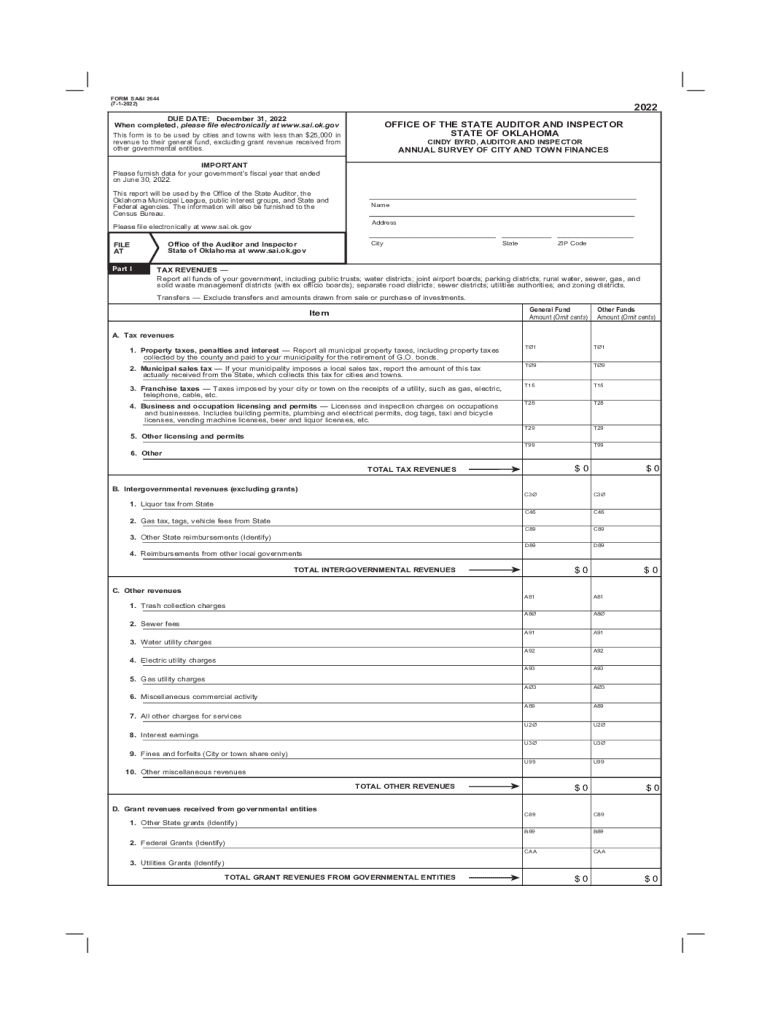

Amount Omit Cents 2022-2026

What is the Amount Omit Cents

The term "omit cents" refers to a method used in financial documentation where the cents portion of a monetary amount is excluded. This practice is often employed in checks, invoices, and contracts to simplify figures and avoid confusion. For example, instead of writing $100.50, one might write $100, omitting the cents. This approach can streamline processes, particularly in contexts where precision to the cent is not critical.

How to Use the Amount Omit Cents

Using the amount omit cents method involves a few straightforward steps. First, identify the total amount due or the figure you wish to document. Next, round this figure down to the nearest whole dollar, disregarding any cents. When filling out forms or checks, ensure that you clearly indicate the total without the cents to avoid misunderstandings. It is essential to communicate this practice to all parties involved to ensure clarity and agreement on the amounts being referenced.

Legal Use of the Amount Omit Cents

The omission of cents in financial documents is legally permissible in many contexts, provided that all parties understand and agree to this practice. However, it is crucial to ensure that the omission does not lead to ambiguity or disputes. In legal contracts or formal agreements, it may be advisable to specify that amounts are to be understood as whole dollars to prevent any potential misunderstandings. Consulting with a legal professional can provide additional guidance on the implications of using this method in specific situations.

