Earnings Garnishment Exemption Form

What is the earnings garnishment exemption?

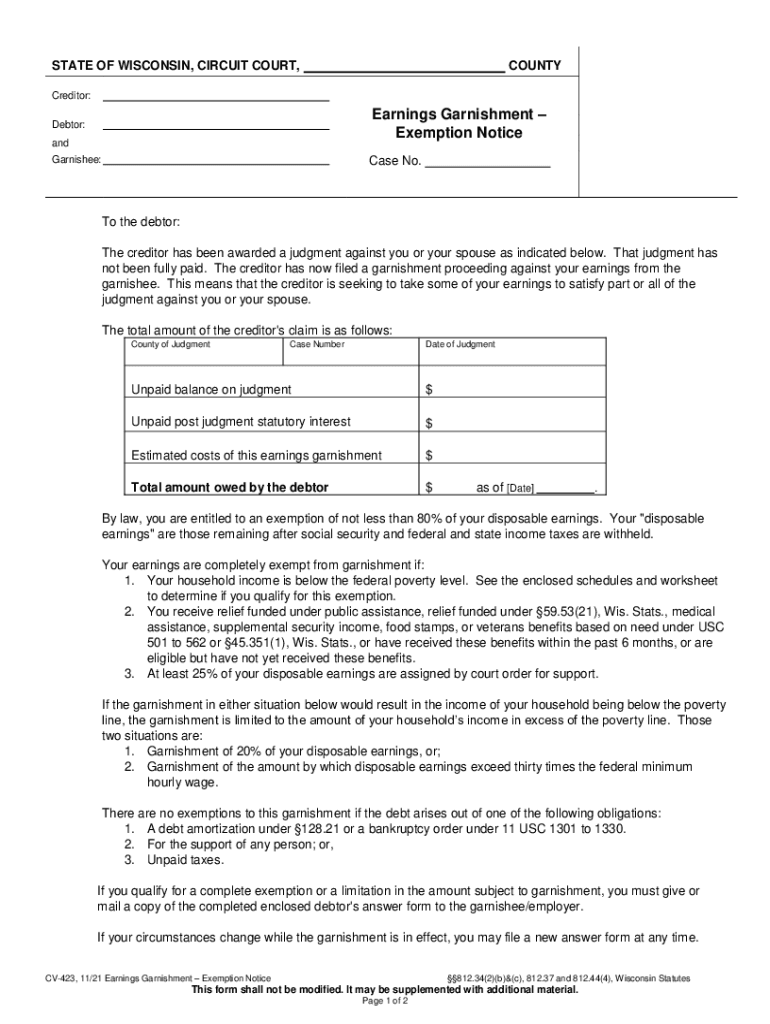

The earnings garnishment exemption is a legal provision that allows individuals in Wisconsin to protect a portion of their income from being seized by creditors through garnishment. This exemption is designed to ensure that individuals retain enough income to support themselves and their dependents. In Wisconsin, the law outlines specific income thresholds and types of income that may be exempt from garnishment, including wages, social security benefits, and certain public assistance payments.

How to use the earnings garnishment exemption

To utilize the earnings garnishment exemption, individuals must complete the garnishment exemption form Wisconsin. This form requires the individual to provide information about their income, expenses, and any dependents. Once completed, the form must be submitted to the court or the creditor's attorney to formally request the exemption. It is essential to ensure that all information is accurate and supported by relevant documentation to increase the likelihood of approval.

Steps to complete the earnings garnishment exemption

Completing the earnings garnishment exemption form involves several steps:

- Gather necessary documentation, including proof of income and expenses.

- Fill out the garnishment exemption form Wisconsin with accurate information.

- Review the form for completeness and accuracy.

- Submit the completed form to the appropriate court or creditor's attorney.

- Keep copies of all submitted documents for your records.

