Occupational Tax Fairburn Form

What is the Occupational Tax Fairburn

The Occupational Tax Fairburn is a municipal tax imposed on individuals and businesses operating within the city of Fairburn, Georgia. This tax is designed to regulate and generate revenue from various professions and business activities. It is essential for local governments to fund essential services and infrastructure. The tax applies to a wide range of occupations, ensuring that all businesses contribute to the community in which they operate.

How to obtain the Occupational Tax Fairburn

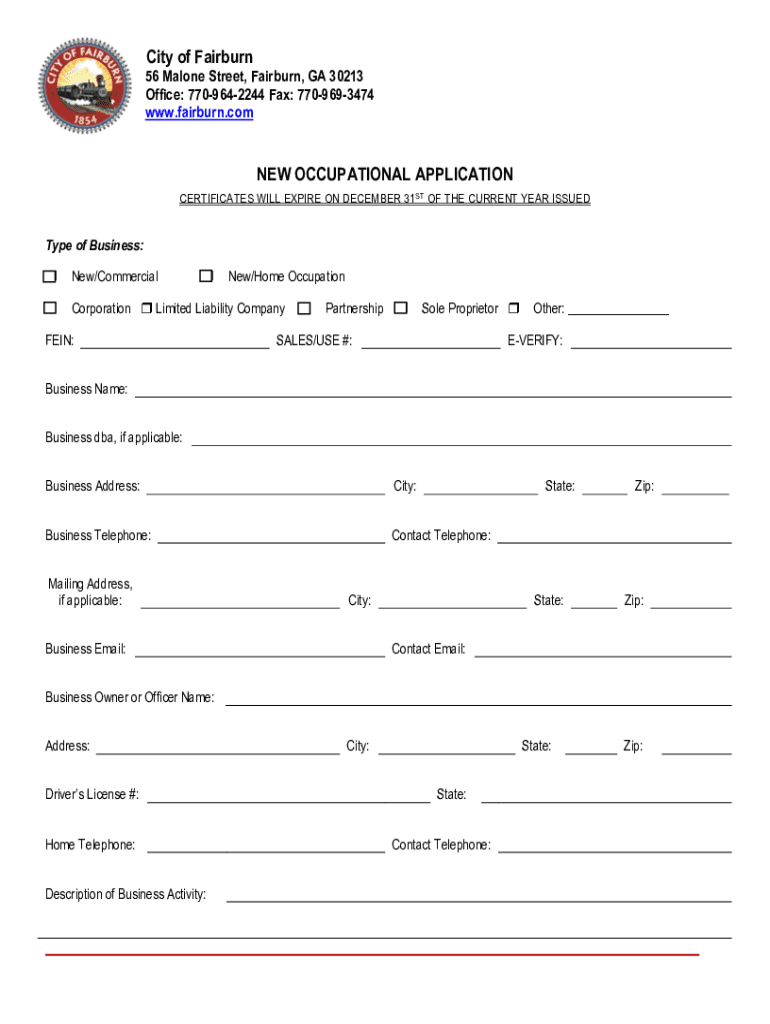

To obtain the Occupational Tax Fairburn, applicants must complete a specific application form provided by the Fairburn city government. This process typically involves submitting personal and business information, including the nature of the business and its location. Applicants may also need to provide proof of any necessary licenses or permits. It is advisable to check the city’s official website for the most current forms and requirements.

Steps to complete the Occupational Tax Fairburn

Completing the Occupational Tax Fairburn involves several key steps:

- Gather necessary documentation, including identification and business licenses.

- Access the application form from the Fairburn city website.

- Fill out the form with accurate information regarding your business or occupation.

- Submit the completed form along with any required fees to the appropriate city department.

- Await confirmation of your application and any further instructions.