Steps to Complete the Amount Omit Cents

Completing a form or document using the amount omit cents approach involves several key steps:

- Determine the total amount you wish to document.

- Round down to the nearest whole dollar, excluding any cents.

- Clearly write the amount as a whole number in the appropriate section of the form.

- Ensure that all parties involved are aware that the cents have been omitted.

- Review the document for clarity and accuracy before finalizing it.

Examples of Using the Amount Omit Cents

Common examples of where the amount omit cents method is applied include:

- Checks: When writing a check, one might write "Pay to the order of John Doe, $250" instead of $250.00.

- Invoices: Businesses may issue invoices stating "Total Due: $1,000" without including cents.

- Contracts: Legal agreements may specify amounts as whole dollars, such as "The total payment shall be $5,000."

IRS Guidelines

The Internal Revenue Service (IRS) generally allows taxpayers to report amounts in whole dollars, omitting cents in various tax forms. However, it is essential to ensure that this practice aligns with specific reporting requirements for different forms. For instance, while some forms may allow rounding to the nearest dollar, others may require precise amounts. Always refer to the IRS instructions for the specific forms you are completing to ensure compliance.

Quick guide on how to complete amount omit cents

Complete Amount Omit Cents effortlessly on any device

Online document management has gained traction among businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, amend, and eSign your paperwork rapidly without hold-ups. Manage Amount Omit Cents on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to amend and eSign Amount Omit Cents with ease

- Locate Amount Omit Cents and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to store your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choosing. Edit and eSign Amount Omit Cents and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct amount omit cents

Create this form in 5 minutes!

How to create an eSignature for the amount omit cents

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does 'omit cents meaning' refer to in pricing?

'Omit cents meaning' refers to the practice of rounding prices to the nearest whole dollar. This simplification makes it easier for customers to understand pricing without the distraction of minimal cents. For businesses using airSlate SignNow, this can streamline invoicing processes and improve customer satisfaction.

-

How can airSlate SignNow help with understanding 'omit cents meaning' in transactions?

AirSlate SignNow allows for clear and concise document presentations, which can include pricing discussions. By providing a straightforward approach to pricing, users can easily communicate the 'omit cents meaning' to clients, ensuring there's no confusion about costs. This feature can enhance client relationships and foster trust.

-

Does airSlate SignNow support pricing structures that omit cents?

Yes, airSlate SignNow can support pricing structures that omit cents. Businesses can set prices as whole numbers, making it easier for clients to understand the total costs. By doing so, it aligns perfectly with the 'omit cents meaning' strategy, ensuring a seamless client experience.

-

What are the benefits of using a solution that incorporates 'omit cents meaning'?

Using a solution that incorporates 'omit cents meaning' can greatly simplify financial transactions. Clients appreciate clear and rounded pricing, enhancing their overall experience. AirSlate SignNow ensures that agreements reflect these considerations, making transactions smooth and user-friendly.

-

Can airSlate SignNow integrate with accounting software to reflect 'omit cents meaning'?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting software. This enables businesses to ensure price rounding practices, reflecting 'omit cents meaning' consistently across platforms, leading to more accurate financial tracking and reporting.

-

Is there an option to customize pricing to omit cents in airSlate SignNow?

Yes, airSlate SignNow allows for customization of pricing structures. Users can choose to round figures and omit cents, ensuring that documents reflect 'omit cents meaning' as preferred. This level of customization can cater to various business models and customer expectations.

-

How does understanding 'omit cents meaning' enhance customer trust?

Understanding 'omit cents meaning' enhances customer trust by providing clarity in pricing. When clients see straightforward, rounded prices, it reduces confusion and establishes transparency. AirSlate SignNow helps facilitate this understanding through its clear, user-friendly document settings.

Get more for Amount Omit Cents

Find out other Amount Omit Cents

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy

- Sign Tennessee Lodger Agreement Template Secure

- Sign Virginia Lodger Agreement Template Safe

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online