Eligibility criteria for the earnings garnishment exemption

Eligibility for the earnings garnishment exemption in Wisconsin typically depends on the individual's income level and the type of income received. Generally, individuals whose income falls below a certain threshold may qualify for the exemption. Additionally, specific types of income, such as social security benefits or public assistance, are often exempt from garnishment regardless of the individual's overall income. It is important to review the specific criteria outlined in Wisconsin law to determine eligibility.

Key elements of the earnings garnishment exemption

Several key elements define the earnings garnishment exemption in Wisconsin:

- Income thresholds: The law specifies income limits that determine eligibility for the exemption.

- Types of income: Certain income sources, such as social security and public assistance, are exempt from garnishment.

- Application process: Individuals must complete and submit the garnishment exemption form Wisconsin to request the exemption.

- Legal protections: The exemption provides legal safeguards to ensure individuals can maintain a basic standard of living.

Legal use of the earnings garnishment exemption

The legal use of the earnings garnishment exemption requires compliance with Wisconsin's statutory requirements. Individuals must accurately complete the garnishment exemption form and submit it within the appropriate time frame. Failure to follow legal procedures can result in the denial of the exemption request. It is advisable to consult with a legal professional if there are uncertainties regarding the process or eligibility.

Quick guide on how to complete earnings garnishment exemption

Complete Earnings Garnishment Exemption effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Earnings Garnishment Exemption on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Earnings Garnishment Exemption with minimal effort

- Locate Earnings Garnishment Exemption and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important segments of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Earnings Garnishment Exemption and ensure efficient communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the earnings garnishment exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a garnishment exemption form Wisconsin?

A garnishment exemption form Wisconsin is a legal document used to claim certain exemptions from wage garnishments. By completing this form, individuals can protect a portion of their income from being seized to satisfy debts. Understanding how to correctly fill out this form is crucial to ensuring your rights are upheld in financial matters.

-

How does airSlate SignNow simplify the process of completing the garnishment exemption form Wisconsin?

airSlate SignNow provides a user-friendly interface that makes it easy to fill out the garnishment exemption form Wisconsin quickly and accurately. With features like templates and electronic signatures, users can complete and submit their forms without the hassle of printing and scanning. This saves time and simplifies the legal process.

-

Are there any costs associated with using airSlate SignNow for the garnishment exemption form Wisconsin?

Yes, airSlate SignNow offers affordable pricing plans to allow users to manage their documents, including the garnishment exemption form Wisconsin. The subscription costs are typically competitive, providing access to advanced features such as unlimited templates and cloud storage. This investment ensures that your documentation needs are met efficiently.

-

Can I integrate airSlate SignNow with other tools to manage the garnishment exemption form Wisconsin?

Absolutely! airSlate SignNow supports integrations with various applications to streamline your workflow. Whether it's linking with your email services or cloud storage, you can easily manage the garnishment exemption form Wisconsin alongside your other essential business tools for enhanced productivity.

-

Is airSlate SignNow secure for handling sensitive documents like the garnishment exemption form Wisconsin?

Yes, airSlate SignNow prioritizes the security of your documents. Our platform uses advanced encryption measures to ensure that your garnishment exemption form Wisconsin and other sensitive files are protected from unauthorized access. You can have peace of mind knowing that your information is safe with us.

-

What are the benefits of using airSlate SignNow for the garnishment exemption form Wisconsin?

Using airSlate SignNow for the garnishment exemption form Wisconsin offers several advantages, including efficiency and ease of use. You can complete your paperwork quickly, saving time and reducing stress when dealing with financial issues. Additionally, the ability to eSign documents promotes faster processing and fewer delays.

-

Can I edit the garnishment exemption form Wisconsin after it has been signed with airSlate SignNow?

Once the garnishment exemption form Wisconsin is signed and finalized, editing is not available since the document is legally binding. However, you can easily create a new document or template to accommodate any changes or new information needed. The platform makes this process straightforward, enhancing document management.

Get more for Earnings Garnishment Exemption

Find out other Earnings Garnishment Exemption

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple