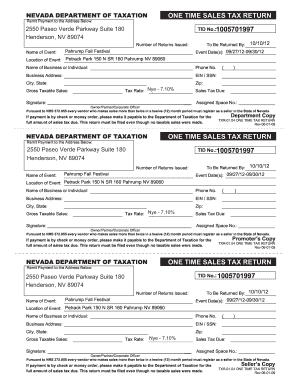

One Time Sales Tax Return One Time Sales Tax Return One Time Sales Tax Pahrumpnv Form

What is the One Time Sales Tax Return?

The One Time Sales Tax Return is a specific form used in Nevada for reporting and paying sales tax on a one-time transaction. This form is particularly useful for businesses or individuals who engage in occasional sales rather than regular sales activities. It allows taxpayers to comply with state sales tax regulations without needing to register for a sales tax permit if they are only making a single sale.

How to Use the One Time Sales Tax Return

To effectively use the One Time Sales Tax Return, you must first gather all relevant information about the transaction. This includes the sale amount, applicable sales tax rate, and any exemptions that may apply. Once you have this information, you can complete the form by entering the required details accurately. After filling out the form, you will submit it along with the calculated sales tax to the appropriate state agency.

Steps to Complete the One Time Sales Tax Return

Completing the One Time Sales Tax Return involves several key steps:

- Gather necessary information about the sale, including the total sale amount.

- Determine the applicable sales tax rate in Nevada.

- Fill out the One Time Sales Tax Return form, ensuring all information is accurate.

- Calculate the total sales tax owed based on the sale amount and tax rate.

- Submit the completed form and payment to the appropriate state agency.

Legal Use of the One Time Sales Tax Return

The One Time Sales Tax Return is legally recognized in Nevada for reporting sales tax on one-time transactions. It is essential to use this form correctly to avoid potential penalties. Compliance with state tax laws ensures that businesses and individuals fulfill their tax obligations while maintaining transparency in their transactions.

Key Elements of the One Time Sales Tax Return

Important elements of the One Time Sales Tax Return include:

- Identification of the seller and buyer.

- Details of the transaction, including the date and description of the goods or services sold.

- Calculation of the total sales tax based on the applicable rate.

- Signature of the seller, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

It is crucial to be aware of filing deadlines for the One Time Sales Tax Return to avoid late fees or penalties. Generally, this form should be submitted promptly after the transaction occurs. Specific deadlines may vary, so it is advisable to check with the Nevada Department of Taxation for the most accurate information.

Penalties for Non-Compliance

Failure to file the One Time Sales Tax Return or pay the associated sales tax can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. To avoid these consequences, it is essential to ensure timely and accurate filing of the form.

Quick guide on how to complete one time sales tax return one time sales tax return one time sales tax pahrumpnv

Prepare One Time Sales Tax Return One Time Sales Tax Return One Time Sales Tax Pahrumpnv effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without any delays. Handle One Time Sales Tax Return One Time Sales Tax Return One Time Sales Tax Pahrumpnv on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign One Time Sales Tax Return One Time Sales Tax Return One Time Sales Tax Pahrumpnv with ease

- Find One Time Sales Tax Return One Time Sales Tax Return One Time Sales Tax Pahrumpnv and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Adjust and eSign One Time Sales Tax Return One Time Sales Tax Return One Time Sales Tax Pahrumpnv and ensure effective communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the one time sales tax return one time sales tax return one time sales tax pahrumpnv

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Nevada sales tax and how does it affect businesses?

Nevada sales tax is a tax imposed on the sale of goods and services within the state. Businesses operating in Nevada must collect this tax from customers and remit it to the state, ensuring compliance with local regulations. Understanding Nevada sales tax is crucial for businesses to avoid penalties and maintain smooth operations.

-

How can airSlate SignNow help with managing documents related to Nevada sales tax?

airSlate SignNow allows businesses to easily prepare, send, and eSign documents related to Nevada sales tax. By streamlining the document management process, companies can ensure that they have all necessary paperwork in order, reducing errors when filing sales tax returns. Our solution enhances efficiency and helps businesses stay compliant with Nevada sales tax requirements.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to suit various business needs, including options for small to large enterprises. Our competitive pricing includes features tailored for effective document management, helping to streamline processes related to Nevada sales tax. Contact our sales team to find the perfect plan that fits your requirements.

-

What features does airSlate SignNow offer for Nevada sales tax documentation?

airSlate SignNow includes features like customizable templates, document tracking, and secure eSigning, all essential for handling Nevada sales tax documentation. These tools make it easier for businesses to manage their compliance and keep records intact. Our platform is designed to save time and reduce the stress of tax-related paperwork.

-

Are there integrations available with airSlate SignNow for accounting software managing Nevada sales tax?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions that help manage Nevada sales tax. By connecting your preferred accounting tools, you can automate the process of generating and managing documents, ensuring accurate tax calculations and reporting. This integration helps businesses streamline their tax management workflows.

-

Why should businesses use airSlate SignNow for eSigning documents related to Nevada sales tax?

Using airSlate SignNow for eSigning ensures that your documents related to Nevada sales tax are executed quickly and securely. Our platform provides a user-friendly interface, allowing you to send and receive signatures with ease. This not only enhances efficiency but also keeps your compliance efforts up to date with the latest regulations.

-

Is airSlate SignNow compliant with Nevada sales tax regulations?

Yes, airSlate SignNow is designed to help businesses maintain compliance with Nevada sales tax regulations. Our document management features ensure that you can easily track, sign, and store documents related to tax transactions. Keeping all your paperwork structured and compliant reduces the risk of facing penalties due to mismanaged sales tax documentation.

Get more for One Time Sales Tax Return One Time Sales Tax Return One Time Sales Tax Pahrumpnv

- Driveramp39s vehicle inspection report colorado department of coloradodot form

- Palliative care documentation sample form

- Measuring units worksheet answer key pdf form

- Duke university sevis school code form

- Prudential uganda online form

- Authorization to hire form

- Nmfc number lookup form

- Teleserve ri online payment form

Find out other One Time Sales Tax Return One Time Sales Tax Return One Time Sales Tax Pahrumpnv

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word