Legal use of the Occupational Tax Fairburn

The legal use of the Occupational Tax Fairburn is crucial for compliance with local regulations. Businesses and individuals must ensure that they have the necessary tax certificate before operating within Fairburn. Failure to obtain this tax can result in penalties or legal action. It is important to maintain accurate records and renew the tax as required by local laws to avoid any compliance issues.

Required Documents

When applying for the Occupational Tax Fairburn, several documents are typically required:

- Completed application form.

- Proof of identity, such as a driver's license or state ID.

- Business licenses or permits, if applicable.

- Any additional documentation specified by the city.

Penalties for Non-Compliance

Non-compliance with the Occupational Tax Fairburn can lead to significant penalties. Individuals or businesses that fail to obtain the necessary tax may face fines, additional fees, or legal action. It is essential to adhere to all filing deadlines and maintain compliance to avoid these consequences. Regularly reviewing local regulations can help ensure that all requirements are met.

Quick guide on how to complete occupational tax fairburn

Complete Occupational Tax Fairburn effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Occupational Tax Fairburn on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign Occupational Tax Fairburn with ease

- Locate Occupational Tax Fairburn then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all details and then click the Done button to save your changes.

- Choose your preferred delivery method for your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worries of lost or mislaid documents, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from your device of choice. Modify and electronically sign Occupational Tax Fairburn to ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the occupational tax fairburn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the new occupational tax?

The new occupational tax refers to a recent tax structure imposed on individuals and businesses based on occupational income. It is important for businesses to understand this tax as it may affect their overall operational costs. Familiarizing yourself with the new occupational tax can help in effective financial planning and compliance.

-

How does airSlate SignNow help with new occupational tax compliance?

airSlate SignNow provides organizations with tools to streamline document management, making compliance with the new occupational tax easier. With automated workflows and eSigning capabilities, businesses can ensure timely submissions of necessary tax documentation. This efficiency helps in reducing errors related to tax compliance.

-

What features does airSlate SignNow offer that relate to the new occupational tax?

airSlate SignNow offers features like document tracking, templates for tax forms, and automated reminders that are vital when dealing with the new occupational tax. These tools simplify the process of preparing and submitting required documents. Enhanced collaboration features also allow teams to work together seamlessly on tax-related documentation.

-

Is pricing for airSlate SignNow affected by the new occupational tax?

While the pricing for airSlate SignNow remains unchanged, businesses must consider the implications of the new occupational tax when budgeting for software expenses. Using airSlate SignNow can ultimately lead to cost savings by improving efficiency in tax compliance processes. Remember that investing in compliance tools can mitigate the financial impact of the new occupational tax.

-

Can airSlate SignNow integrate with accounting software related to new occupational tax?

Yes, airSlate SignNow integrates seamlessly with various accounting software platforms that help manage financial records related to the new occupational tax. These integrations facilitate smooth data transfers and help maintain tax compliance efficiently. By integrating with your existing software, airSlate SignNow further streamlines your tax process.

-

What are the benefits of using airSlate SignNow in relation to the new occupational tax?

Using airSlate SignNow offers signNow benefits for businesses dealing with the new occupational tax, such as reduced processing time and improved document accuracy. eSigning features accelerate the signature collection process, ensuring that all tax documents are filed timely. This solution also enhances record-keeping, which is crucial for tax audits.

-

How secure is airSlate SignNow when handling documents affected by the new occupational tax?

airSlate SignNow prioritizes document security, providing a secure platform for managing sensitive information related to the new occupational tax. With encrypted eSignatures and secure cloud storage, your documents remain protected against unauthorized access. Our commitment to security ensures compliance with all necessary regulations.

Get more for Occupational Tax Fairburn

- Atls post test questions and answers 10th edition pdf form

- Non mendelian genetics worksheet form

- Ff fet form2506 11

- Wakemed doctors note form

- Melville nelson self care assessment form

- Dd form 137 4

- Power of attorney for bank account pdf form

- 1 of 10 confidential patient information central illinois chiropractic

Find out other Occupational Tax Fairburn

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer